Mfg and Refurbishment Metallizing Biz for Sale in Ahmedabad

About Business

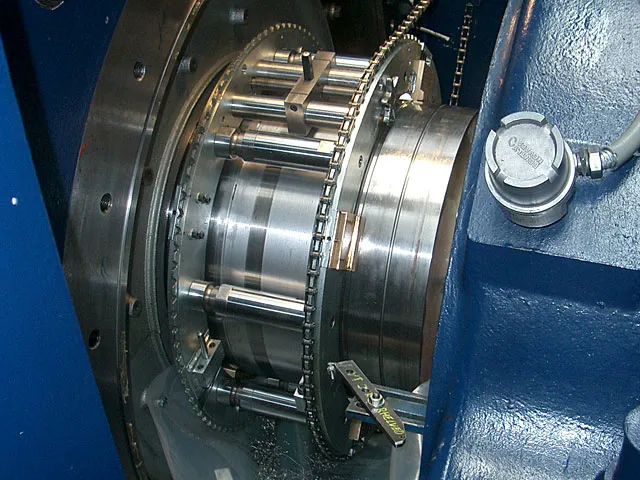

Manufacturer and refurbisher of spare parts for a wide range of equipment, including Air/Gas compressors, Cement plants, Power plants, Steam and gas turbines, as well as undertaking custom development projects tailored to the clients specific requirements for the past 18 years.

Product range for engineering spares include:

All the spares for air/gas compressors viz. cylinders, pistons, piston rods, valves, connecting rods, after coolers, inter coolers, etc;

Spares for imported D.G sets viz. Inlet valves, valve seats, exhaust valves, valve guides, liners, etc;

Spares for Gas turbines viz; 12 point bolts, inconel springs, retainer springs, diverter damper seals, flower washers, etc;

Spares for cement plant viz. chain links, thrust pads, drives of lignite mill, hydraulic cooler, dowel pin, cone pin, seal rings.

Clientele type

Cater to a diverse client base includes turbine and compressor manufacturers, refineries, chemical plants, metallic smelter plants, cement and fertilizer plants as well as automobile and shipyards.

Premises

LEASED

Lease per month (in INR): 1.45 L

Security Deposit (in INR): 3.00 L

Carpet Area: 4,210 sq ft

Workshop area is approx. 2650 square feet

Administrative area is 1560 square feet

Asking Price Includes

The price includes team, inventory, plant and machinery, client network.

Reason

Retirement. So looking for succession planning.

More Details

It is one of the few companies which provide single point solution of metallizing, machining and assembly of various rotating and reciprocating equipment under one roof. Also, can develop spares by reverse engineering by preparing manufacturing drawings for actual fitment and working.

Team details include:

One executive Director with the experience of 31 years in the manufacturing industry and 2 technical directors

4 technical staff members and 3 Administrative members

Registered with many industry giants such as Reliance Industry, Adani Limited, Tata Motors, Tata Chemicals, and Tata Power.

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?