Established Manufacturing Plant For Sale Near Jalandhar

About Business

They are involved in providing aluminum die-cast services that include manufacturing of cooker OEM handles for Hawkins, railway parts such as handrests, footrests, tables, knobs, and side panels, as well as hand press juicers made of aluminum. Additionally, they produce kitchen frames, trolleys, and also do various other job works.

Clientele type

They have clientele in multiple industries including but not cooking industry, railway industry, foam industry, automobile industry, etc.

Premises

OWNED

Premise Size: 13000

Market Value (in INR): 5.00 Cr

They are providing the setup only, with all the equipment and the machines

Asking Price Includes

Complete manufacturing unit with land.

Reason

The business was operated by a seasoned entrepreneur, however after their demise the next generation is planning to sell the business.

More Details

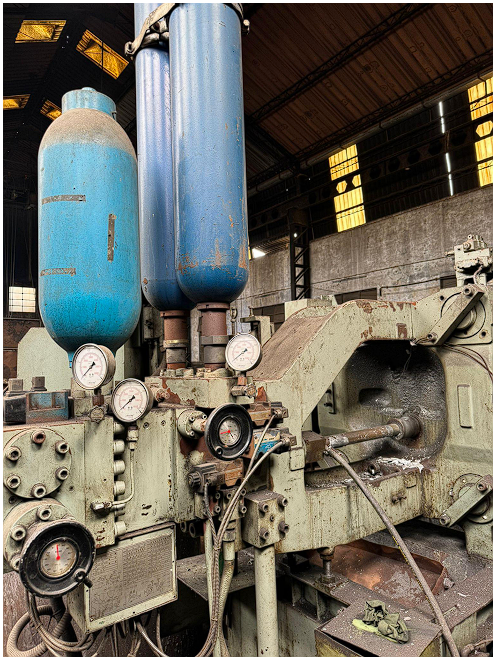

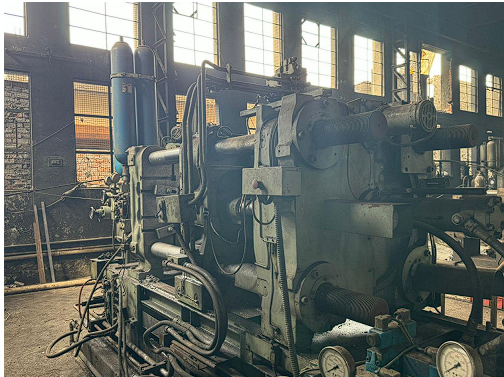

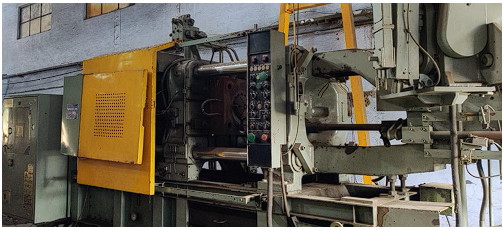

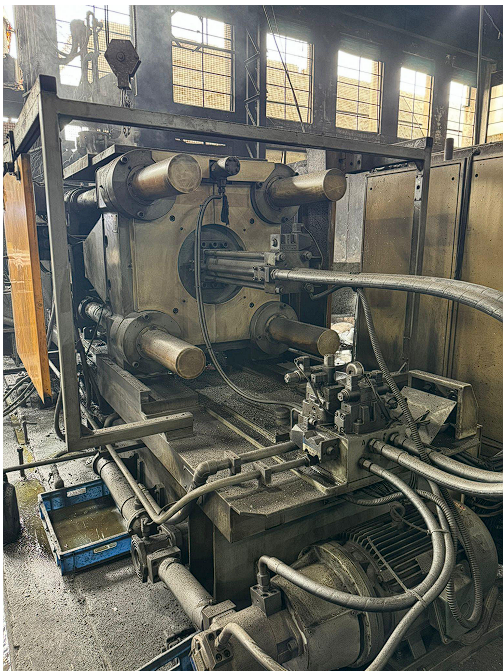

Established in 1997, they stand as a distinguished entity specializing in high-pressure aluminum die casting for both automotive and non-automotive components. With a keen focus on precision engineering and quality assurance, they have earned a reputable position as suppliers of Indian Railway chair car components. The production capacity of the facility is 25 tons per month with a product range spanning component weights from 0.04 kg to 4.0 kg, using material grades including LM-6, LM-24, ADC-12, and ZAMAK-5. Here is the list of machinery: 1. YIZUMI 400T HPDC 2. TOYO 250T HPDC 3. SS ENGINEERING 80T HPDC 4. ZINC HOT CHAMBER 10T 5. FURNACE x 2 (Oil-Fired Capacity: 150KG) 6. FURNACE Electric (Capacity: 300KG) 7. FURNACE Electric (Capacity: 250KG) 8. MILLING x 2 9. LATHE x 2 10. CYLINDRICAL GRINDER 11. SURFACE GRINDER 12. POWER PRESS 10T x 2 13. POWER PRESS 20T 14. POWER PRESS 35T 15. PNEUMATIC PRESS 30T 16. HYDRAULIC PRESS 30T x 3 17. AIR COMPRESSOR (Anest Iwata) 18. GAIDU WELDING MACHINE WITH ROTATOR 19. DRILL MACHINE ½“ x 6 20. DRILL MACHINES 1’ x 2 21. GENSET 125KVA 22. KDM TURNING ADDA 23. BIRDI THREAD MACHINE 24. SEMI AUTO STRAPPING MACHINE 25. MISC (MEASURING INSTRUMENTS, BINS, RACKS, GAUGES)

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?