Power Plant Machinery Services Company Looking for Investment

About Business

It is private limited company providing operation and maintenance services to Power station which was started in 2012 at Pondicherry. The company is ISO registered. They are service provider of Thermal Power Plants includes thermal power plant design, Commissioning, overhauling of thermal power plants, operation & maintenance of thermal power plants owing capacity Up to 660 MW.

Key Services are:

• Maintenance of Power Plant Equipments

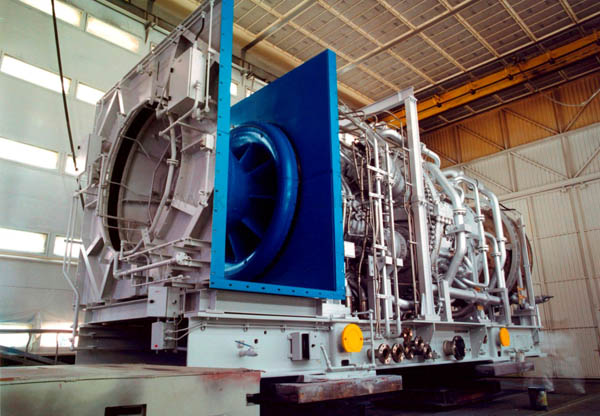

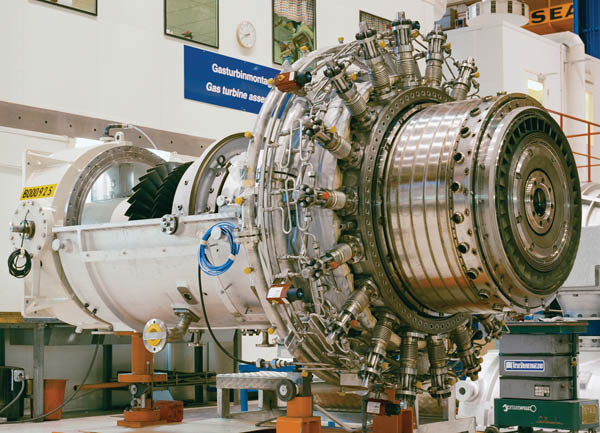

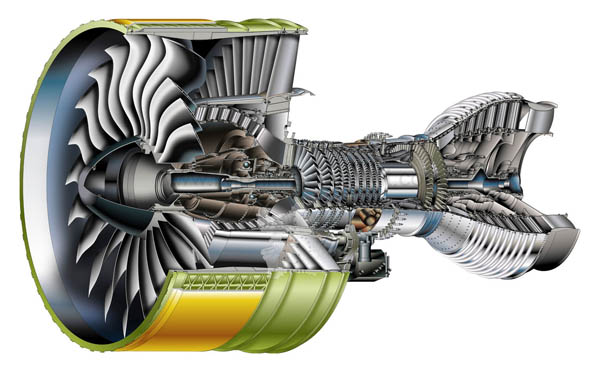

• Overhauling Of Turbine & Generators in Thermal Power Plants

• Erection of Thermal Power Plants Auxiliaries

Power Plant Services includes:

Mechanical

• Operation and Maintenance of Power Plants Equipment including Mechanical, Electrical & C&I

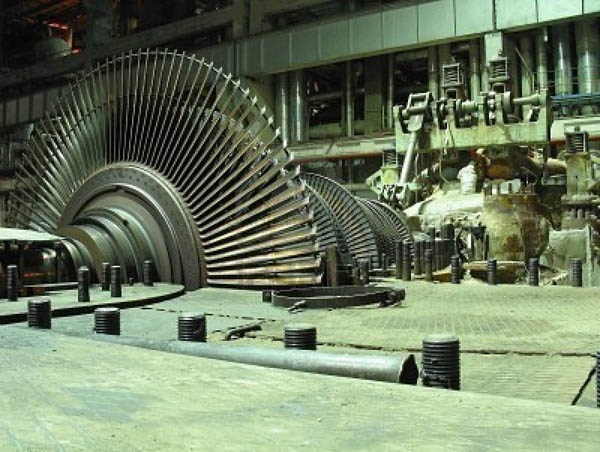

• Overhauling of Steam Turbine & Steam Generators

• Maintenance of Turbine, Generator and its Auxiliaries

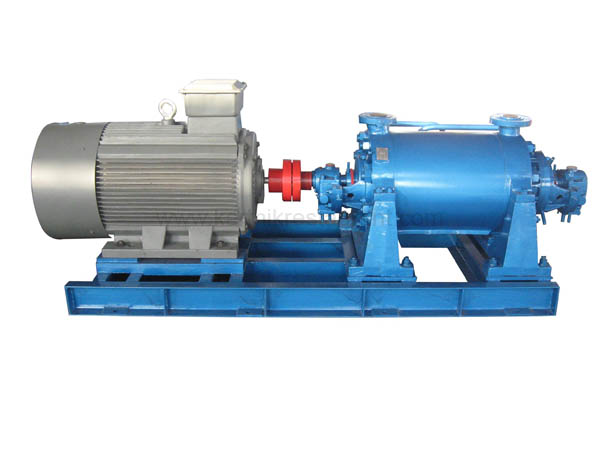

• Maintenance of Balance of Plants

• Overhauling and Maintenance of Coal Mills & Feeders, Mechanical Equipments of Coal Handling Plant

• Overhauling and Maintenance of Cooling Towers

• Reblading of Turbine Rotors, MPI of Turbine, Alumina blast of Turbine

• Spray Insulation & Refractory

• Overhauling of Heat Exchangers

• Overhauling and Maintenance of Air Compressor, centralized Air Conditioning

• Overhauling and Replacement of High Pressure Vales

• Rubber Lining of Tanks

Electrical

• Overhauling and Maintenance of LT & HT Motors

• Replacement & Lying of HT Cable

• Maintenance of Lighting System of Power Plants

They have received many certificates of appreciation from many power companies. They have expert team of professionals with a vast experience in this industry. They have employee strength of 1800. The company has 36 projects all over India. The company growth rate of 30 percent average net profit margin is 22 percent per year. Their clients are Damodhar Valley, General Electric, NTPC, some Nuclear Power Stations, Neyveli Lignite, Lanco Power, Hindustan Power, Etc.

The last year turnover was INR 36 Cr. They have INR 60 crores projects in hand. They are looking for Investors, sub-contractors having investment potential depending upon the project size of 10 lakhs to 2 crores.

Reason

Expansion

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?