Established Hair Skin Clinic Selling Assets In Bangalore

About Business

They have been specializing in natural hair loss treatment since 2007, with clinics initially established in Lucknow and Delhi, and later expanding to Bangalore in 2019. However, due to the impracticality of extensive travel every 30 days, they have decided to cease operations in Bangalore.

Clientele type

With a focus on homeopathy, natural remedies, and trichology-related medical expertise, their clientele encompasses individuals seeking safe and natural health solutions for hair and skin concerns.

Premises

LEASED

Lease per month (in INR): 50.00 K

Security Deposit (in INR): 2.50 L

Carpet Area: 900 sq ft

Nestled in a strategic locale near a notable arch, this premise is characterized by its glass-clad structure on the first floor. It features a spacious 30x3 feet LED display, accompanied by eye-catching posters.

Positioned at a corner, the building enjoys high visibility from both sides, inviting substantial foot traffic from adjacent roads. Moreover, an extra 40x3 feet signboard supplements its presence, enhancing its prominence.

Asking Price Includes

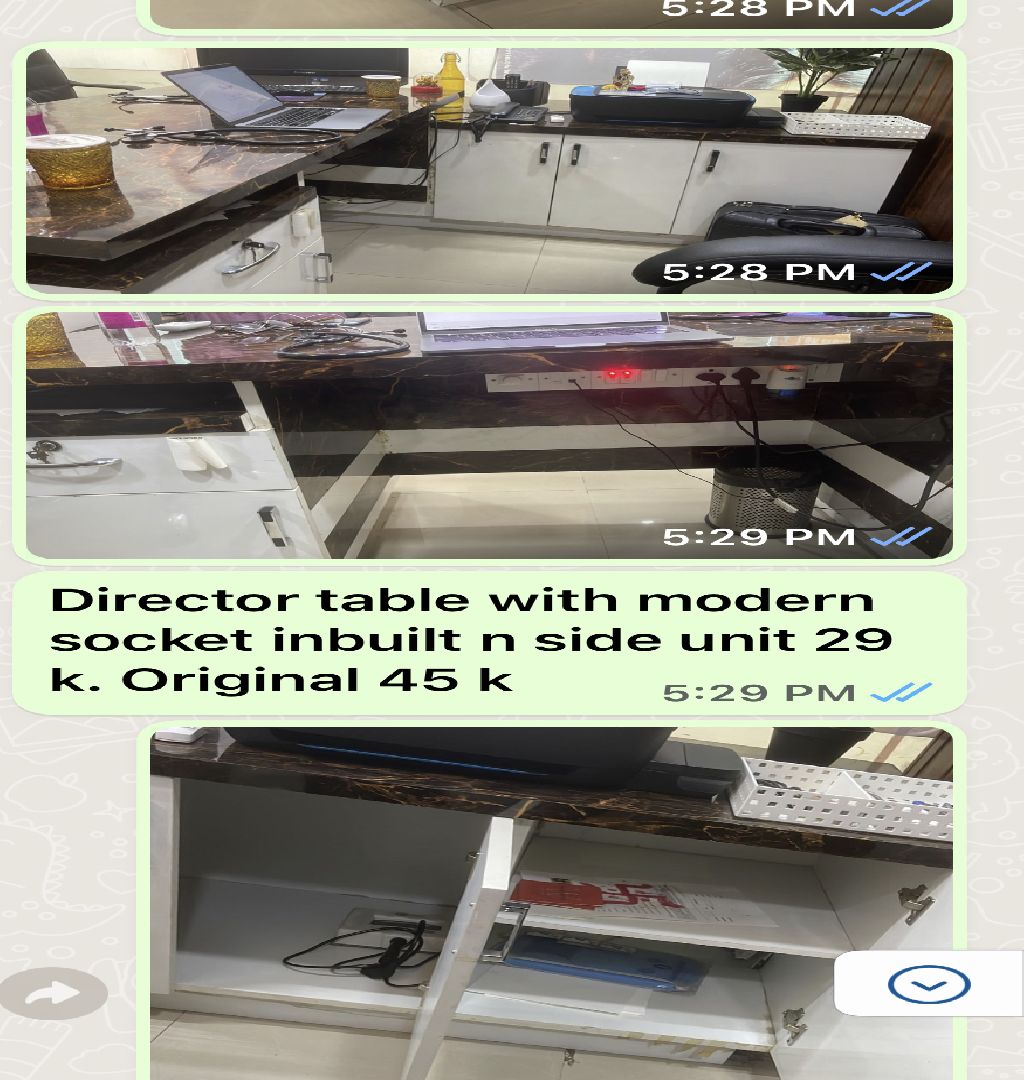

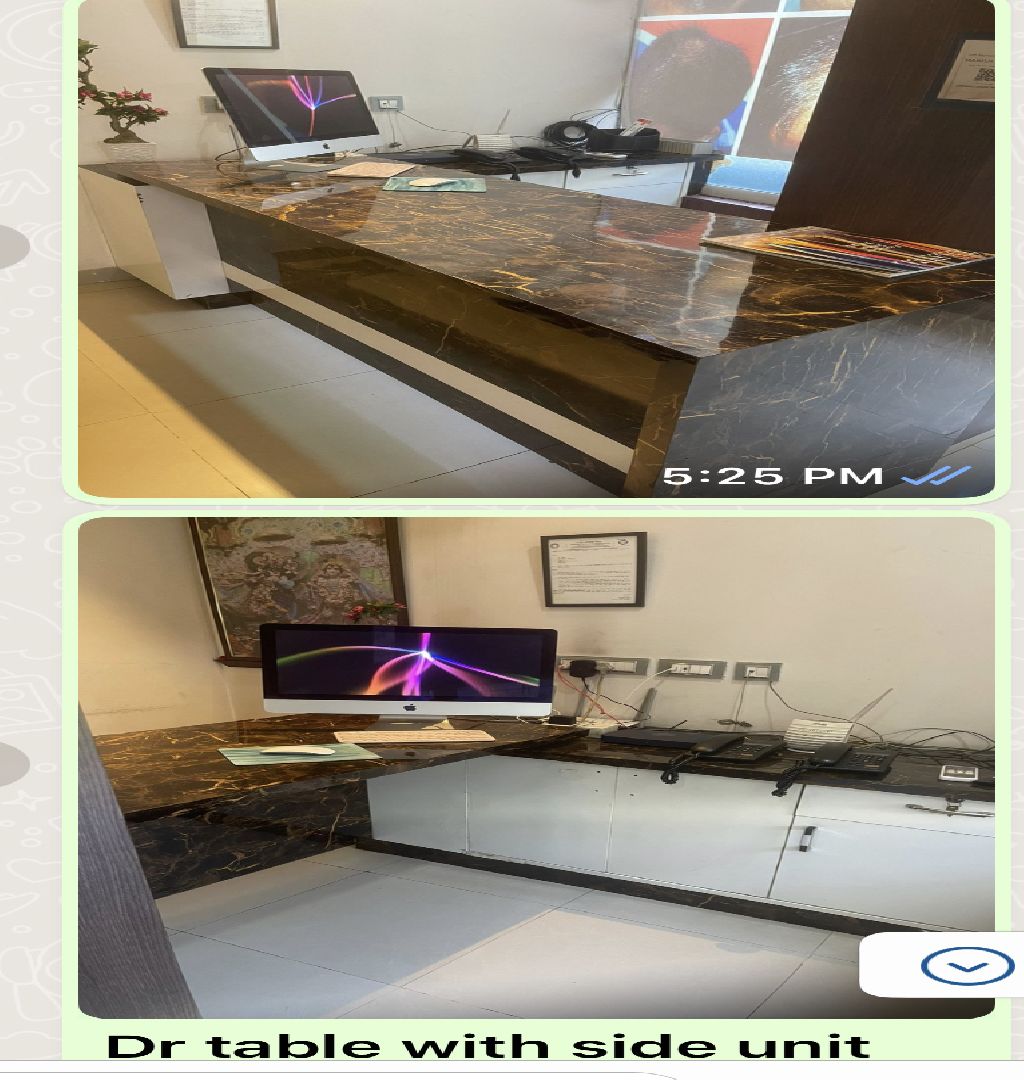

The inventory includes:

Comprehensive laser therapy bio-lights.

Six executive chairs for a comfortable experience.

Two reception tables.

Therapy chamber and fixtures led.

Air conditioning units for a pleasant environment.

Backup power with two batteries and an inverter.

Ample shelving in the pharmacy, complete with a blister packing machine for homeopathy.

Essential appliances such as a microwave and refrigerator.

Dedicated fixtures for a pooja room.

Three all-in-one computer systems.

Decorative flower holders and vases.

A mixer grinder for convenience.

Two comfortable three-seater Durian sofas for the waiting area.

For visual reference, kindly refer to the attached images.

Reason

Due to the impracticality of extensive travel every 30 days, they have decided to cease operations in Bangalore.

More Details

They are selling 90% of the assets which they bought in 2019.

The same Premise could also be re-rented for 5 more years, and operations can be started after Asset Purchase.

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?