Remote ICU Technology Startup Raising Funds

About Business

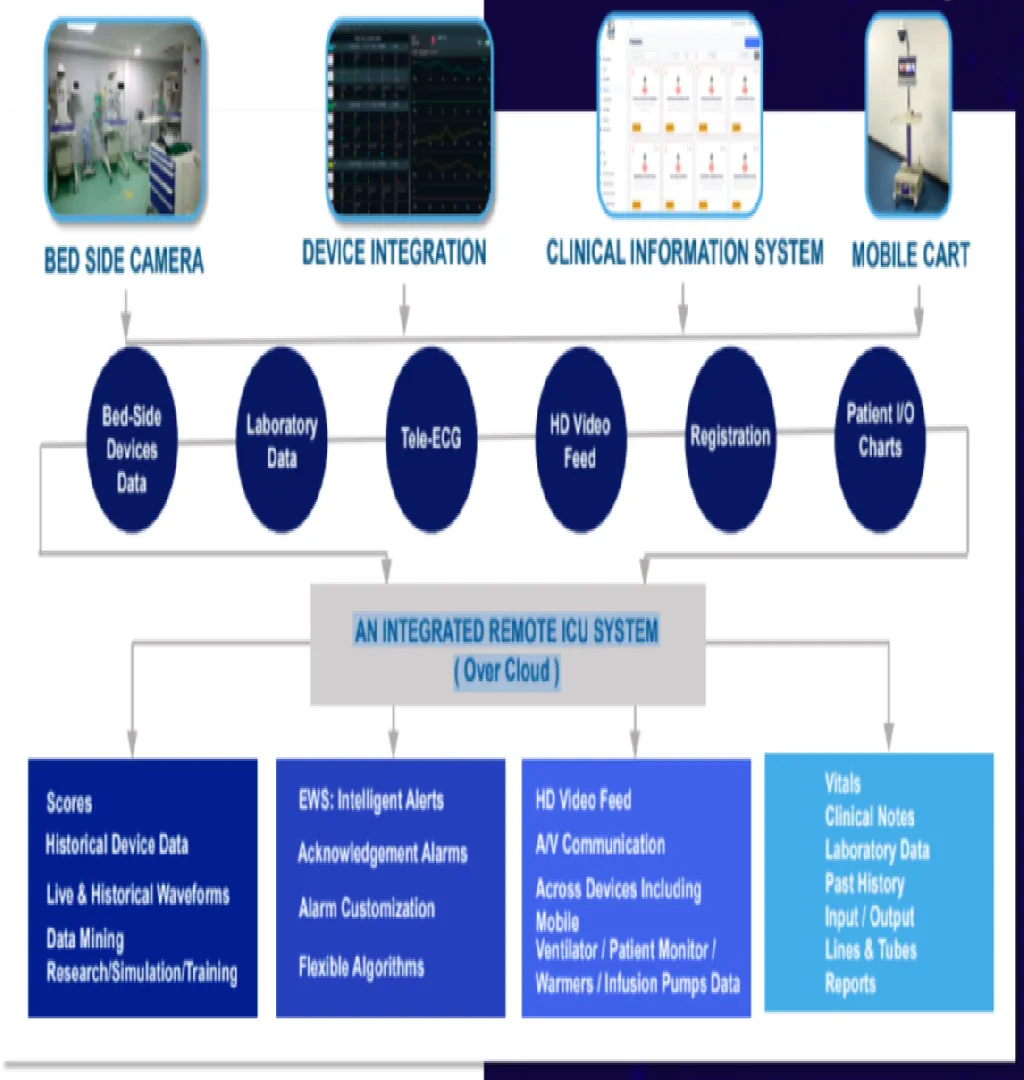

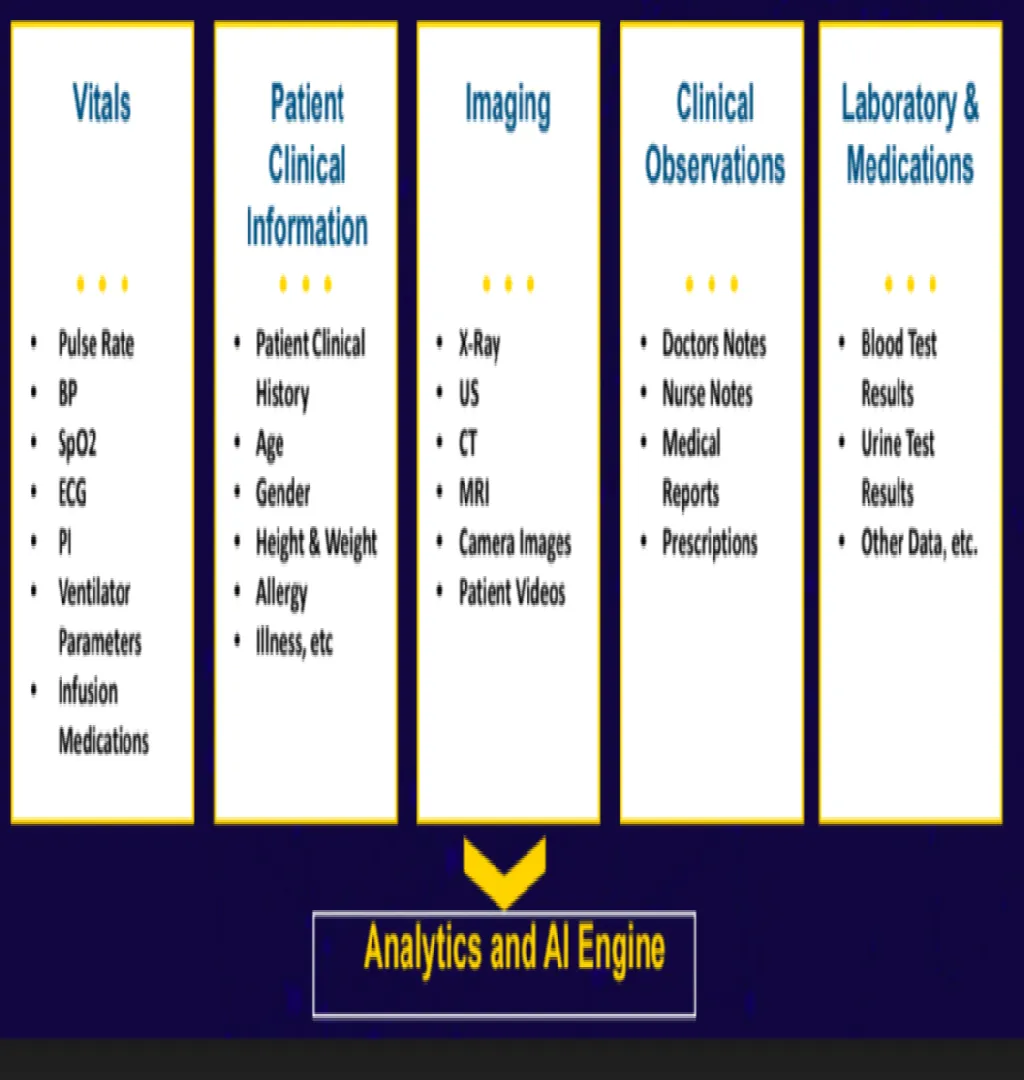

Integrated remote ICU System over the cloud, more than 30 devices are connected via proprietary IoT device and shown over a dashboard at the command center in real-time, with analytics and alerts.

Clientele type

Private Hospitals

Government Hospitals

Intensivists

Physicians

AIIMS Nagpur, AIIMS Delhi, and RGICD Bangalore already using the technology, and discussions ongoing with renowned hospitals like Apollo Group, Omni Group, and Medulance among others.

Premises

LEASED

Lease per month (in INR): 30.00 K

Security Deposit (in INR): 1.00 L

Carpet Area: 1,000 sq ft

Rented Premise In Gandhinagar

Asking Price Includes

Equity shares in the company

Asking Price

INR 3.00 Cr

Minimum ticket size

INR 3.00 Cr

Reason

Seed Funding Required. We have letter of intent and a strong pipeline, we need funds to further develop technology and invest into team and resources to be able to tap the highly scalable market.

More Details

A visionary company that aims to create an autonomous Healthcare ecosystem starting with Tele-ICU using its cutting-edge technology. In India, there are likely to be 5 Lakh ICU beds and less than 9000 Intensivists. ICUs in small to medium size hospitals face shortages of critical care specialists (Intensivists) and in the absence of that, hospitals lose revenue and reputation both. The Tech stack digitizes ICUs to make access available for critical care specialists.

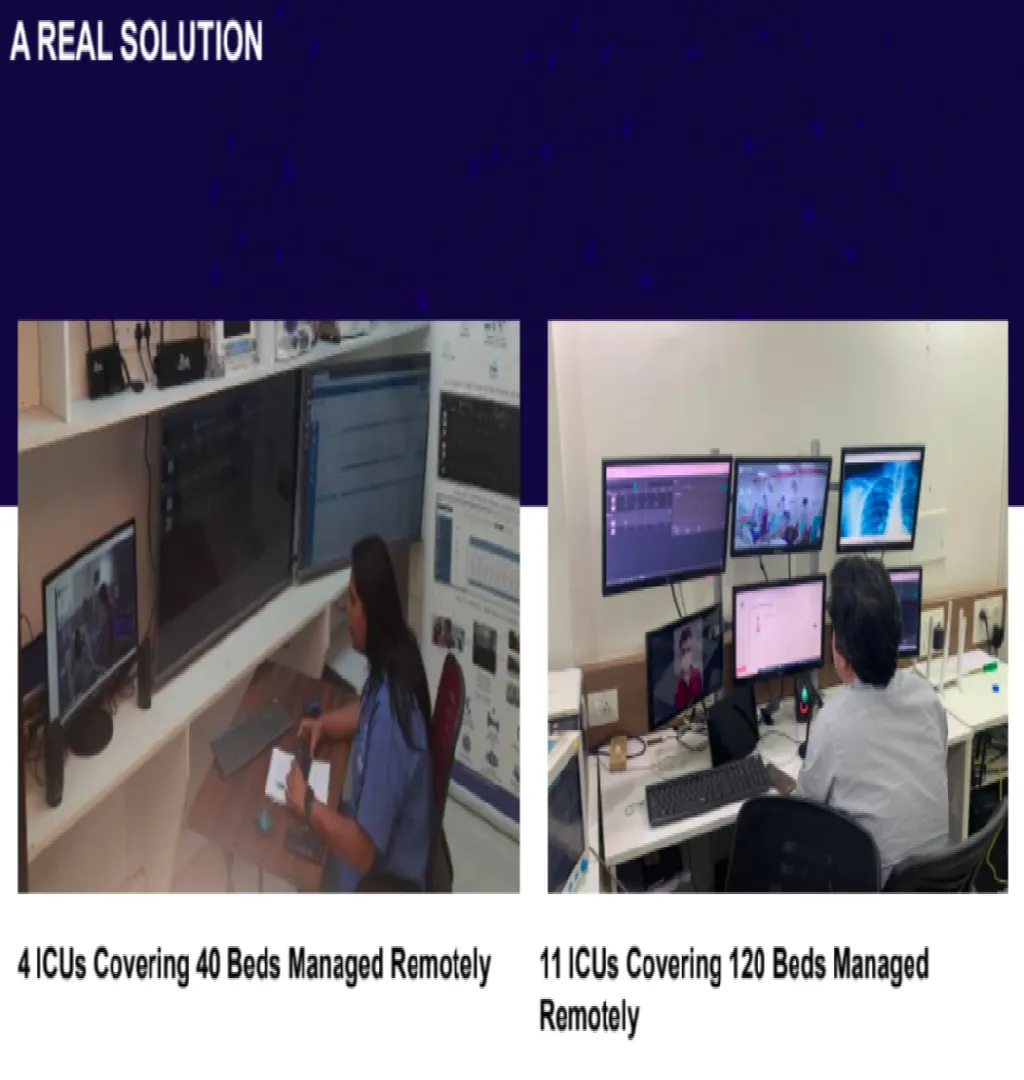

We solve the problems of all stakeholders through our innovative tele-ICU software and hardware. Once connected patients are monitored at Command Center by Intensivists through Mobile Cart, Device Integration Technology, and Tele EMR. This technology solution brings proven results in connected hospitals such as increased revenue, improved occupancy, better service quality, and lower mortality rates.

Keywords

Business Tags

Fundraising for ₹10 Cr – 500 Cr

Confidential Process Completed in 120 Days

Strategic Preparation, Aligned Investor Outreach and Seamless Closure

Supported by Advisors with 26+ Years of Experience