Factory Asset For Sale In Vadodara

About Business

Factory & Office Facilities Available for Sale

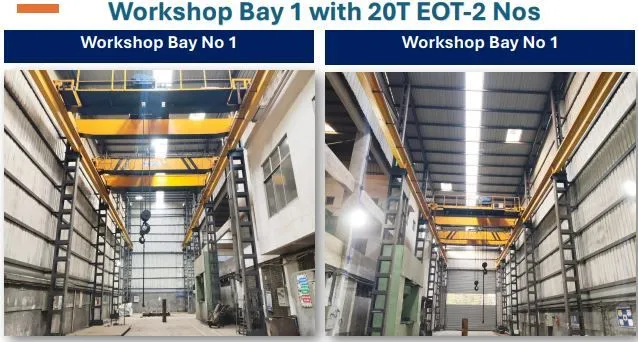

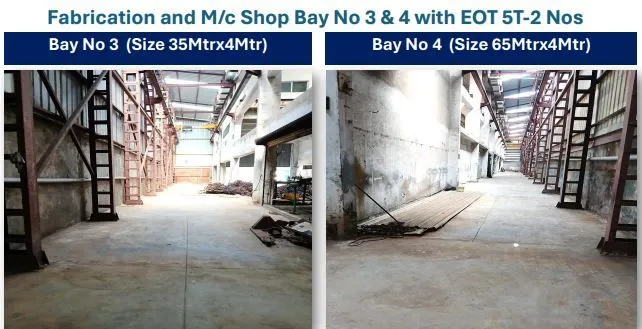

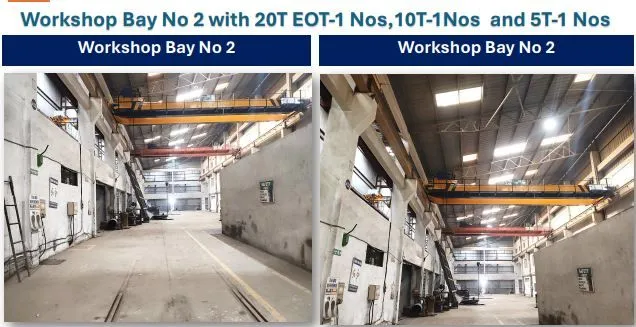

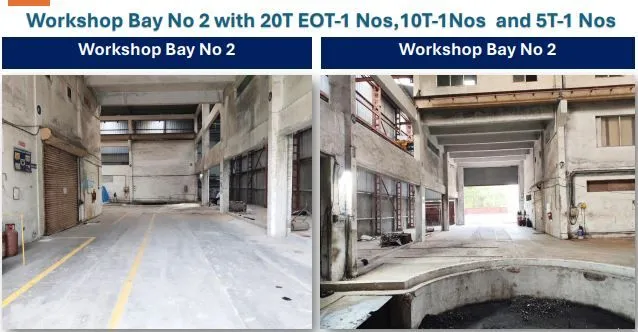

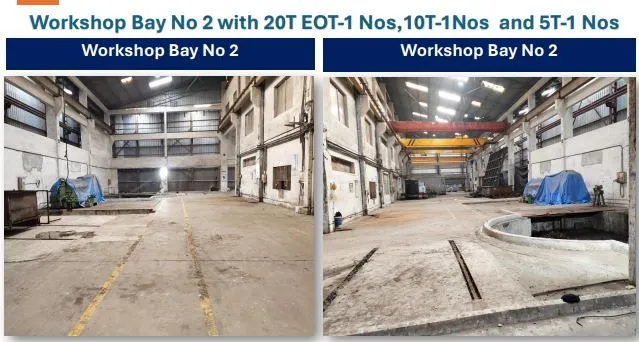

A fabrication unit measuring 33,000 sq. ft. is up for sale.

Key Features:

- The unit is in excellent condition with all basic amenities, such as a power supply and water storage.

- Includes an HVAC Executive Wing, office space accommodating 100+ people, and shop space.

- The major structure is RCC (Reinforced Cement Concrete).

Assets Available:

1. Total Land Area: 33,000 sq. ft.

- Management & Office Area (First Floor): 8,000 sq. ft.

2. Sanctioned Electricity Load: 100 kW (3 Phase).

3. Power Backup: 125 kVA (3 Phase Generator Set).

4. Security & Accessibility:

- 3 Gates with 2 security cabins.

- Direct access to a 48-feet wide tar road.

- Easy access to the main road (<1 km).

5. Logistics & Movement:

- Sufficient turnaround space inside and outside for 40-ft trailers.

6. Security & Surveillance:

- Safe & secured premises.

- Fully equipped CCTV system with 48 cameras, including motion control CCTV at critical locations.

Clientele type

Suitable for:

Fabrication of Static Equipment / Skids / Fabricated & Machined Assembly

1. Machine shop

2. Assembly and testing shop

3. Hot Blasting & Paint shop

4. Warehouse

5. Machine Maintenance and spares warehouse

6. Chemical & Pharma Projects

7. Detailed engineering of plants, etc.

Premises

It's the company's owned asset, which is for sale.

Asking Price Includes

It's assets for sale.

Reason

The founder is ready to sell the factory assets.

More Details

Building Details

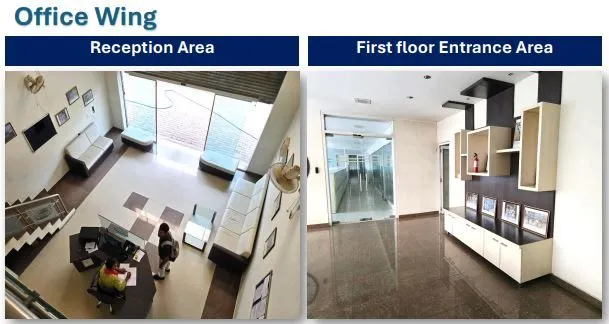

The building consists of four wings:

- Management Wing

- Office & Administrative Wing

- Executive & VIP Guest House - Located on the 2nd floor

- Production Wing

- Production team seating area - Ground floor

- Store Area – Ground floor, with dedicated facilities for welding consumables

- Separate Forming and SS shop - Ground floor

Keywords

Business Tags

Business Exit for ₹10 Cr – 200 Cr

Structured Transition Completed in 120 Days

Credible Buyer Connections, Confidential Discussions, and Seamless Closure

Supported by Advisors with 26+ Years of Experience