Are you planning to invest in Indian startups in 2024? If so, then this blog can be your go-to guide. We have covered the 5 expert strategies that you can consider while investing in a startup company/business.

India is the third-largest startup market in the world, with more than 1,27,000 recognized startups all over the country as per the data by the Department for Promotion of Industry and Internal Trade (DPIIT).

These Indian startups come from various industries such as IT, healthcare, education, agriculture, food & beverage, and many more. With a lot of creative people, new tech trends, and a nurturing environment, Indian startups are ready to grow big.

Let’s look at the top 5 expert ways that can help you start your startup investment journey in 2024.

Top 5 Startup Investment Strategies in India 2024

Investing in Indian startups can be an exciting venture, especially given the country’s thriving entrepreneurial ecosystem. Here’s an overview of the top five expert strategies to invest in Indian startups in 2024.

1. Online Funding Platforms:

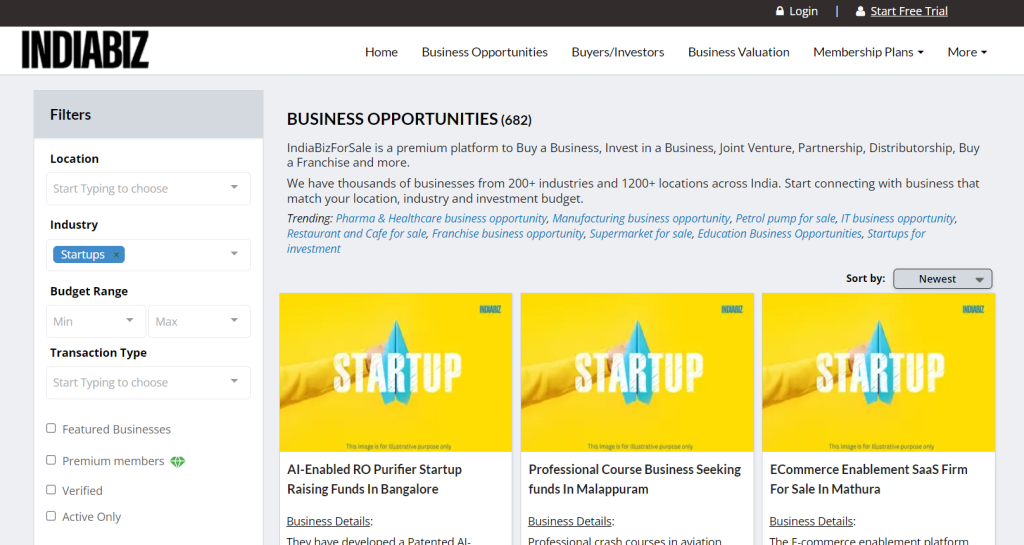

An emerging trend involves leveraging online startup investment platforms that connect private business investors, HNIs, and NRIs with startups/businesses actively seeking funding or planning for exit. Platforms such as IndiaBizForSale, BusinessEx, SMERGERS, and others serve as dynamic marketplaces where you can explore a diverse range of startup investment opportunities.

These platforms facilitate direct connections between investors and startups, streamlining the funding process. Investors can get detailed profiles of startups, understand their business models, and engage in discussions, making it a transparent and accessible way to discover and invest in promising ventures.

2. Angel Investing:

Angel investing in India is experiencing a significant upswing, with projections indicating a robust 12% CAGR from 2022 to 2025. By 2025, the market is expected to reach $7 billion, up from $3.2 billion in 2022, as active angel investors double from 2,200 to over 4,500. High-net-worth individuals (HNIs) are increasingly recognizing angel investing as an attractive asset class.

Direct investment in startups can give you the biggest return compared to investing in VC firms, however, the challenges of identifying good startups for investment, the time it takes in due diligence, valuation negotiation, compliance checks, etc can take enormous amounts of time if not managed by professionals.

Ideally, you can identify a few direct startup investments (like, your preferred industry) each year. The idea is to build a portfolio of investments into startups in a 2-3-year window of time.

3. Crowdfunding Platforms:

The landscape of crowdfunding platforms in India is poised for noteworthy growth, backed by compelling statistical data. Crowdfunding platforms like Kickstarter, and Indiegogo may be a promising approach for investors who wish to diversify their portfolios and actively participate in the development of the Indian startup ecosystem.

However, you should check the ever-changing compliance and regulatory framework for crowdfunding in India.

4. Venture Capital Firms:

Venture capital firms remain a pillar in the startup investment landscape. For potential investors eyeing the startup landscape through venture capital, the numbers tell an intriguing story.

In India, 1,660 Venture Capital Funds are managing a combined portfolio of 15,900 companies, signaling a vast pool of opportunities. Good startup investment deals are more likely to reach suitable VC firms than any individual investors.

So, Investors should research and identify venture capital firms based on the general managers’ track record, the theme of the fund, the size of the fund, and many other factors. Investing via VC funds is a very good bet to start investing in startups especially if your corpus to invest in this asset class is at least INR 1Cr and above. Even though you do not need to invest all that money in one go, generally 2-3 years in trenches. VC funds would charge you yearly management fees (generally 2% of your corpus) and a share in profit (generally 20%) at the time of exit.

5. Secondary Market Transactions:

Navigating the maturing landscape of the Indian startup ecosystem involves exploring secondary market transactions as a viable investment avenue. In this phase, potential investors have the opportunity to purchase shares from existing investors or employees, providing a unique entry point into well-established startups.

The intricacies of secondary market transactions necessitate collaboration with financial advisors and legal experts. This approach not only offers liquidity for existing stakeholders but also allows new investors to participate in the success story of proven startups. As the secondary market gains prominence, it becomes a strategic consideration for those looking to engage with established players in the Indian startup ecosystem.

Success Tips

All the above options are suggested by industry experts which can help you to start investing in booming startups.

Utilizing online platforms (such as IndiaBizForSale) is the most preferred choice of experts as it helps you to connect with startups directly and provides you with a large number of startup investment opportunities on one single platform.

It helps you to get upfront clarity about the startup from the founders to make an informed investment decision. In addition, you get two options whether you want to become a partner in their growing entrepreneurial journey or want to stay as a silent investor.

Startup trends in India are booming with the help of advancements in technology (AI) and creative-minded people who bring innovative solutions that positively contribute to the Indian economy.

If you are someone who wants to become a part of their growth journey, investing in these startups can be a success key.

Thanks for reading! Happy Investing!