A running hospital with a good brand name for sale

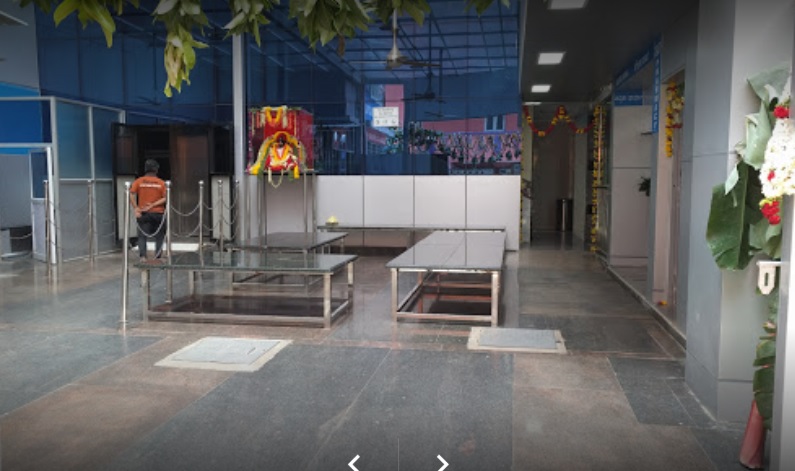

About Business

Multi-specialty Hospital with following services Laboratory Services, Radiology Services, Pharma, Cath Lab, Endoscopy Suite, Casualty, ICU, Blood Bank, Mortuary, Doctor & Patient Lounges, and three Ultra Modern OTs.

Clientele type

Patients generally from North-East of India come to Kadugodi Bangalore for Medical Reasons. This is the only hospital located in Kadugodi.

Premises

Total carpet area of the hospital is 25,000 Sq Ft.

Per month rent of the building is INR4.5Lakhs

Security deposit is 55Lakh(Not included in asking price)

Hospital building is a four floor building.

Building is having 250 KVA Electric Power, 250 KVA Generator, One passenger Lift, One Patient Lift, Medical gas pipeline system.

Asking Price Includes

All business assets and equipments

Reason

The managing director who is my father passed away treating Covid Patients. The family wishes not to continue with the business.

More Details

All staff members required to run the hospital from accountants to maintenance staff to housekeeping staff to duty doctors are available.

Hospital has ICU Beds: 12 (Remote Controlled), Ward Beds: 25, Special Wards with AC and TV: 4, Casualty Beds: 4, Consultation Chambers: 6

Hospital has following equipment Cardiac Cath Lab, CT Scanner, Xray Machine & Mobile X-Ray,3 OTs dedicated to Heart, Neuro, Laproscopic and Endoscopic Procedures,Ultrasound Scanners, Endoscopy Suite, C-Arm, Computer Network and CCTV Systems,Medical Gas Pipeline Systems.

Hospital has a inhouse Pharmacy and clinical lab.

Other Facilities hospital has are Patient Lounge with Canteen Area, Doctors Lounge, Nurses Hostel for 40 members.

There is enough space to increase hospital beds by 100 in the same hospital building complex.

Keywords

Business Tags

₹10 to ₹200 Cr

Complete Investment Banking Solution in 120 Days

Seamless Fundraising/M&A transactions

Start your growth journey with our 25+ Years of Experienced Professional Team.

Contact IBGrid TeamFrequently Asked Questions

How to contact a business owner directly to buy or invest in a business?

Connecting with a business owner directly is simple! Just follow these 3 easy steps: 1. Create your FREE Investor/Buyer profile on IndiaBizForSale 2. Explore the 'Business Opportunities' section to find 10,000+ business opportunities matching your investment preferences. 3. Click on the 'Contact Business' button and connect with business owner directly. Check here to know how it worksNote: Once you create your profile, you will get ONE introduction credit, allowing you to contact any ONE featured business.

How does IndiaBiz verify the business information?

The business opportunity is either posted by the business owner or advisor. After that, our team checks the information for completeness, language, and accuracy. Once the basic checks are met; only then the opportunity is published. We also get users' feedback for the opportunities they contact and based on their feedback, the opportunity maybe put on HOLD till further clarification. Many opportunities are not published when it does not pass through our internal procedure checks. We sincerely request you to carry out complete due diligence before taking the transaction ahead. In addition, the contact details of the business are verified via phone/email.

What to consider before buying or investing in a business?

Below are some of the factors that need to be considered before buying or investing in a business:- Growth prospects of the industry and business

- Sales, profitability, and cash flow of the business should be considered

- Consideration you have to pay; form of consideration (either cash or shares or some combination of both) to be paid?

- Source of financing the purchase

- Amount of additional investment that will be required to grow business

- Does the business have second-line of management?

- Are you going to run the business on day-to-day basis or appoint some professional for the same?

- What decisions are to be taken to improve the profitability of the business?

- Time period of payback or return is envisaged from the business?

- Any long-term strategic benefit or synergy with your existing business?

- Will the clients continue with the business after the acquisition?