Dessert and Food Premixes Business For Sale In Mumbai

About Business

Business Journey:

The company has a legacy dating back to 1982, establishing itself as a food manufacturing brand with over 40 years of experience. It initially started with traditional products like vermicelli and badam mix, growing steadily with minimal investment in advertising (less than 1% of expenses allocated to ads).

Built on organic growth and customer loyalty, the brand today enjoys a customer retention rate exceeding 90%. It has developed a strong network of over 100 distributors and 100+ HoReCa clients and has recently expanded into international markets such as Israel, Angola, Oman, and Kenya.

With an annual turnover of approximately INR 5.5 crore (including GST) and consistent profitability, the business is now at a pivotal point as the current founder plans to retire due to health reasons, opening the door for new leadership and expansion opportunities.

Products and Services:

The product portfolio includes a wide range of consumer items such as kheer mix, basundi mix, rabdi mix, gulab jamun mix, custard powder, ice cream mixes, falooda mixes, chocolate whip toppings, food colors, food flavors, baking powder, corn flour, mukhwas (mouth fresheners), and dried yeast.

In addition to retail offerings, the company provides direct-to-consumer products like cake kits and waffle mixes through major online platforms such as Amazon, Flipkart, and Jiomart.

On the business-to-business side, it supplies premixes for soft-serve frozen desserts, kulfis, Belgian waffles, thick shakes, and dessert decorations, catering to hotels, restaurants, caterers, and cafes.

Upcoming products in the pipeline include ready-to-cook vegan, sugar-free, and gluten-free mixes, aimed for launch in mid-2025.

Unique Selling Propositions:

1. A strong foundation of brand loyalty built over four decades.

2. Operations that are independent of the founder's daily involvement, ensuring smooth continuity.

Clientele type

Client Segments:

- Distributors handling general trade and retail distribution

- Retailers, including local stores and supermarket chains

- Direct consumers through online platforms such as Amazon, Flipkart, and Jiomart

- Hotels, restaurants, cafes, and catering services

- Quick Service Restaurant (QSR) chains and cloud kitchens

- Export clients across Israel, Angola, Oman, and Kenya

Industries Served:

- Food and Beverage sector, including manufacturers and retailers

- Hospitality sector, covering hotels, resorts, and serviced apartments

- Restaurant sector, spanning standalone outlets, fine dining, QSRs, and restaurant chains

- Catering services for events, institutions, and corporate needs

- E-commerce and Direct-to-Consumer (D2C) platforms

- Food franchising industry requiring standardized, high-quality premixes

- International food trade catering to ethnic Indian food markets overseas

Additional Insights:

The B2B product range - including premixes for soft serve desserts, waffles, thick shakes, and kulfis - is designed to support businesses in achieving consistency, superior quality, and cost-effectiveness, which are crucial for success in the food service industry.

Meanwhile, the B2C product line emphasizes convenient and easy-to-prepare foods, catering to busy professionals and health-conscious consumers seeking quick yet nutritious options.

Premises

OWNED

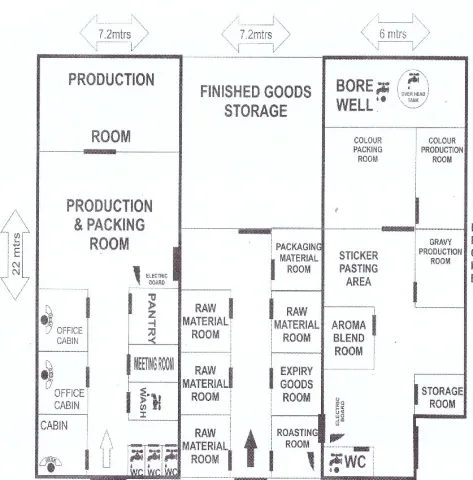

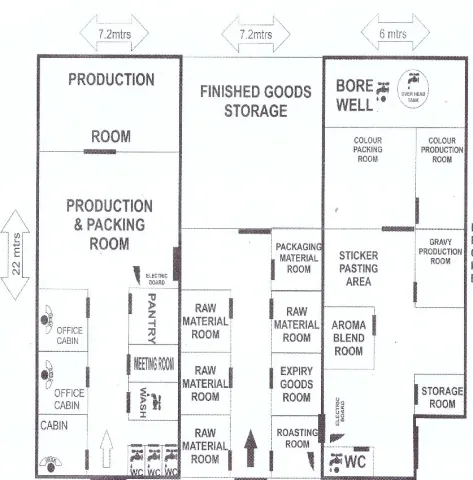

Premise Size: 7000sq ft

Market Value (in INR): 3.50 Cr

The manufacturing facility operates on a 3,000 sq ft area, with an additional 3,000 sq ft available for immediate expansion. It is strategically located on Thane-Bhiwandi Road in Kasheli, just 150 meters from the upcoming Kasheli Metro Station.

Since the operations are not location-dependent, the factory can also be shifted in phases if required.

Asking Price Includes

Everything other than land and buildings, which will be at actuals if interested or factory can be relocated.

Reason

The owner (promoter) is planning to retire due to a medical condition.

Licenses

FSSAI, GST, UDHYAM, ISO9001, ISO22000, KOSHER, HALAL

More Details

Promoter/Ownership Structure:

The business is fully family-owned and is legally well-structured. The current owner is planning to retire due to health concerns, creating an opportunity for new leadership.

Operational Model:

The company operates independently without requiring the daily involvement of the promoter. Established systems and processes ensure that production, sales, and compliance functions continue smoothly. The business is structured for professional management rather than being reliant on any individual figure, unlike service-driven businesses such as law firms or hospitals.

Succession Plan:

With the owner preparing for retirement, the business is positioned for a seamless transition, making it ideal for acquisition by a new owner, investor, or the appointment of a professional CEO.

Awards and Achievements:

Business Longevity:

Surviving and thriving for over 40 years in the food manufacturing sector - an industry where more than 90% of FMCG brands fail - is a significant achievement in itself.

Certifications:

- FSSAI Licensed Manufacturer

- ISO 9001:2008 Certified

- ISO 22000:2005 Certified

- Kosher Certified

- Halal Certified

Performance Highlights:

- Maintains a customer retention rate exceeding 90%, a benchmark rarely achieved in the FMCG sector.

- All 150+ digital listings consistently hold ratings of 4 stars and above on e-commerce platforms like Flipkart.

Export Milestones:

- Successfully exporting products to Israel, Angola, Oman, and Kenya.

Financial Strength:

- The company is consistently profitable with minimal debt exposure (only INR 35 lakhs in unsecured credit).

- Achieves steady year-on-year growth while maintaining an advertising spend of less than 1% of revenue - a rare feat for a consumer brand.

Keywords

Business Tags

Business Exit for ₹10 Cr – 200 Cr

Structured Transition Completed in 120 Days

Credible Buyer Connections, Confidential Discussions, and Seamless Closure

Supported by Advisors with 26+ Years of Experience