Manufacturing Business for Sale In Bangalore

About Business

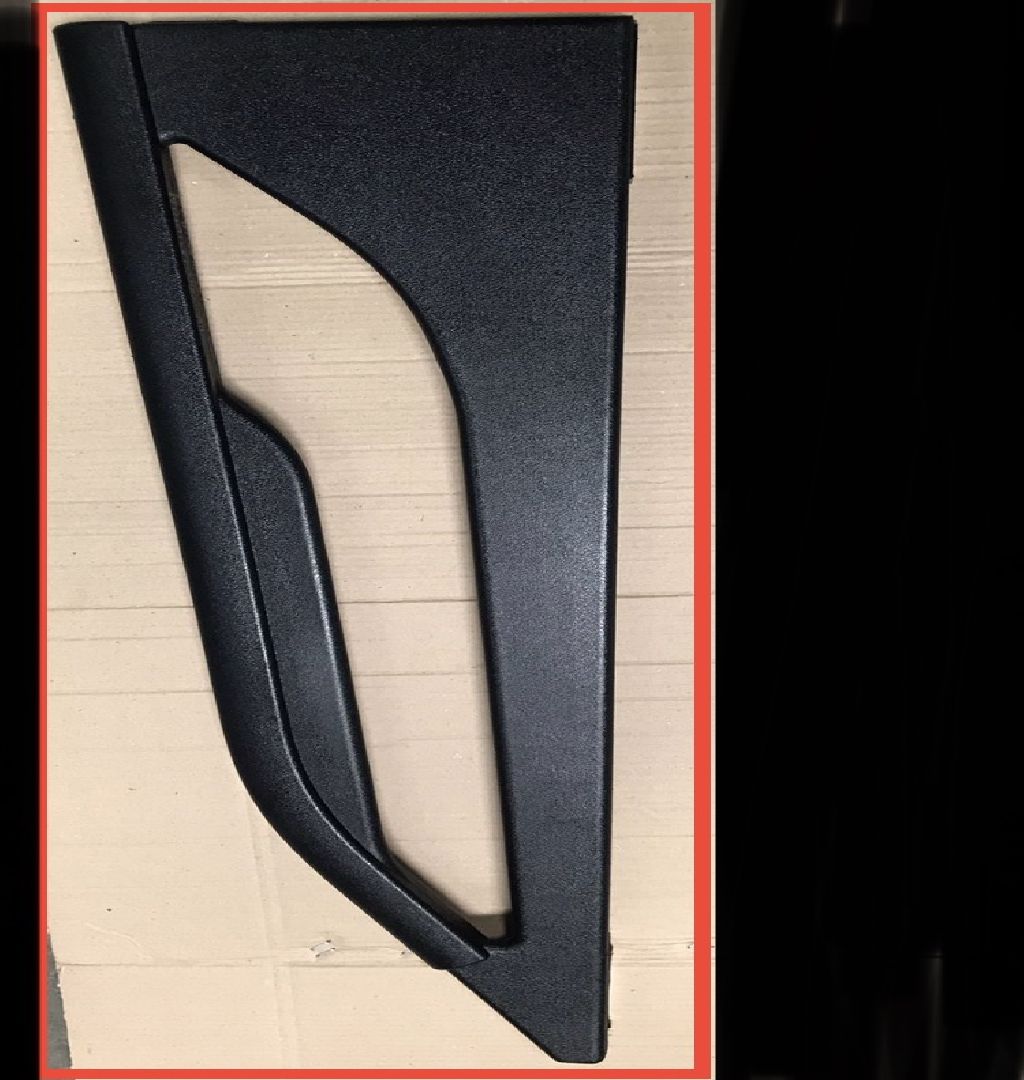

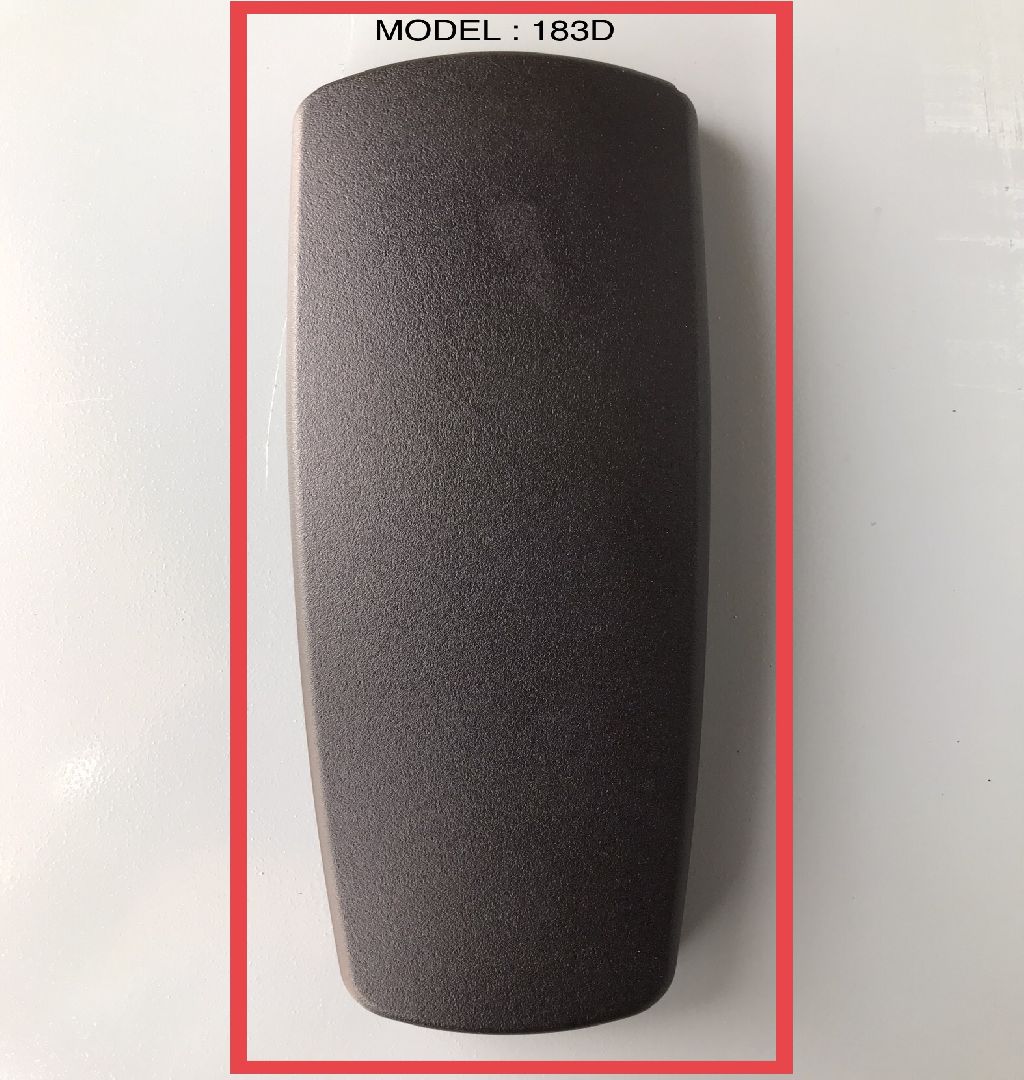

They are a Manufacturer of Polyurethane Armrest for office chair industries, Luxury Buses and Sleeping Coaches, Headrest and Ladder for Railways.

Clientele type

Some of their esteemed clientele are Feather Products Private Limited, Pace Seating Systems Private Limited, Aster Comfort Design Private Limited, Opal Designs and Engineers Private Limited.

Premises

LEASED

Lease per month (in INR): 16.00 K

Security Deposit (in INR): 1.00 L

Carpet Area: 1,500 sq ft

At the factory, during a single 10-hour shift, they have the capacity to produce 2000 units per day using their state-of-the-art automatic machine equipped with 40 molds. Over a 25-day working month, this translates to an impressive output of 50,000 units.

Asking Price Includes

The asking price of 1.2 Cr is for Investment, if someone wants to acquire the business, then the terms could be elaborated to potential buyers.

Reason

They need funds for working capital liquidity.

More Details

Proprietor: Possesses an extensive 25-year background in the manufacturing industry, including a distinguished role as a General Manager.

The primary customer's demand stands at an impressive 100,000 units per month.

Raw materials are sourced from Delhi, ensuring the highest quality inputs.

The potential for expansion extends beyond their current operations, with the capability to venture into manufacturing products for the automobile industry.

Furthermore, the local market in Bangalore presents a significant opportunity. To tap into this potential, they are looking to acquire three additional machines and secure a 20,000-square-foot space.

The Company is completely bootstrapped and the Promoter has infused a sum of 70 lakhs in the business.

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?