India's First Social Shopping Ecommerce Marketplace With 70 Brands Onboard Looking For Exit

About Business

We have created an online store like flipkart and amazon.

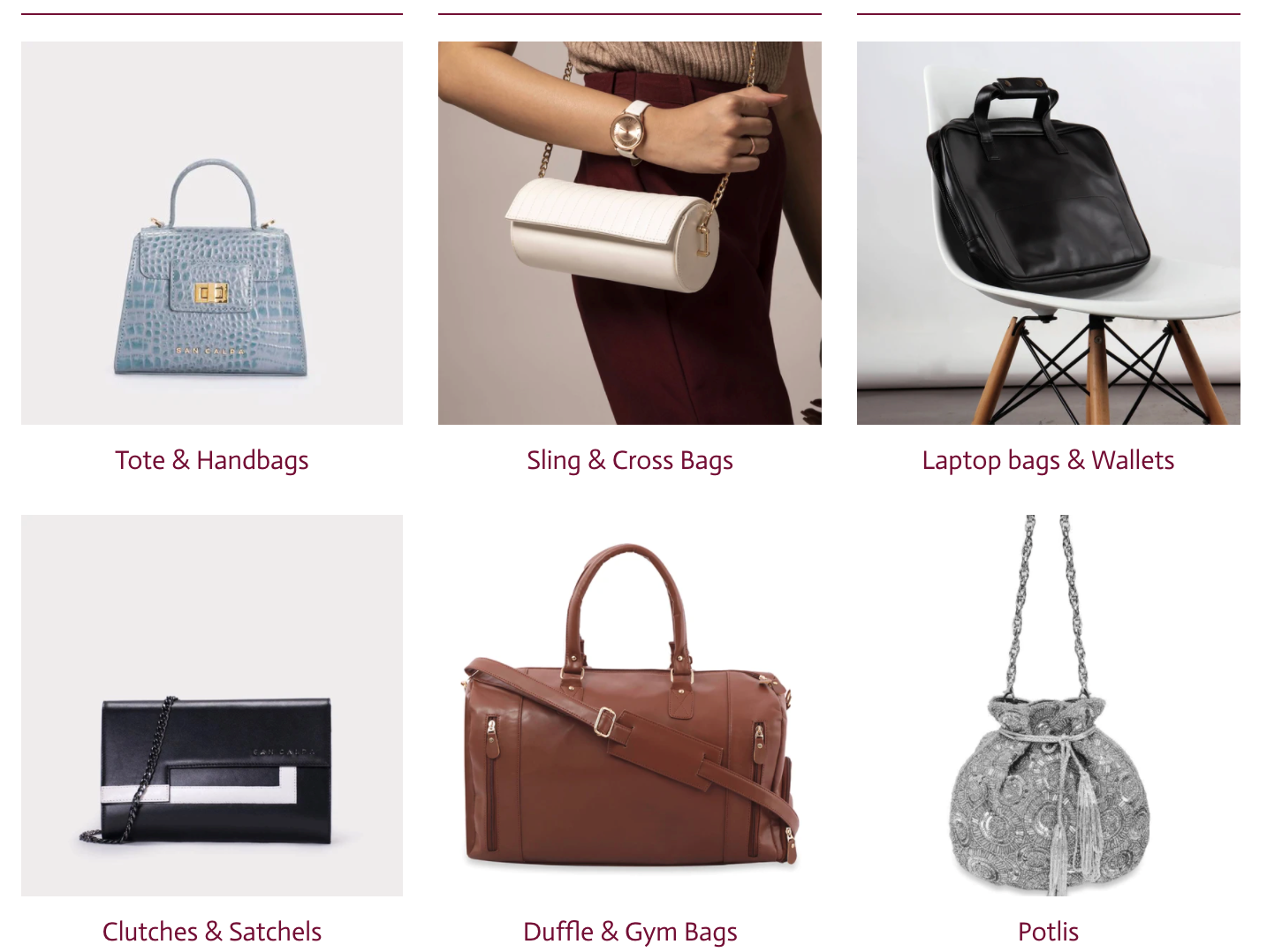

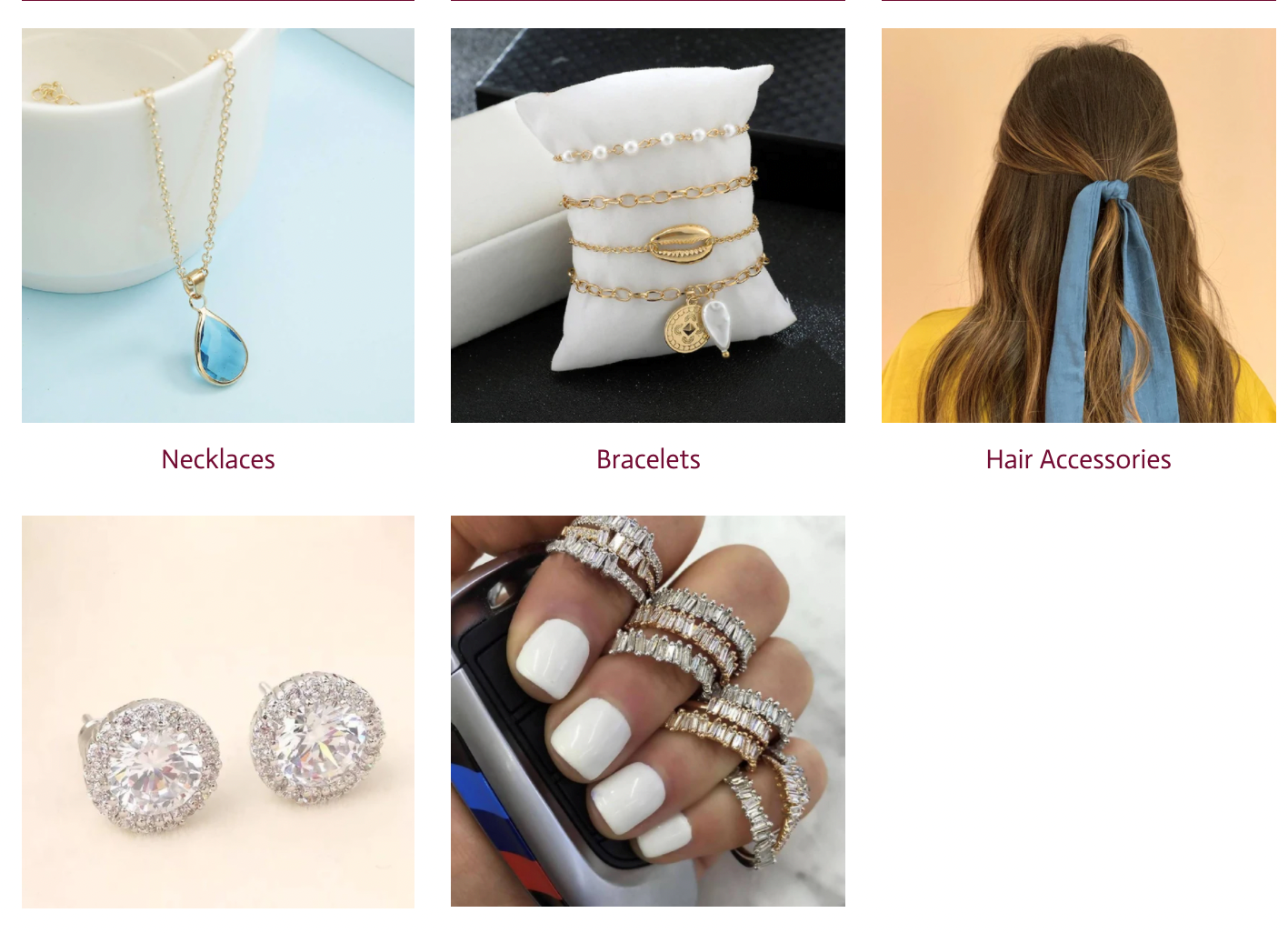

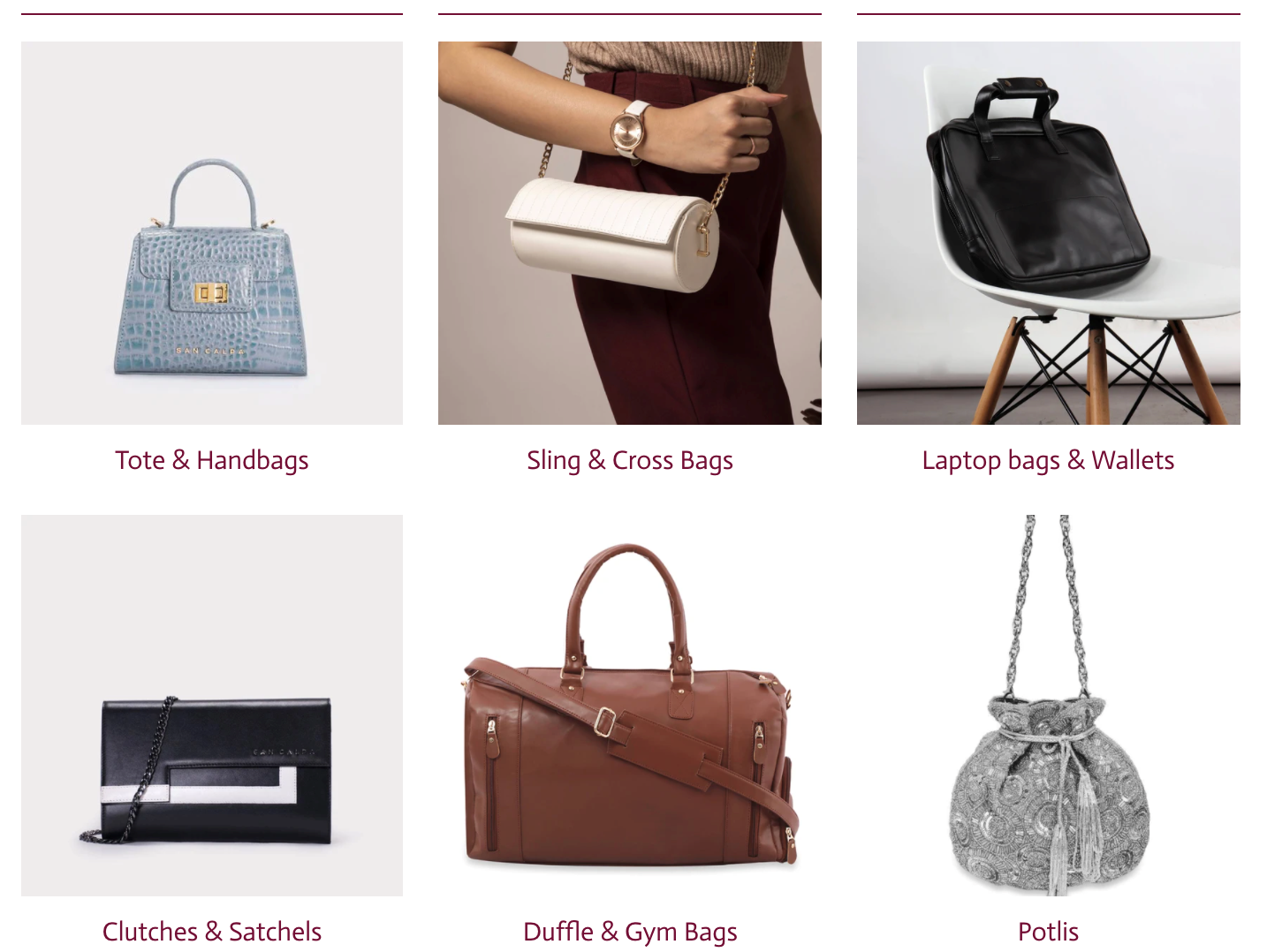

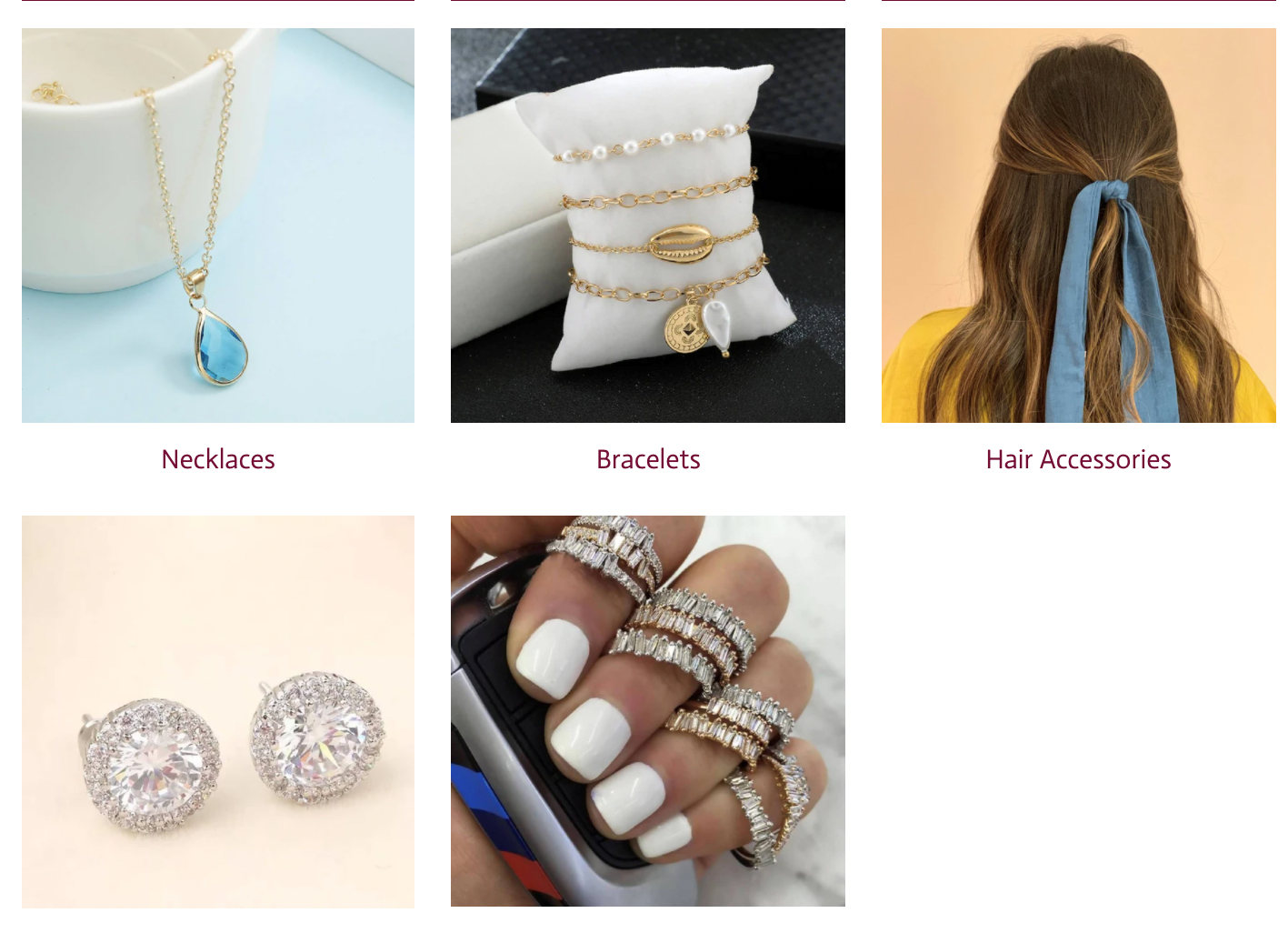

We have product categories range from women and men's apparel, shoes, skincare, bags, fragrances, sports, accessories etc. with over 70 brands onboard including reputed brands like Adidas, TaylorMade, UnderArmour, etc.

Clientele type

Till now we have 70 sellers are registered on our platform.

Premises

At present we are working form home.

Asking Price Includes

Asking price includes whole with all digital assets.

Reason

It has been around 7 months since our inception. Extreme budgetary constraints have restricted us from unleashing it's true potential.

More Details

Our brand is India’s first social shopping e-commerce platform with over 70 brands onboard, including renowned brands like Adidas, TaylorMade, and Under Armour, with a product count of approx. 2000.

It allows friends and families to shop online together in a fun and interactive way by enabling them to create multiple groups, live chatting, real-time product sharing, following each other’s cursors, creating a common Wishlist, etc.

The business currently runs on a commission-based model, wherein, we charge between 20-30% commission for every sale that goes through our platform.

The company is based in New Delhi, India and all its operations are conducted entirely online. The company was started in September 2020 with the mission of bringing friends and family together during the Covid-19 pandemic when social interactions became unsafe and rare. We wanted to add a social element to the formerly bland and lonely experience of online shopping, by making the process more fun, interactive, and social. With the introduction of our website, gone are the days when people will have to send screenshots of their favorite products to their friends while shopping online.

The business is run entirely online with the website built on Shopify and the order fulfilment taking place via our third-party shipping partner. This is a very cost-efficient business and can be expanded further with minimum cost. We even enjoy the first-mover advantage, which further makes us confident of the future success of our website. If the right sort of skills and resources are put behind the company, it can scale to unimaginable heights.

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?