Mfg of Raw Materials for Intraocular lenses Raising Funds

About Business

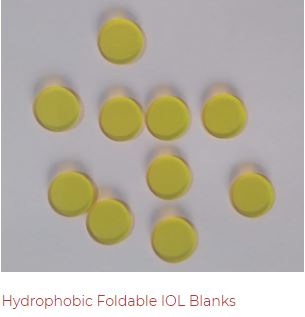

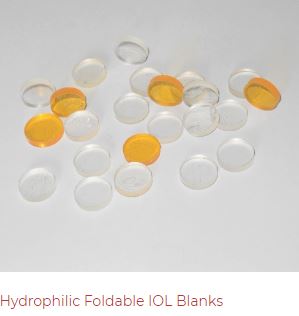

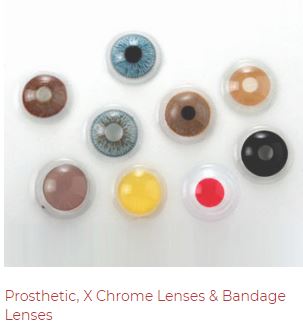

Manufacturers of raw materials for Intra-Ocular Lenses & Contact Lenses.

Clientele type

They mainly supply raw materials to manufacturers of Intra-Ocular Lenses and Contact Lenses.

Premises

They have set up a sound infrastructure facility, which is equipped with advanced machinery, fully equipped quality control center and an R&D unit.

It is based across a sprawling area of 400 square yards with an installed capacity of 20,000 units per month. These machines are handled by experienced operators and team members and help us in meeting the urgent requirements of our clients.

Some of the machines installed at our unit are:

Curve Generator

Vacuum Coating Unit

Trepaning Machine

Centering Machine

Glass Slitting Machine

UV Cleaning Machine

Polishing Machine

Asking Price Includes

15% of stakes in the company. (Excluding ownership of premises)

Asking Price

INR 5.00 Cr

Minimum ticket size

INR 5.00 Cr

Reason

They need to raise money to develop a new technology (mold) that would increase their current revenue by 5x and chances of being acquired.

More Details

They have been a cash flow positive company since 2007. Our turnover in the last financial year was about INR 1.5 Cr. per annum with an EBITDA margin of 35%.

They are one of the few companies in the world with the technology to manufacture materials for Intra-Ocular Lenses.

They are looking for a strategic partner with a background in biotech/pharma/high precision molding, to invest about INR 50 lakhs in exchange for 15% of the company stake. This money will be used to develop a unique technology that:

a) Will increase the current revenue and profits by 5x, and

b) Drastically increase the chances of us being acquired by an existing Intra-Ocular Lens manufacturing company for at least 7 Cr, plus a royalty.

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?