Fintech Platform That Facilitates Alternative Investments

About Business

The company offers alternative investment channels for the top 5% of wealth holders.

Clientele type

We are going to act as dealmakers and tap the top 5% wealth holder and upper middle class for safe alternate investment

Premises

The company is based out of Bangalore and they have a USA-based subsidiary that is registered in the State of Delaware.

The company owns commercial spaces that it leases out.

These spaces are worth almost INR 1 crore. Other premises are leased by the business.

Asking Price Includes

13% stake in the company

Reason

Sales & marketing expenses include channel partnerships costs for which 70% of the funds will be used;

More Details

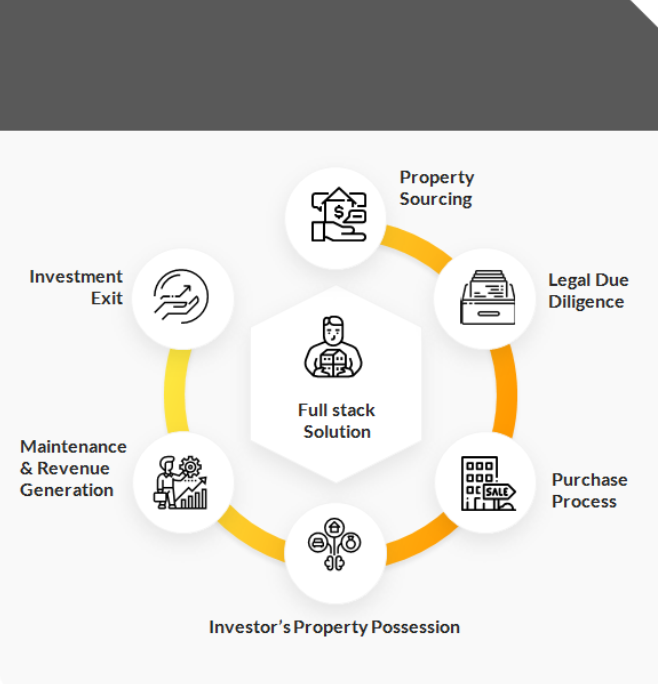

Have added and further plan to add multiple asset classes (on our online platforms) such as office space, international properties, warehouses, data centers, hospitals, electric vehicles, which are being structured into different business models such as revenue-based financing (RBF), fractional real estate (FRE), which are curated by capable asset acquisition team from business and finance background.

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?