Engineering Firm Raising Funds in Chennai

About Business

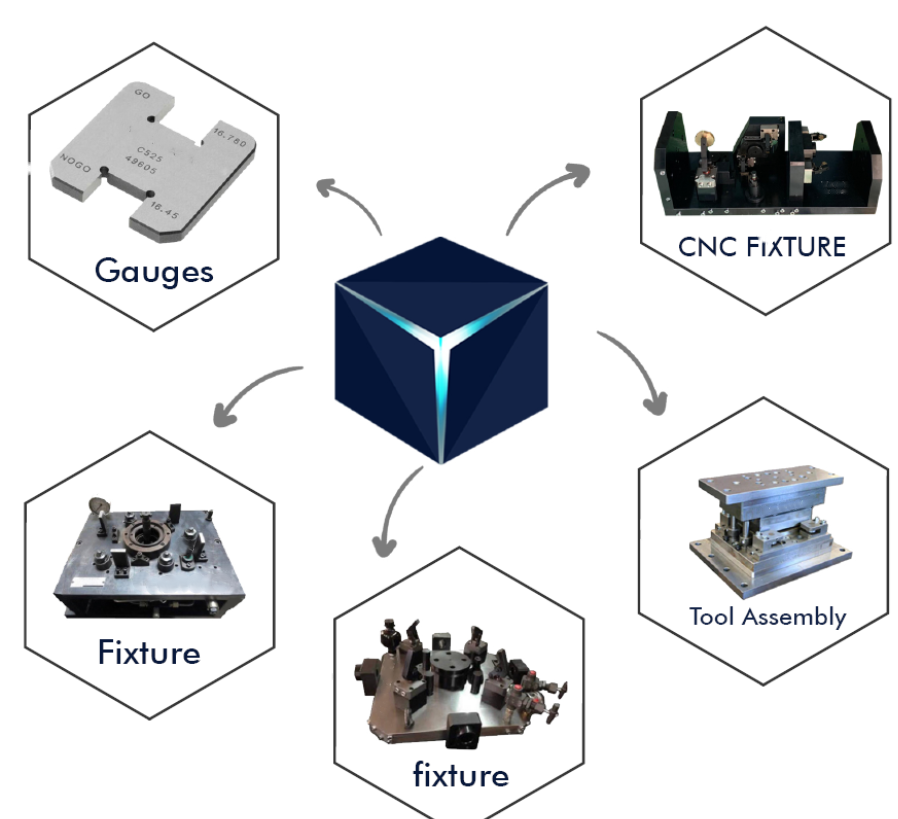

They design and build custom and standard Tooling, Fixtures, SPM’s & gauges

Clientele type

Medical, Aerospace, Automotive, Defense, and Manufacturing Industries.

Some of their notable clients include Brakes India and Tsugami

Premises

LEASED

Lease per month (in INR): 25.00 K

Security Deposit (in INR): 2.00 L

Carpet Area: 1,500 sq ft

NA

Asking Price Includes

The Promoter is preferably looking for a Strategic investor with experience in the Machine and Tooling Industry.

Depending on the deal size (5 Cr, Negotiable), equity dilution will be discussed with the promoter.

Reason

Purchase Land and Machinery and Expansion of Business.

More Details

Vision:

To thrive and build the ability to provide all Tool Room services from design to engineering to simulation to machining to try-out all under one Roof.

Quality & Commitment:

Since their initial founding, they have earned a reputation for manufacturing the highest quality tooling, Fixtures & Gauges. They do so by applying their expertise and the latest technology, techniques & instruments to design, engineer, manufacture and test your job. In all that they do, customers can rely on them to deliver on time, every time.

Manufacturing/Repair Custom Gauges, Fixture Design and Build:

They design and build custom and standard gauges for the Medical, Aerospace, automotive, defense, and manufacturing industries. All of their services are designed to meet the needs of their customers.

Exacting Tolerances:

This is one of their most popular capabilities. They can make parts accurately down to 2 tenths and it’s made a big difference for many of their customers. They strive to achieve the highest level of excellence in the Products they Manufacture/Engineer. With this Niche work, they ensure all details are accounted for and calculated and handled in a timely manner.

Background of Promoter:

The promoter is an Electrical engineer, Graduated in 2009 from Velammal Engineering College, Chennai.

He has got 12+ years of Experience in various field, including 10+ in Engineering Field.

He is working as a top Management Professional in a Japanese Company in Chennai, and also has started this company in 2019.

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?