Repair And Service Center Raising Funds In Nagaon

About Business

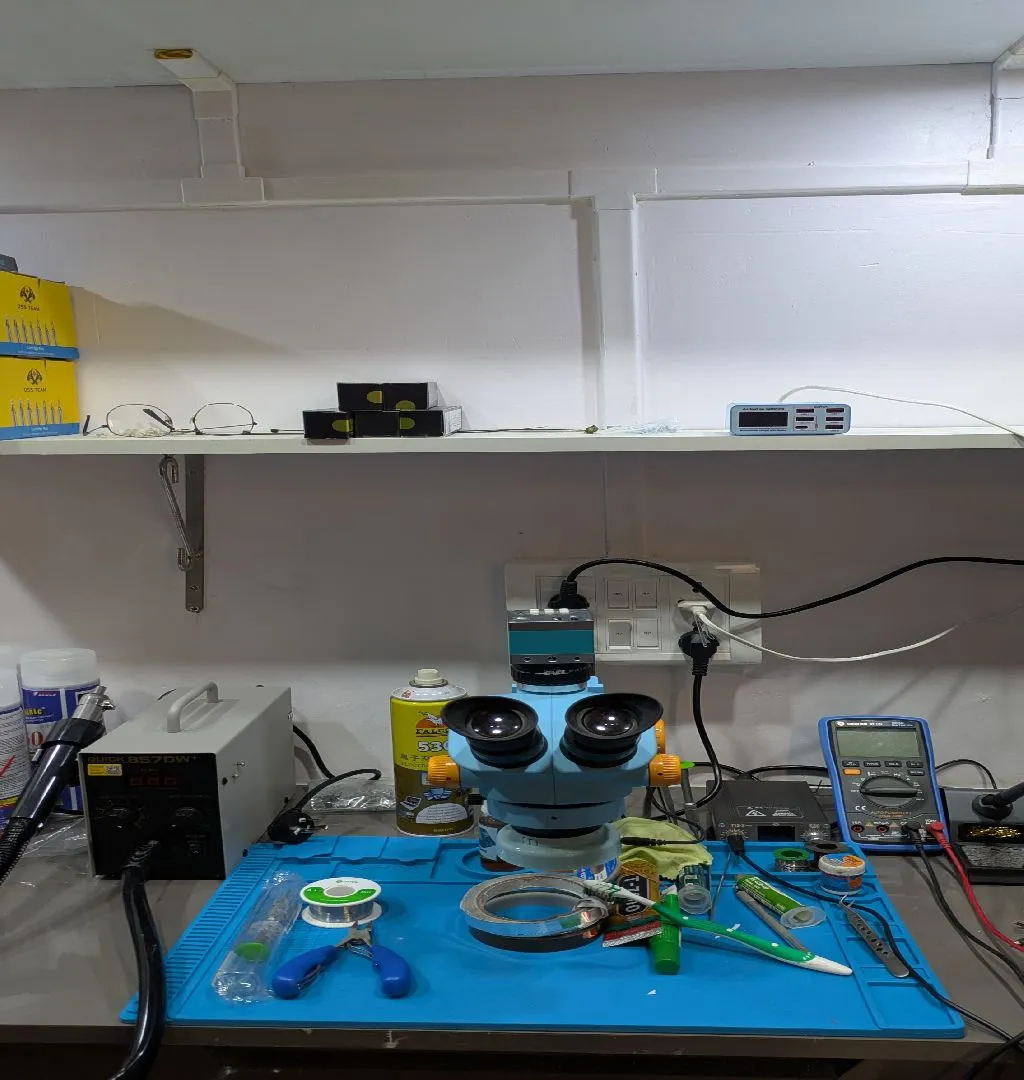

The branches are located in semi-urban areas of Assam, offering a wide range of mobile repair services, including screen replacement, battery repair, water damage repair, IC reballing, and more. The business ensures clear and competitive pricing, delivering excellent value for money. All repairs come with a 90-day warranty, providing customers with peace of mind. The repair facility is equipped with the latest tools and technology to guarantee efficient and high-quality repairs. Lean and agile workflows have been implemented to optimize efficiency and minimize turnaround times, ensuring exceptional service. Each repair undergoes a strict quality assurance process to maintain the highest standards of workmanship.

Clientele type

The main clientele includes wholesale customers and retail customers.

Premises

LEASED

Lease per month (in INR): 3.00 K

Security Deposit (in INR): 50.00 K

Carpet Area: 68 sq ft

Asking Price Includes

The deal includes a 20% stake for the partner, along with a 15% annual interest. Further details will be discussed with the potential investors.

Asking Price

INR 15.00 L

Minimum ticket size

INR 10.00 L

Reason

The company plans to open additional repair centers in key semi-metropolitan areas, as not all customers can travel to metropolitan locations. Additionally, there are plans to start a doorstep service in the future. Expanding the number of service centers will be crucial to building a larger customer base and offering better accessibility to services.

More Details

The company has a young and dynamic team and a strong expansion plan across the country.

Keywords

Business Tags

Fundraising for ₹10 Cr – 500 Cr

Confidential Process Completed in 120 Days

Strategic Preparation, Aligned Investor Outreach and Seamless Closure

Supported by Advisors with 26+ Years of Experience