Established Analytical CRO Looking For Partner

About Business

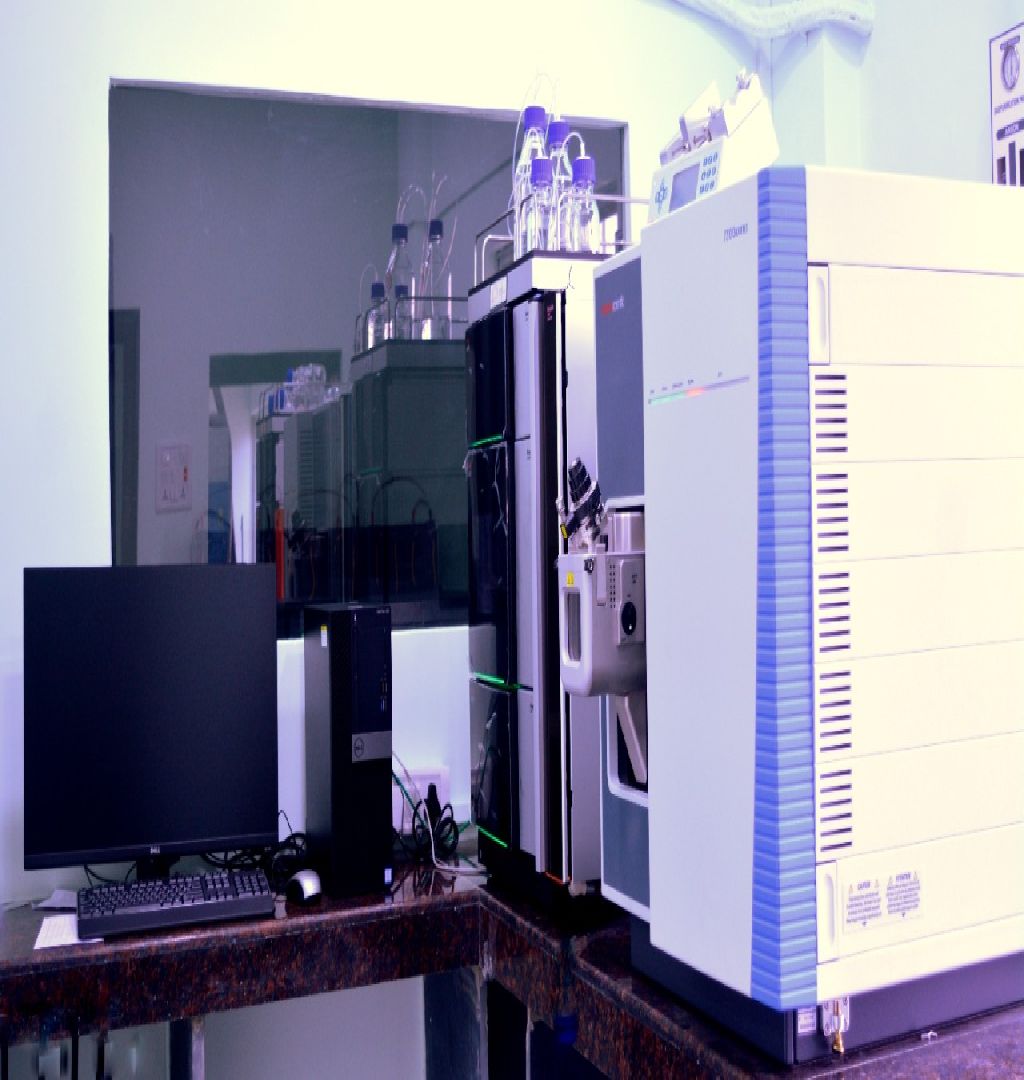

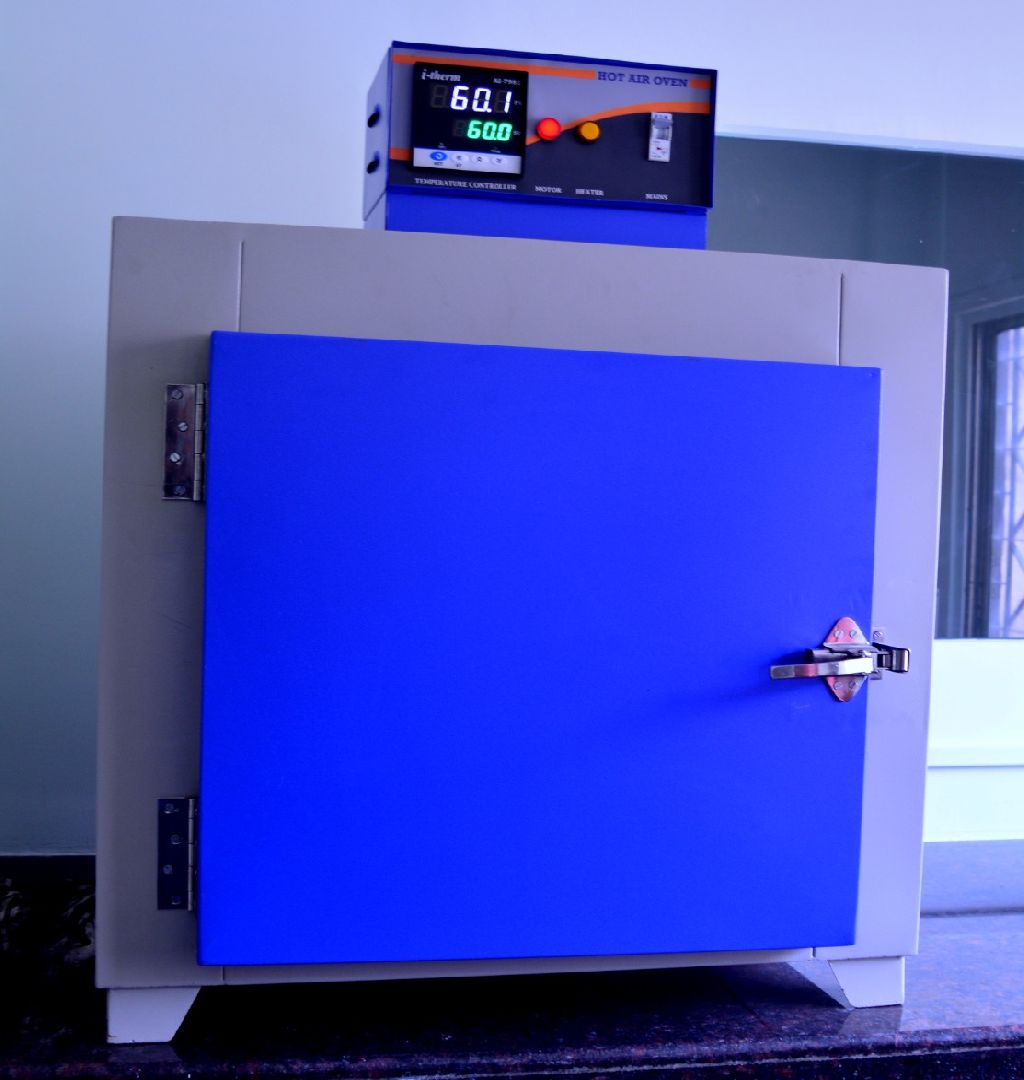

Analytical testing services:

Our major service offerings include:

- Extractables and leachable studies for drug products and medical devices

- N-Nitrosamine testing as per the current regulatory requirements

- Genotoxic impurity testing

- Method development, validation and analysis for Assay, Related substances and other impurity analysis in different drug substances and drug products

- Genotoxic impurity testing

- Elemental analysis as per ICH Q3D, USP 232 and 233 (wherever applicable)

- Glass delamination studies.

Clientele type

- Lupin

- Micro Labs

- Ricon Pharma (USA)

- Slayback Pharma (USA)

- Ingenus Pharmaceuticals

- Otsuka Pharma

- Godrej Industries

- Zenvision Pharma

- Laxmi Organic Industries Limited

- BDR Pharmaceutical

- Piramal Pharma Limited

- Mangalam Drugs and Organics Ltd.

- Aastrid Life Sciences Pvt Ltd

- Stira Pharmaceuticals LLC (USA)

- Univet Pharma (Ireland)

- Aarti Drugs Limited

- Caplin Point

- Orbicular

- Ashish Life sciences

- Kores India

- Respect labs

- Asolutions Pharmaceuticals

- Calyx chemicals and pharmaceuticals

- Supriya Lifesciences

- Aculife Healthcare

- Deepak Fertilizer (DFPCL)

Premises

LEASED

Lease per month (in INR): 32.00 K

Security Deposit (in INR): 1.25 L

Carpet Area: 3,000 sq ft

Asking Price Includes

25% share and annual returns as per discussion.

Asking Price

INR 3.00 Cr

Minimum ticket size

INR 3.00 Cr

Reason

Funds required for instrument purchase and marketing

More Details

The team is one of the most experienced team in the field of Extractables and leachable studies and trace-level analysis.

Our team has more than 20 years of experience in analytical research and more specifically in trace-level analysis, extractables, and leachables in various drug products, processing components, and medical devices.

We have crossed INR 2.1 Cr for FY 22-23 and are expecting a revenue of ~ INR 2.4 Cr.

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?