Proven US Gamified Learning Platform Raising Funds

About Business

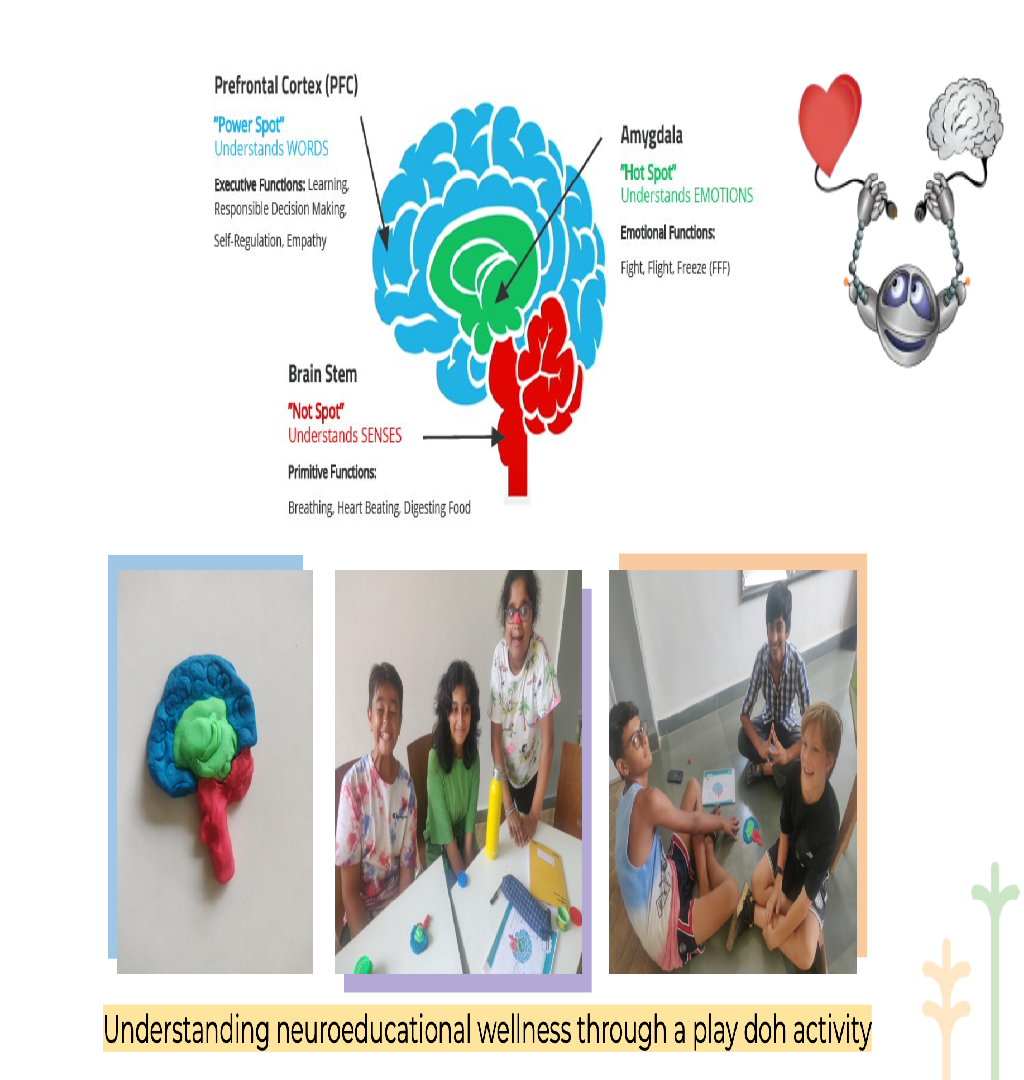

1). Social and Emotional Learning (SEL) Curriculum - blended format, 2) Integrated Learning Management System, 3) Student Driven Online Learning Environment, 4) Character Licensing and IP, 5) Professional Development training modules

Clientele type

Educational Districts, State Governments, School Administrators, Educators, Parents, Non-profits working with children

Premises

not applicable

Asking Price Includes

This is an ED Tech company. Included: Curriculum, Lesson Plans, comic books, board games, workbooks, student online learning environment, integrated learning management system, professional development (PD) platform content and modules, Character licensing for India (negotiable) .

Reason

The reason behind the transaction will be elaborated upon investor introduction

More Details

Thoughts leaders in curriculum design and implementation, PhD;s in SEL, Psychology, Certified in Educational Neuroscience and School reform. The team has over 15+ years developing and implementing our platform's Curriculum in some of the largest school districts in the U.S. including Los Angles, Chicago, Washington DC and others.

Given India's direction with NEP (National Education Policy 2020) and our platform's inherent alignment with the corresponding National Curriculum Framework (NCF 2023) - we are looking to sell or partner with leading Ed Tech companies focusing on the wholistic approach to educating children with a focus on mental wellbeing of students. (WHICH IS the direction of NEP and NCF.)

India Gov. Allocated Rs. 1,13,000 crores for K12 education 2023/24, largest sum of money ever allocated for education - strong focus in SEL.

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?