Well Established Quench and Temper Business Planing To Exit

About Business

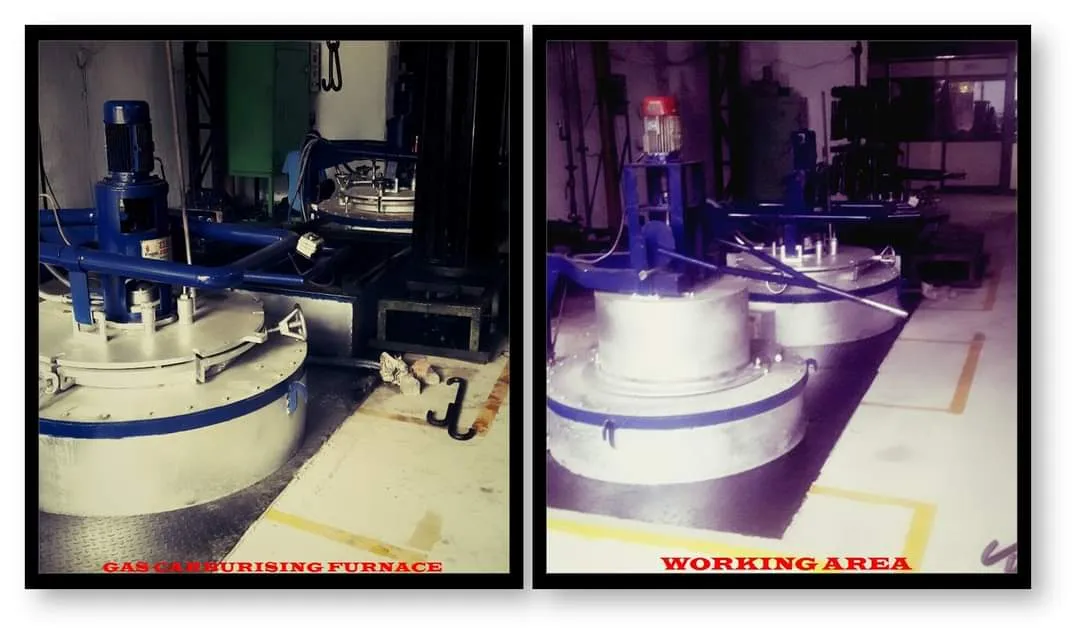

Hardening and tempering, Case Hardening, Quench and Temper.

Clientele type

Some of our big clients are Kumaran engineers ( Ashok Leyland vendor), hammam( Wipro vendor), Ashwini precision ( Bosch vendor).

Premises

We have taken factory on rent, INR60,000 is the per month rent.

Security deposit is INR5,00,000(Included in asking price)

The carpet area of the factory is 3200Sq Ft.

Asking Price Includes

Asking price includes all the machinery which cost us around 1,20,00,000.

Reason

Need funds for some other business.

More Details

We have stopped operation currently. But we had planned to expand business by adding sealed Quench furnaces.

Within the factory, we have 1 temper furnace, 1 oil tank(Capacity 8000L), 2 hardness testing machines, chemical floor setup(mythical), 3 control panels for controlling furnaces, 1 oximeter, 1 Polishing machine, 5-ton crane.

Monthly we are getting orders of approximately 40Ton to 50Ton(1Ton = 1000kg), for 1Kg we are charging INR9.

The factory is fully set up, buyer can start from the day of purchase.

Keywords

Business Tags

Business Exit for ₹10 Cr – 200 Cr

Structured Transition Completed in 120 Days

Credible Buyer Connections, Confidential Discussions, and Seamless Closure

Supported by Advisors with 26+ Years of Experience