Full Functioning South Indian Restaurants for Sale in Pune

About Business

2 South Indian Restaurant

Clientele type

South Indian and Fusion Food Lovers

Premises

Corner Shop on main road

Asking Price Includes

All equipment, electronics, staff, grocery (for 15 days), all vendor contacts, branding, fully trained staff and etc

Reason

Out of 2 partners one is moving to Australia

More Details

Full Functioning South Indian Restaurant. Was fully operations until COVID lockdown.

All equipment, seating arrangements, canopies, billing facilities, staff are also included.

The restaurant is located at a prime location in Wakad.

Shop Rent is INR 55,000 (negotiable).

Area: 350 sqft covered area + 2000 sqft open area.

Monthly sale is average INR 6.85 lakh per month (peak sale of INR 8.2 lakhs).

Setup cost: INR 18 lakhs.

Expected price: INR 8.5 lakhs.

Running since: August 2016.

Seating Capacity: 44 + lot of additional open space.

All Staff available: you can decide to keep or remove them.

All equipment, well designed outdoor seating with 2 movable awnings, counter setup, storage racks, billing setup, fridge, grinders, everything you would need to get started..will share all the vendor details as well like grocery, gas, dairy, cooldrinks.

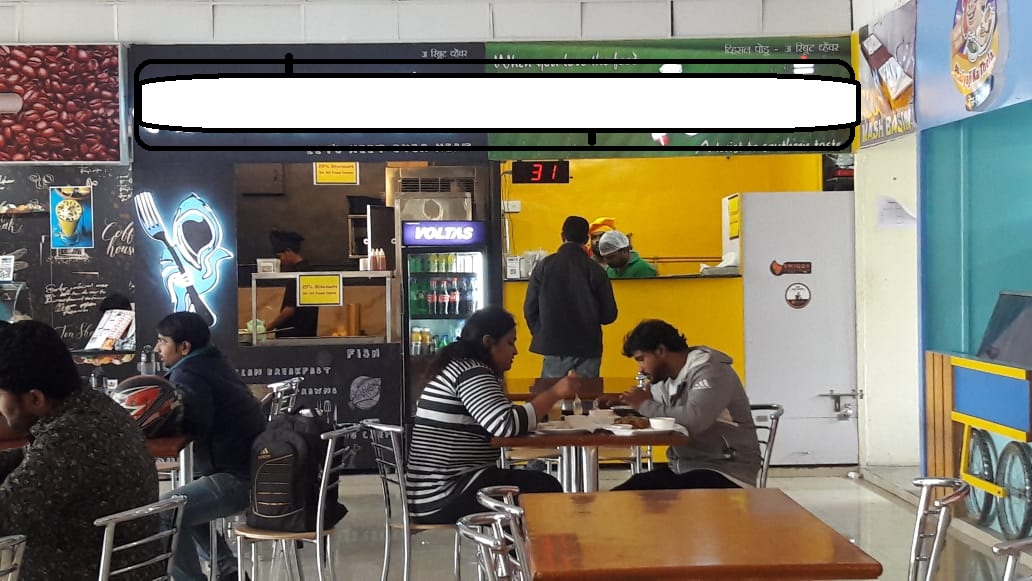

Another restaurant detail:

Address: Hinjawadi Phase 3.

Phase 3 shop rent is INR 42,000 for all shops combined (negotiable with owner).

The area is 260 sqft + common seating food mall area.

Monthly Sale is INR 5.2 lakhs (peak sale is INR 6.8 lakhs).

Setup Cost is INR 6.5 lakhs.

Running since: April 2018.

Seating Capacity: food court with 180+ seating capacity.

Expected Price is INR 3.5 lakhs.

All Staff available: you can decide to keep or remove them.

All equipment, counter setup, storage racks, billing setup, fridge, grinders, everything you would need to get started..will share all the vendor details as well like grocery, gas, dairy, cold drinks.

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?