Pune Based Well Established Waffle Brand Looking for Investors

About Business

We serve four types of waffles i.e. Candy, Belgian, Hongkong and Savoury waffles. We have waffles in five different flavours i.e. Vanilla, Chocolate, Red Velvet, Charcoal and Green Matcha. We also serve a variety of shakes with different combinations.

Clientele type

People from all age groups.

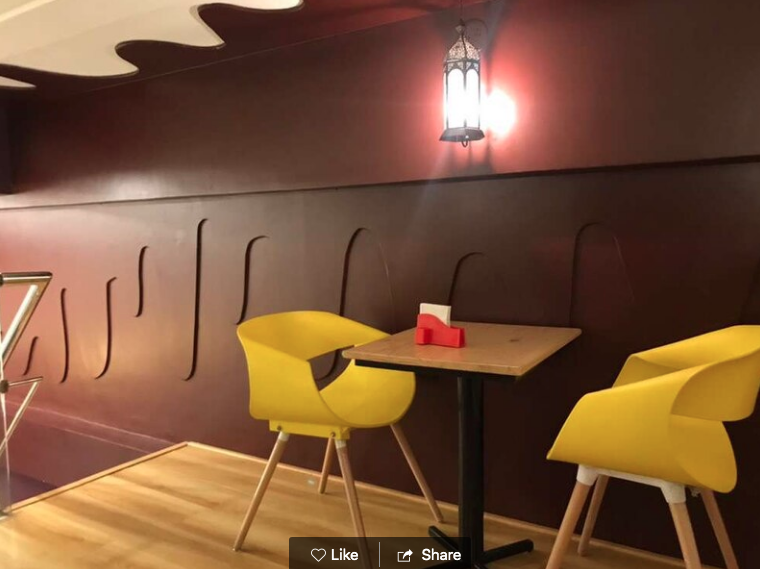

Premises

We have a social media marketing team. We use POS software for daily accounts. Zomato, Swiggy, Food panda, Website

Asking Price Includes

Expansion, Partnership and company outlets

Reason

Investment

More Details

This Partnership business is operational since Oct 2018. They are one of the Very few brands which serve Belgian and Hongkong waffles together with many flavors. They have in-house recipes for the chocolate sauce which has unique and awesome taste.

Their waffle recipes have received a very good response.

Daily customer footfall is 18 to 20.

Monthly revenue is between INR 80,000 to 90,000.

They are looking for Investors to expand their business. Asking price is INR 50 lakhs.

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?