Pallet manufacturer looking to raise funds against property

About Business

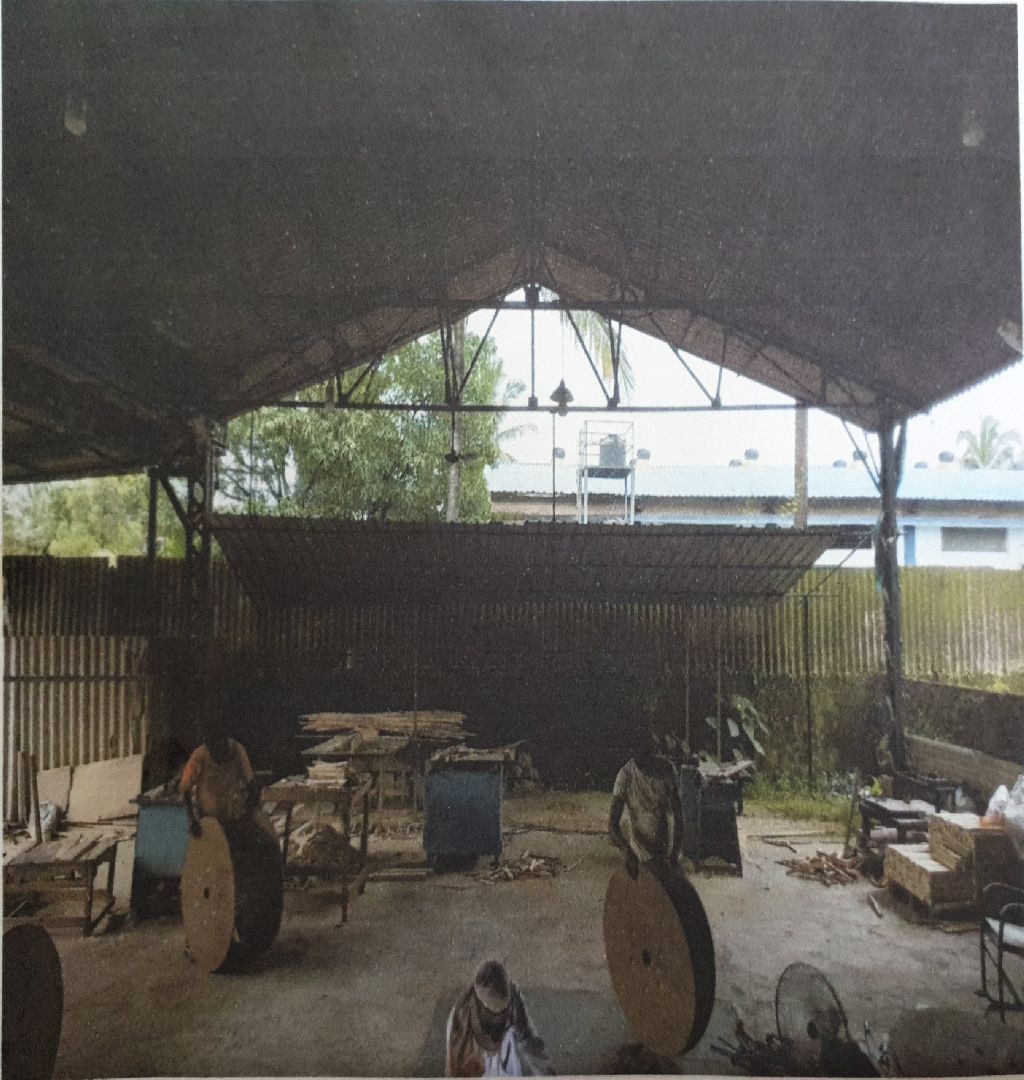

We are pioneers in manufacturing of wooden & plywood pallets, crates, boxes, cable drums and all related items in the field of packing for heavy machinery.

Clientele type

We supply to few of the leading companies from pharma industry, tech industry, pipe / cable & other manufacturing industries.

Premises

OWNED

Premise Size: 1,115 sq mtr

Market Value (in INR): 2.25 Cr

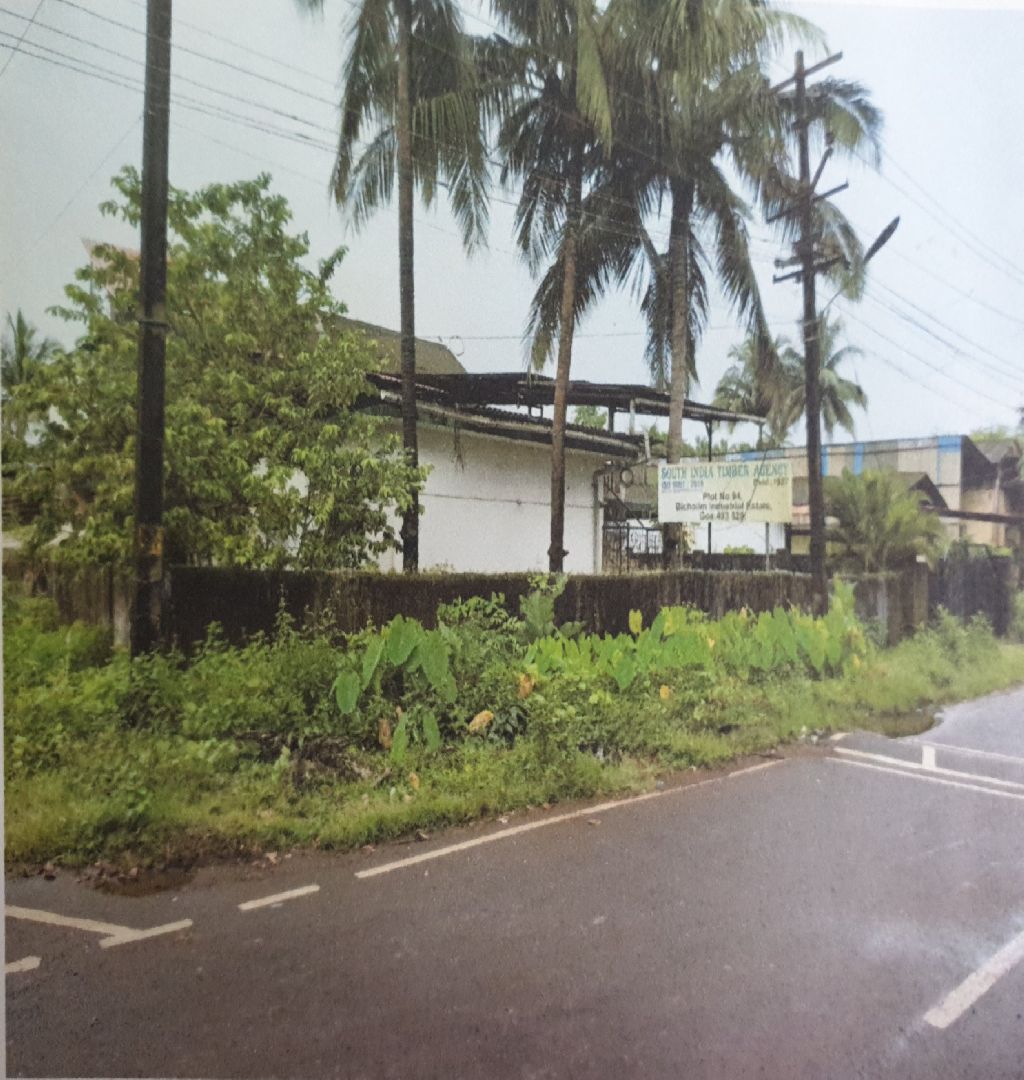

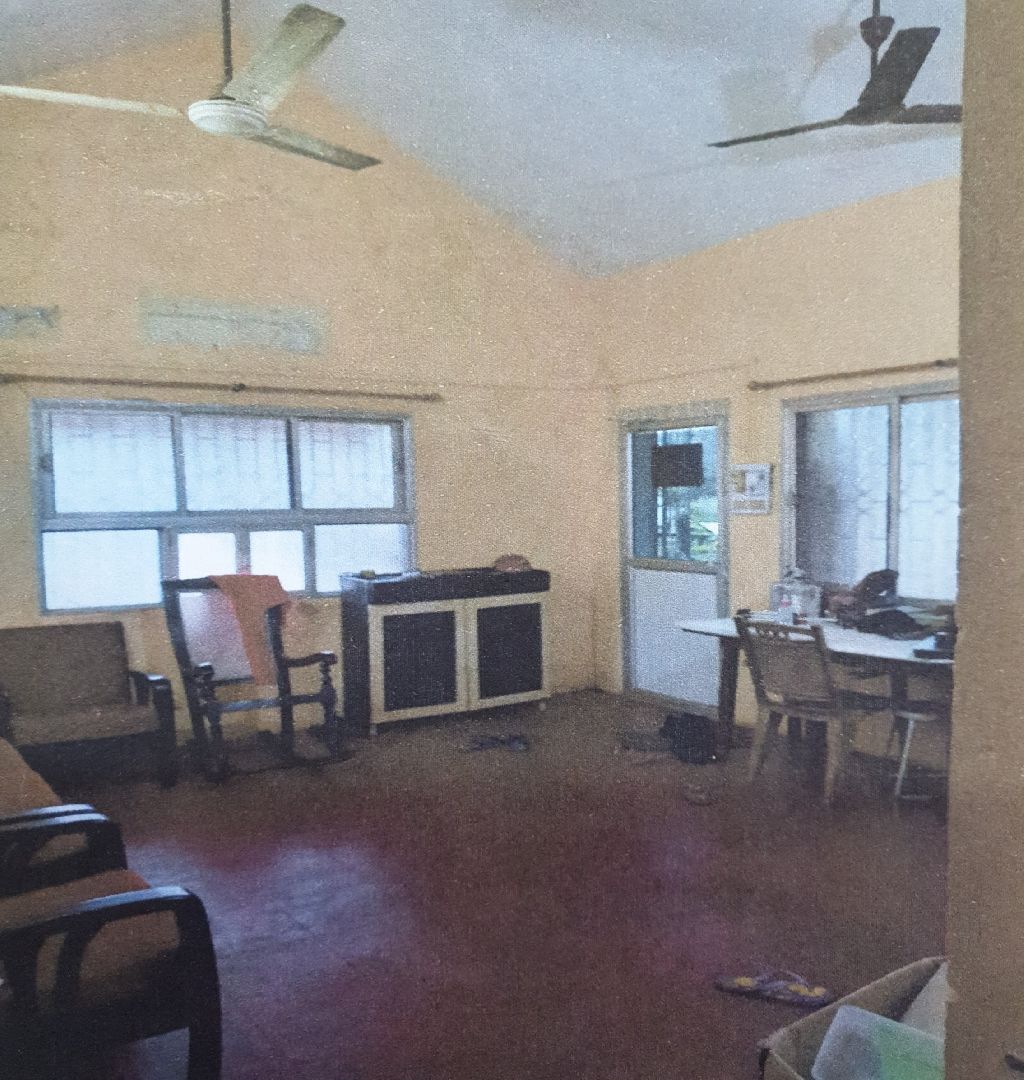

Prime location corner factory in Bicholim Industrial Estate, Goa It is 30 minutes drive from Mapusa (Goa) Plot Area: 1,115 Sq Meter Builtup: Shed 1: 219.96 Sq Meter Shed 2: 104.5 Sq Meter RCC Bldg. G+1: 313.46 sq Meter Ground Floor: Full AC Office Space with Director Cabin plus 1 Store Room, 2 Toilets, 1 Kitchen First Floor: 2 Rooms, 1 Kitchen, 2 Terraces (front and back), 2 Toilets, 1 Bathroom Plumbing: Concealed GI pipes Flooring: IPS flooring / rough concrete flooring Doors: Rolling shutters for office. MS Grill and Gates with decorative design Roof height 12' to 14' (Accessible to containers) Electric Control Board with 79 hp 3 phase power with underground cabling directly from the transformer Automated lighting schedules for evening cut-off Water is available twice a day Garden: 3 coconut trees 3 palm trees 1 papaya tree 1 lemon grass herb N no. Of ferns and Aloe vera

Asking Price Includes

Our property is valued at 2.25 crores as per the last valuation report generated by our financier I would like to raise funds against our property (Rs. 1.5 crores) with a fixed return of 75,000 Rupees per month plus 25% profit sharing stake in our business. The profit will be paid up on a quarterly basis. Exit Plan and Returns 1. Rental and profit sharing returns (75k - 1 lakh will start from 3rd month from date of raising the funds) 2. Exit can be planned 3 years down the line with an option of buyback available after 1 year at a premium of 6% 3. The returns can be calculated as sum of monthly amount and amount received at the time of selling to other investor at a premium of around 1.85 crores. a. So total probable returns can be calculated to be around 33 lakhs (monthly rent and profit sharing sum) + 30 lakhs (at exit) = 63 lakhs in 3 years and b. 9 lakhs + 9 lakhs = 18 lakhs in 1 year *Note: Above calculation is considered as 1 lakh Rs. Per month Based on sum of Fixed rent and an estimated profit which will be paid at the end of each quarter

Reason

The investment will be utilized to procure raw material & machinery & make company debt free to bounce back into the business post COVID-19

More Details

We have a valid Band saw license, Carpentry Forest license, factory and boilers license, ISPM, and Pollution license. Clientele and brand value worth generating around 5-10 lakhs monthly sales that will translate into a profit margin of around 15% avg We have a skilled workforce along with a scalable infrastructure and trusted clientele. Due to unavailability of funds we have lost an order book of around Rs. 46 Lakhs worth of revenue in last 1 year that could have translated into profit of Rs. 4.08 Lakhs

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?