Emery Crushing Sizing Bznss wd Land Plant n Building Assets

About Business

It's a Private Limited company started in 1963 with the aim of providing Emery Grains for import substitution. It now sells 4 varieties of grains at different price levels.It is also agent for wide variety of PebblesThe company has been in the export market for several years and has served around 15 countries for 58 years. Facilities: Manufacturing plant (3 units) for different products: each equipped for crushing & grading as per buyer’s needs. Lumps are outsourced with adequate quality control. Production & grading with adequate testing procedures USP's:Good brand recall, Well recognized in the market, Highly scalable, 58 yrs of presence in the market, Good Scope to re-enter & expand markets & completely Debt free company Products:Emery Grains-Abrasive powders-Hard Grains & Aggregates-Floor Hardeners-Hard Calcined Bauxite- Pebbles Target industries:Emery Papers / Metal & Stone polishing / shot blasting, Cement or Epoxy Hard wearing floors industry, Flour, Rice & Dal Mills and Refractories ( for Hard Calc. Bxte) Asking Price: incl. industrial land. Bedi(near Port): 2.61 lacs sq ft (19 Cr.) and Bldg, P&M, Stocks (3.5 Cr.)

Clientele type

Emery Papers / Metal & Stone polishing / shot blasting, Cement or Epoxy Hard wearing floors industry, Flour, Rice & Dal Mills and Refractories ( for Hard Calc. Bxte)

Premises

OWNED

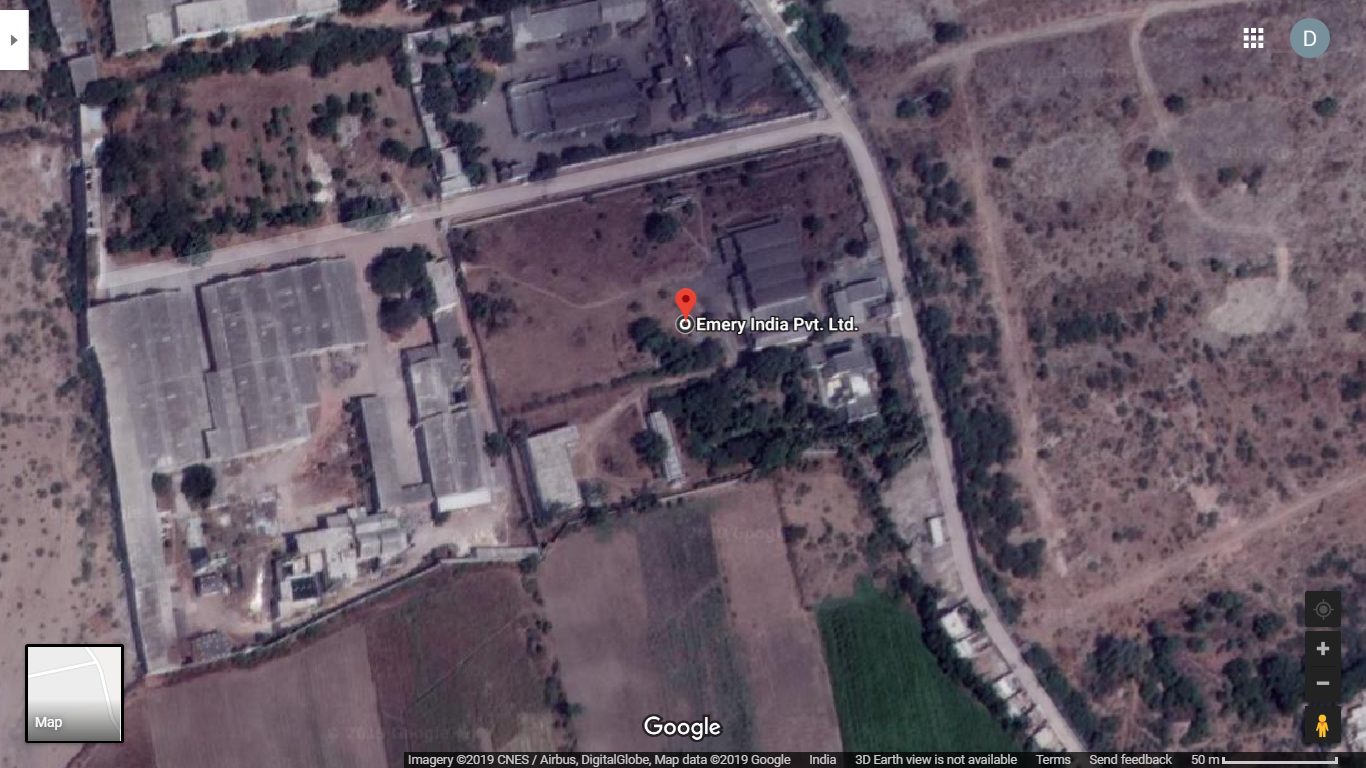

Premise Size: 261360 s.ft (6 acres)

Market Value (in INR): 22.50 Cr

within Jamnagar Municiapal Corporation: Industrial land (2.5 km from Bedi Port - under fast track development): 2.61 lacs sq ft (6 acres) (15 bigha) (19 Cr.) and Bldg, P&M, Stocks (3.5 Cr.)

Asking Price Includes

Within Jamnagar Municipal Corporation: Industrial land and urban plot. (2.5 km from Bedi Port): 2.61 lacs sq ft (6 acres) (19 Cr.) and Bldg, P&M, Stocks (3.5 Cr.)

Reason

Owners are planning to shift abroad

More Details

Ready & running manufacturing business unit with ample land & building space with all compliances in order. (2.5 km from Bedi Port - under fast track development) Entrant can choose his line of interest & input suitably. We had Rs.2.5 crr turnover in early '90s & in 2013-2015 with same machinery visit emeryindialion in

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?