Profitable Innovative Medical Safety Business for Sale

About Business

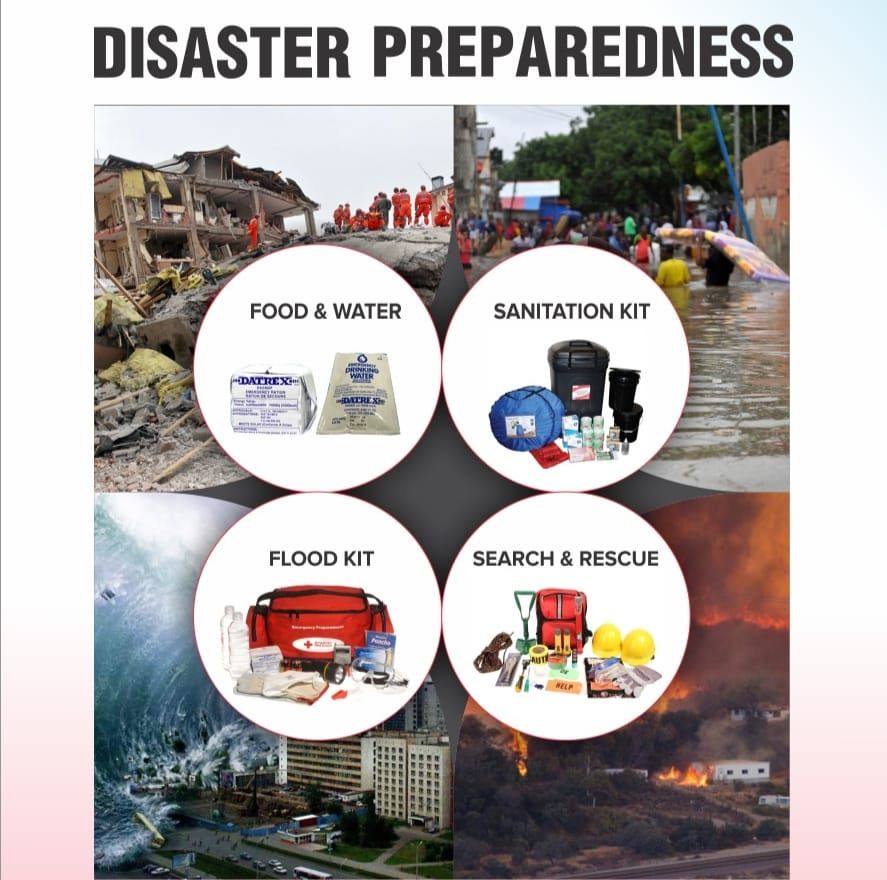

We are domain experts for designing customized medical preparedness and disaster management equipment, devices & kits. We aim to improve medical safety standards at workplaces. We deal in basic life-saving equipment such as first aid kits, medical first responder kits, and more. Our key product portfolio consists of - First Aid Kit, AED’s, Physiotherapy Equipment, EVAC+CHAIR, MANIKINS, Ambulance, and Many More. We have also introduced a first aid training and certification program by a team of well-experienced certified professional instructors.

Clientele type

Top MNCs in various sectors including Fortune 100 companies, TOP Government Organizations including defence force, State Governments, and NGOs.

Premises

LEASED

Lease per month (in INR): 40,000

Asking Price Includes

Inventory, Employee, Leased office

Reason

No successor to take care of the business at this point

More Details

A plug-and-play asset, with ready clients, a strong order pipeline, and an excellent reputation.

The potential of this business in this space is growing rapidly.

The sales increased during covid.

This business can be scaled to greater heights in a very short span of time by expanding the footprint to other parts of India & adding more relevant services for servicing client needs.

Exports also can be considered for specific products. Need for dynamic leadership & timely investments to take care of cash flows.

An excellent company worth acquiring to add to the existing portfolios and scale up rapidly. It's commendable that with just 5 employees.

The company has a turnover of nearly 5 -6 CR per year with an average revenue generation of 1 CR per employee.

A strong client base and easy to scale up if the footprint is extended to other major cities. (Currently operational only in Telangana, AP, TN, Karnataka & Odisha. Invested in adding long-term clients & focussed on partnering with domestic & international OEM & strategic partners like; ZOLL, Spencer, Evac+Chair, EMS, IEM, St Johns, ResMed, Deccan Coach Builders. Current inventory – valued at about 70 Lakh.

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?