Rehab Medical Device Manufacturer Seeking Funds In Jaipur

About Business

They specialize in the production of a diverse range of healthcare products, currently offering a portfolio of 75 items that includes:

4

Body braces

Cervical supports

Knee and ankle support

Traction kits

Hot and cold therapy products.

Surgical belts.

Clientele type

They distribute their products throughout India via an extensive network of 11 dedicated distributors, and also export to three other countries.

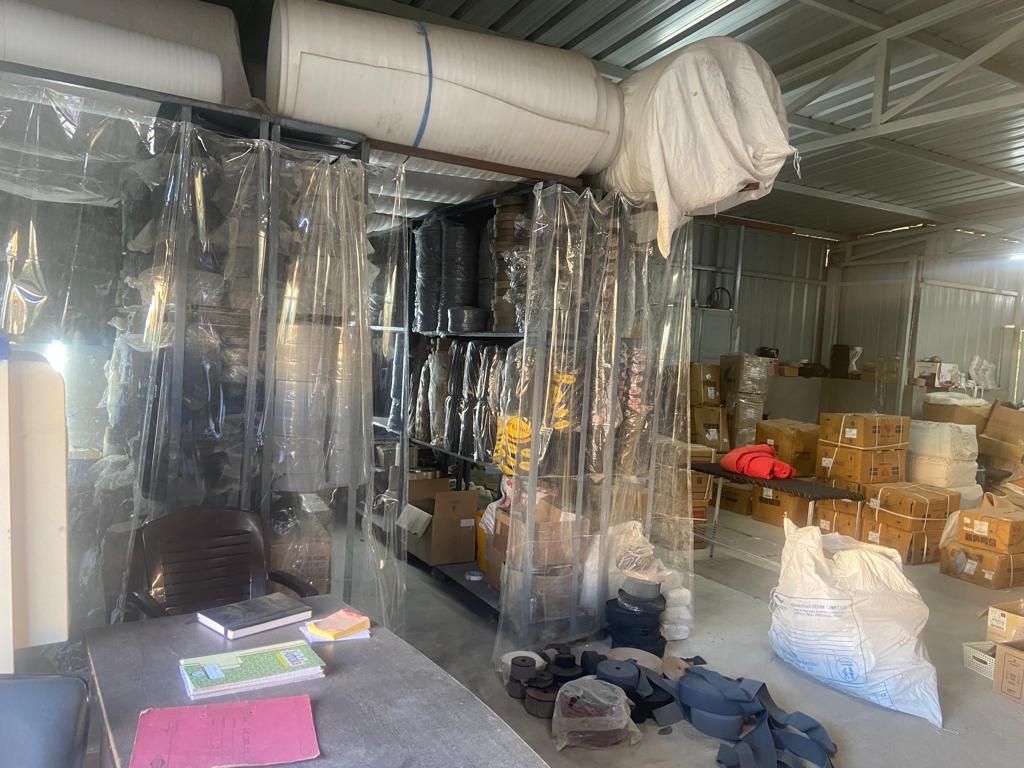

Premises

LEASED

Lease per month (in INR): 84.00 K

Security Deposit (in INR): 1.00 L

Carpet Area: 12,000 sq ft

The plant is presently operating at 50% capacity due to a capital shortage, but despite this constraint, they are experiencing strong demand and successfully selling their products. At their current operational level, they are producing goods with a monthly value of 1.20 crore.

Asking Price Includes

The terms of the transaction will be discussed with potential Investors.

Asking Price

INR 4.00 Cr

Minimum ticket size

INR 4.00 Cr

Reason

They require funds to bolster their working capital liquidity and support the marketing efforts for their newly launched brand.

More Details

They have a seven-year track record in OEM manufacturing, with an impressive capability to produce 70% of the raw materials in-house, ensuring top-notch quality at competitive pricing. Their recent brand launch, 'BFN - Build for Nurture,' marks their foray into the market.

They engage in white-labeling services for select companies, spanning across Sri Lanka, South Africa, and Nepal.

In March 2022, they successfully completed a substantial consignment, generating a turnover of 9 crores. Following this accomplishment, they strategically invested in machinery to enhance efficiency, reduce raw material costs, and overall manufacturing expenses. Consequently, they have experienced a temporary reduction in liquidity within their working capital.

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?