Hello Professionals,

As we all know, every business at some point in time reaches a stage where it requires capital to expand, improve operations, or take on new opportunities.

Whether you are looking to expand, enter into new markets, upgrade your technology, or improvise operations, securing the right funding is very important.

One effective way to raise funds is through private equity (PE) firms. Private equity firms do not just give money but also provide valuable expertise, industry knowledge, and mentorship.

As per the report by EY, PE firms have been active buyers of sponsor-backed assets. Last year saw global exit activity rise 23% by value and 16% by volume across all channels. PE firms have acquired 79 companies in total from other PE firms, amounting to US$167 billion, a significant increase from US$73 billion the year prior.

In this article, we have covered everything that you need to know about private equity firms, including how they work, types of private equity investments, how to find the right private equity firm, and more.

1. Introduction to Private Equity Firms

1.1. What are Private Equity Firms?

Private equity (PE) firms are investment firms that provide capital to those companies that are underperforming or have high growth potential but require money, resources, or expertise to grow. The goal of PE firms is to generate high returns by improving the performance of the company and then selling them later.

1.2. Importance of Private Equity Firms in Business Growth

Private equity firms enter into the business not only to invest their money but also to help businesses grow and expand by providing their expertise. Let’s look into the role played by private equity firms in business growth;

Investment:

- Funding: Private equity firms provide funds to companies looking for expansion, or wanting to upgrade technology and infrastructure. Private equity investment helps smaller or mid-sized businesses that might be struggling to get funding from traditional sources (like banks).

- Debt Financing: In leveraged buyouts (LBOs), PE firms may use debt to finance a large portion of the acquisition, which can be beneficial for growing a business without requiring large equity investments.

Guidance and Expertise

- Experienced Teams: Private equity firms bring in their experienced teams that help businesses improve their operations, sales, marketing, and overall performance. They may even offer mentoring for existing leaders to help them overcome growth challenges.

- Industry Expertise: Many PE firms have expertise in specific industries and bring valuable knowledge and connections to the table, which can help businesses improve their operations or enter into new markets.

Focus on Long-Term Growth

- Strategic Planning: Private equity firms generally focus on long-term growth plans by investing 3-7 years, compared to publicly listed companies that focus on short-term growth.

- Scalable Business Models: By investing in scalable business models, private equity firms help companies expand into new locations, launch new products, or enter new industries, all of which help companies grow.

Turning Around Underperforming Businesses

- Restructuring: Many private equity firms specialize in helping distressed or underperforming businesses by bringing in expert management teams, making necessary changes, and providing capital.

- Saving Jobs: In cases of distressed companies, private equity investments can prevent layoffs and business closures by restructuring operations or refocusing the business model, thus protecting jobs.

1.3. PE Firm vs. Other Funding Options

Private equity is just one way to raise funds. There are various other options as well like venture capital (VC) funding, bank loans, or listing it publicly through IPO. However, private equity funding offers a more hands-on approach. With PE, you get not just money, but also strategic support to grow your business faster.

| Funding Option | Private Equity (PE) Firm | Venture Capital (VC) | Bank Loans | Initial Public Offering (IPO) |

|---|---|---|---|---|

| Stage of Investment | PE firms invest in mature companies looking for growth. | VC firms generally invest in early-stage startups with high growth potential. | Bank loans are suitable for those companies that have stable cash flow. | IPO is suitable for established companies looking to raise capital by going public. |

| Ownership | PE firms acquire 100% ownership or majority stakes in the company. | VC firms acquire minority stakes in startups or early-stage companies. | Business owners do not need to give ownership as bank loans are based on collateral or creditworthiness. | Public shares are sold to investors, diluting ownership. |

| Level of Involvement | Private equity firms hold high involvement in the decision-making process. | VCs also provide guidance and networking but do not get involved too much in decision-making. | No active involvement in day-to-day operations. | Provides capital but requires the company to follow public reporting regulations. |

| Repayment Obligation | No repayments are required. Private equity firms exit through sale, IPO, or secondary buyout. | No fixed repayments are required; VC exits either through acquisitions or IPOs. | Fixed interest needs to be paid within the time period. | No repayments; capital raised through public sale of shares. |

| Risk | High risk for investors due to high involvement in decision-making process. | High risk due to the early-stage nature of the businesses. | Lower risk for lenders since they are secured against company assets. | Risk of market volatility; subject to public market conditions. |

| Exit Strategy | Exits via IPO, mergers, secondary buyouts, or sale to strategic buyers. | Exits typically through IPO, acquisition, or buyouts. | No exit strategy is involved; the loan is repaid over time. | High risk for investors due to high involvement in the decision-making process. |

2. How Do Private Equity Firms Work

Private equity firms gather funds from private investors, insurance companies, high-net-worth individuals (HNI investors), or institutional investors and pool it into a private equity fund which the PE firm then uses to buy businesses, help them grow, and later sell their stakes for a profit.

2.1. How Private Equity Firms Manage Their Funds

Private equity firms are responsible for raising, managing, and providing capital throughout the lifecycle of a private equity fund. We’ve broken it down in a simpler way to give you an overview of how private equity funds are managed:

- Fundraising: The private equity firm raises money from limited partners (LPs) like pension funds and, private equity investors. This raised money is pooled into the private equity fund and managed by the general partners (GPs).

- Investment: After raising capital, the firm uses the private equity fund to purchase high-growth potential businesses. These investments are referred to as buyouts or growth capital, depending on the strategy of the firm

- Value Creation and Active Management: The PE firm works closely with portfolio companies to enhance performance through operational improvements, leadership restructuring, strategic acquisitions, and cost management.

- Exit: Once the portfolio company has been scaled and its value has been maximized, the private equity firm looks for an exit through an IPO, merger, or secondary buyout.

2.2. Top Private Equity Firms

Now, the question arises which are the top private equity firms? Below are some of the India’s best private equity firms;

- Blackstone Group: The organization has invested in companies like Embassy Office Parks REIT, Nexus Malls, and Mphasis. Blackstone exited its investment in Intelenet Global Services by selling it to Teleperformance for $1 billion in 2018.

- KKR: An international investment company managing approximately $553 billion of assets as of December 31, 2023, KKR has invested private equity in portfolio companies with a total enterprise value of approximately $710 billion since its founding in 1976.

- Carlyle Group: Carlyle has made investments in India, including PNB Housing Finance, SBI Life Insurance, and Delhivery, a leading supply chain services company.

These private equity firms generally have significant resources and expertise, helping portfolio companies expand through operational improvements, strategic acquisitions, or market expansion.

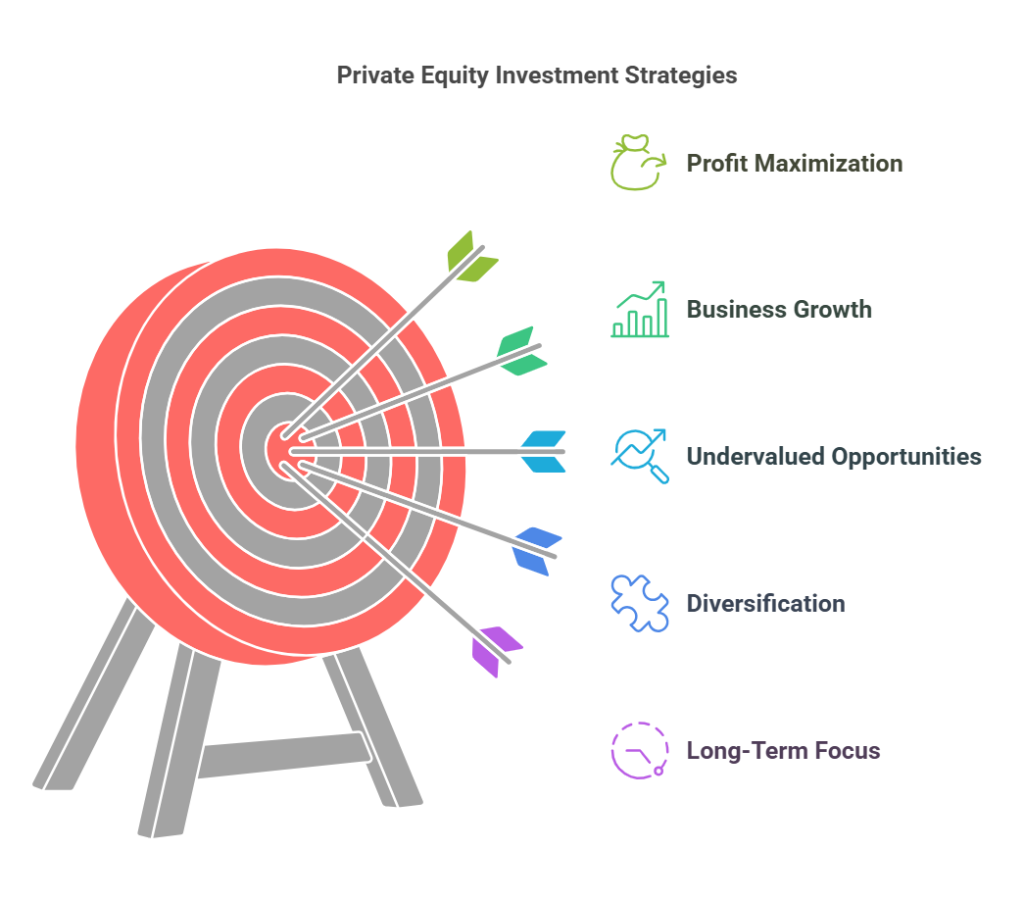

3. Why Private Equity Firms Invest in Businesses

Private equity firms invest in businesses because they want to make money by improving or growing those businesses and selling them for a higher price than they bought them. Here’s why they do it:

- Making Profit: The primary aim of private equity investment is to make huge profits. PE firms generally buy or invest in businesses to add value by expanding business or improving operations. In short, the aim of private equity firms is to buy low, improve, and sell high.

- Business Growth: Private equity firms do not just buy businesses and leave them alone. They help businesses to expand and make them profitable companies.

- Undervalued Opportunities: PE firms look for businesses that are undervalued or not working at full potential. By buying these businesses and making improvements, private equity firms can increase the value of the business and sell it at a higher price, making a profit.

- Diversification: Through investing in other businesses, private equity firms get a chance to grow their portfolios, reduce risk, and increase the chance of overall returns.

- Long-Term Focus: Private equity firms often take a long-term approach instead of a short-term approach like public markets. This helps them to improve efficiency, productivity, and profitability.

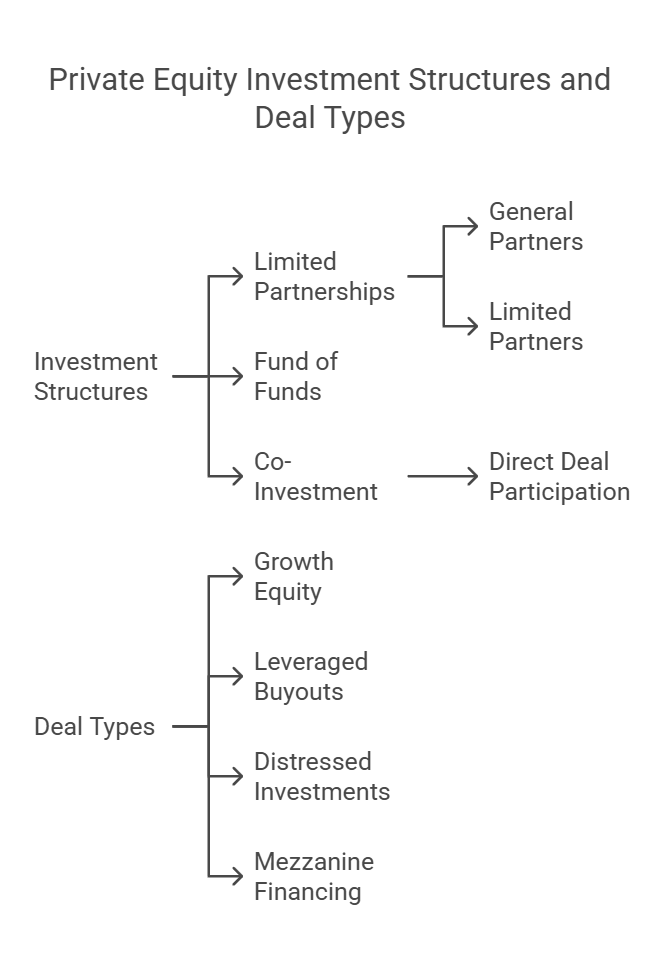

4. Private Equity Investment Structures & Deal Types

4.1 Investment Structures

4.1.1 Limited Partnerships

- This is one of the most common forms of investment by private equity firms.

- Consists of General Partners who manage the fund and Limited Partners who provide the capital.

- General partners invest and manage the portfolio while limited partners are not involved in day-to-day operations.

4.1.2 Fund of Funds

- A fund that invests in multiple private equity funds rather than investing directly into companies.

- This provides diversification and access to various private equity investment strategies.

4.1.3 Co-Investment

- This allows limited partners to invest directly in specific deals alongside the main private equity fund.

- Co-Investment gives the limited partners an opportunity to increase their involvement in good investments without additional management fees.

4.2 Private Equity Firms Deal Types

There are various kinds of deals by which private equity firms invest their money into businesses:

4.2.1 Growth Equity:

- Investing in growing businesses that need capital to expand.

- This involves a minor investment with established revenue and profitability.

4.2.2 Leveraged Buyouts (LBOs)

- It involves buying a majority stake in a company using equity and debt financing.

- The goal of this deal type is to improve the performance of the company and then sell it at a profit.

4.2.3 Distressed Investments

- Investing in struggling companies that are facing financial issues or bankruptcy.

- The goal is to turn around the company around and sell them at a profit.

4.2.4 Mezzanine Financing

- This is the combination of both equity and debt financing.

- It is generally used to fund acquisitions, expansions, and buyouts.

- It is a riskier method but provides a higher return than traditional debt.

5. Debt vs. Equity Financing: Which is Best for Your Business?

When raising funds for your business, one of the biggest decisions business owners face is choosing between debt financing and equity financing. These are the two types of fundraising methods through which businesses raise money depending on their goals.

Let’s understand what exactly is debt financing and equity financing and what are their advantages and disadvantages;

Debt Financing

Debt financing involves borrowing money from banks, private equity firms, or business investors. In this method, business owners need to pay interest over time, and the investors do not get any ownership in their business but is repaid through fixed payments, regardless of your company’s performance.

Debt Financing Advantages:

- No loss of ownership or control.

- Interest payments are often tax-deductible

- You know in advance how much interest you need to pay each month, making it easier for you (business owners) to predict and plan their financials accordingly.

Debt Financing Disadvantages:

- Regular payments must be made, which can impact cash flow.

- Need to give collateral to the lender, which means you could put some business assets at risk.

- Debt ratios may affect your ability to secure additional funding.

Equity Financing

Equity financing refers to providing some ownership or control in your company to investors, in exchange for funding. When private equity firms make investments they generally provide equity financing. Private equity firms share the risks and rewards of your company’s success or failure.

Equity Financing Advantages:

- No repayment obligations or fixed interest rates.

- PE firms bring expertise, experience, and network.

- Flexible, long-term capital that does not pressure cash flow.

Equity Financing Disadvantages:

- You need to give some part of your ownership and control.

- Investors will expect a return on their investment, often seeking an exit after 3-7 years.

- Sharing decision-making power with PE firms can slow down decision-making.

Choosing between debt and equity financing is critical for business owners to understand, as each has its own advantages and disadvantages.

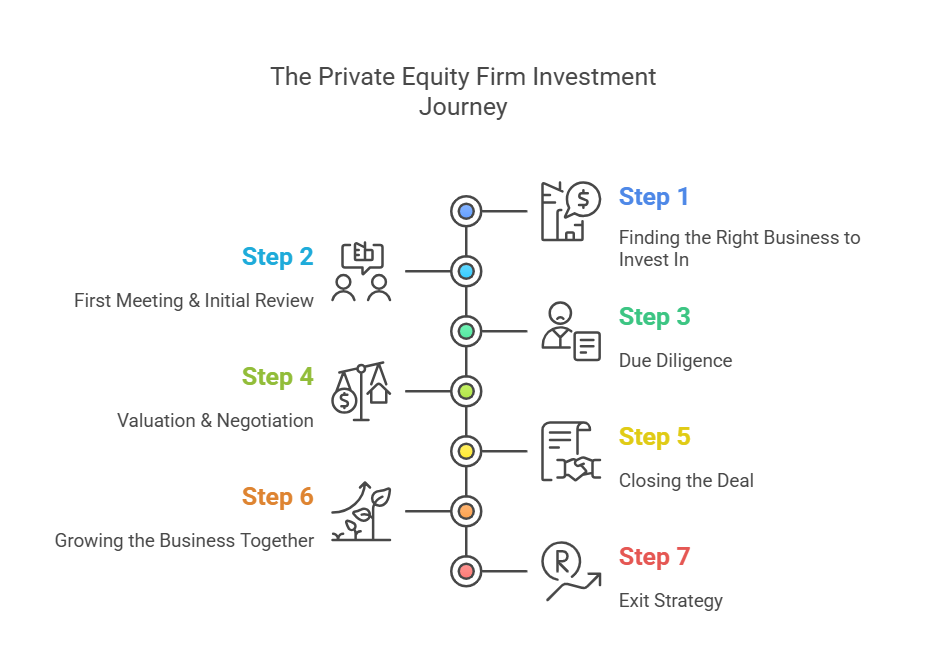

6. Private Equity Firm Investment Process

Private equity (PE) firms invest in businesses to help them grow and make a profit when they sell their stake later. Here’s how the process works:

Step 1. Finding the Right Business to Invest In

- Private equity firms look for businesses with strong growth potential. They do this by researching industries, attending networking events, and reviewing business proposals from owners looking for investment.

Step 2. First Meeting & Initial Review

- Once they find a business that seems like a good match, they set up a meeting with the owner. They review financial details, growth plans, and market potential to see if they fit their investment strategy.

Step 3. Due Diligence

- If they are interested, the PE firm will conduct thorough due diligence, analyzing your company’s financials, operations, and legal structure to evaluate the risk and value associated with investing in your company.

Step 4. Valuation & Negotiation

- The PE firm will value your business based on EBITDA multiples, Discounted Cash Flow (DCF) models, or comparable transactions in the market. Then, they discuss investment terms with the business owner, including how much stake the PE firm will take.

Step 5. Closing the Deal

- Once both sides agree on the terms, they sign legal documents, and the PE firm transfers the private equity funds, officially becoming part-owner of the business.

Step 6: Growing the Business Together

- PE firms don’t just invest money—they also help businesses grow by offering strategic guidance, hiring experts, or expanding into new markets.

Step 7: Exit Strategy

- After a few years (typically 3-7 years), PE firms sell their stake either by selling the business to another company, launching an IPO, or selling their share to another investor—making a return on their investment.

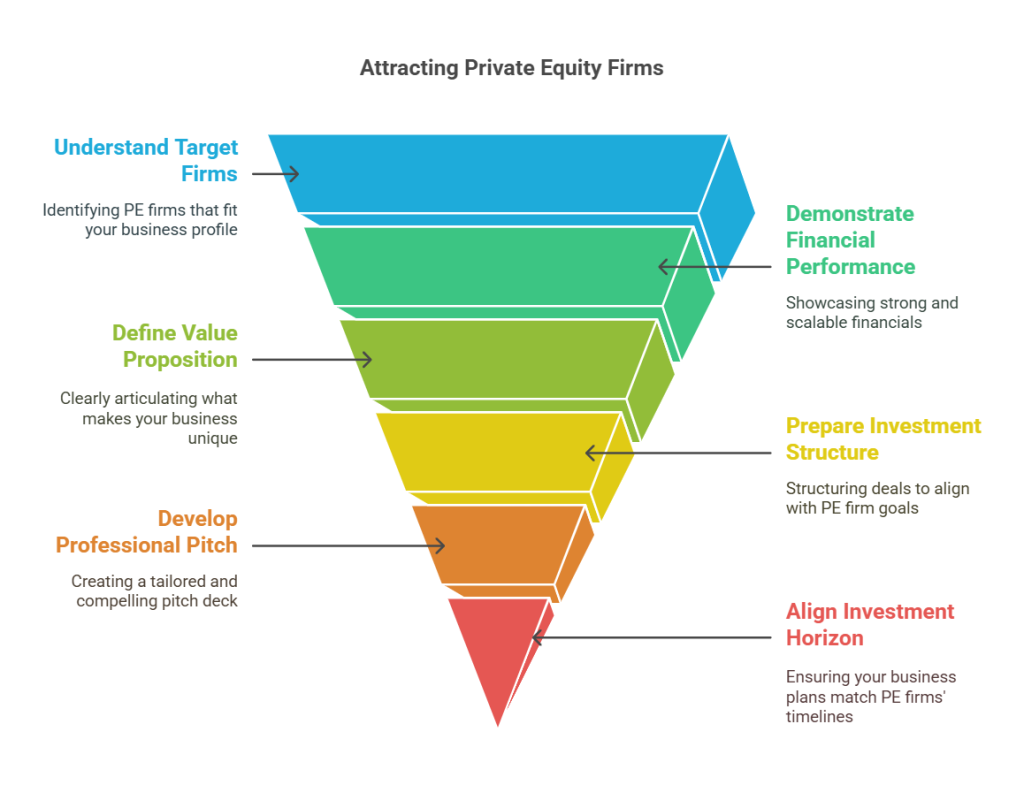

7. How to Attract Private Equity Firms

Attracting the right private equity firms is a strategic process that involves positioning your business in a way that aligns with their investment goals and interests. Here are some key points that every business owner should consider to attract the right PE firms;

1. Know Your Target

- Find the right fit: Do thorough research about private equity firms that focus on businesses that align with your industry, growth stage, and location.

- Understand their investment strategy: Get familiar with the size of the investment, the investment strategy, and which company size the PE firms like to invest.

- Track Record: Explore those PE firms that have a successful track record in your industry that are more likely to understand your business challenges and opportunities.

2. Demonstrate Strong Financial Performance

- Solid financials: Make sure your business financials are organized, and showcase strong performance, including growth potential, and profitability.

- Financial projections: Prepare realistic financial projections that show how you plan to grow and use the investment. Be prepared to justify your assumptions with data and a strong business case.

- Scalability and growth potential: PE firms are often looking for companies that can scale. Showcase how additional capital can help expand your operations, reach new markets, or innovate.

3. Clearly Define Your Value Proposition

- Compelling story: Share a compelling story about your company’s history, achievements, and vision for the future. What makes your business unique? Why should a PE firm be interested in your company?

- Strong management team: Describe your management team. PE firms want to know that the company will be effectively run and that you have the expertise to execute growth strategies.

- Competitive advantage: Show how your company is different from your competitors. PE firms must ensure that they are not doing anything wrong by investing their money in your company.

4. Prepare an Attractive Investment Structure

- Clear exit plan: PE firms want to know how they will eventually receive a return on their investment. Create a clear exit plan, whether it’s through a sale or IPO.

- Shareholder alignment: Be transparent about the structure of your current ownership and how new investment will fit into that structure. Having a fair and reasonable ownership split can make the deal more attractive.

5. Develop a Professional Pitch

- Pitch deck: Create a professional, concise pitch deck that highlights your business, market opportunity, financials, and growth plan.

- Tailor the pitch: Tailor your pitch to each specific PE firm’s investment goals and interests.

- Be transparent and honest: Be upfront about any challenges your business faces, but also show how you plan to address them. PE firms value honesty and are often more impressed with companies that recognize their challenges.

6. Align with Their Investment Time Period

- Time frame: PE firms usually hold the company for 3-7 years and then exit. Make sure to be clear about your plans for the future and how these align with the private equity firm’s expectations.

8. Real World Examples

Below are two actual examples of companies that had been invested in by private equity firms and how that affected their growth.

- Lenskart: Lenskart, a big eyewear retail chain has received private equity investments from big PE firms like IDG Ventures, TPG Growth, TR Capital, and International Finance Corporation.

- Jio Platforms: Jio also raised private equity funds from PE firms such as Silver Lake, KKR, and more.

These examples showcase how private equity investments have brought success to top companies.

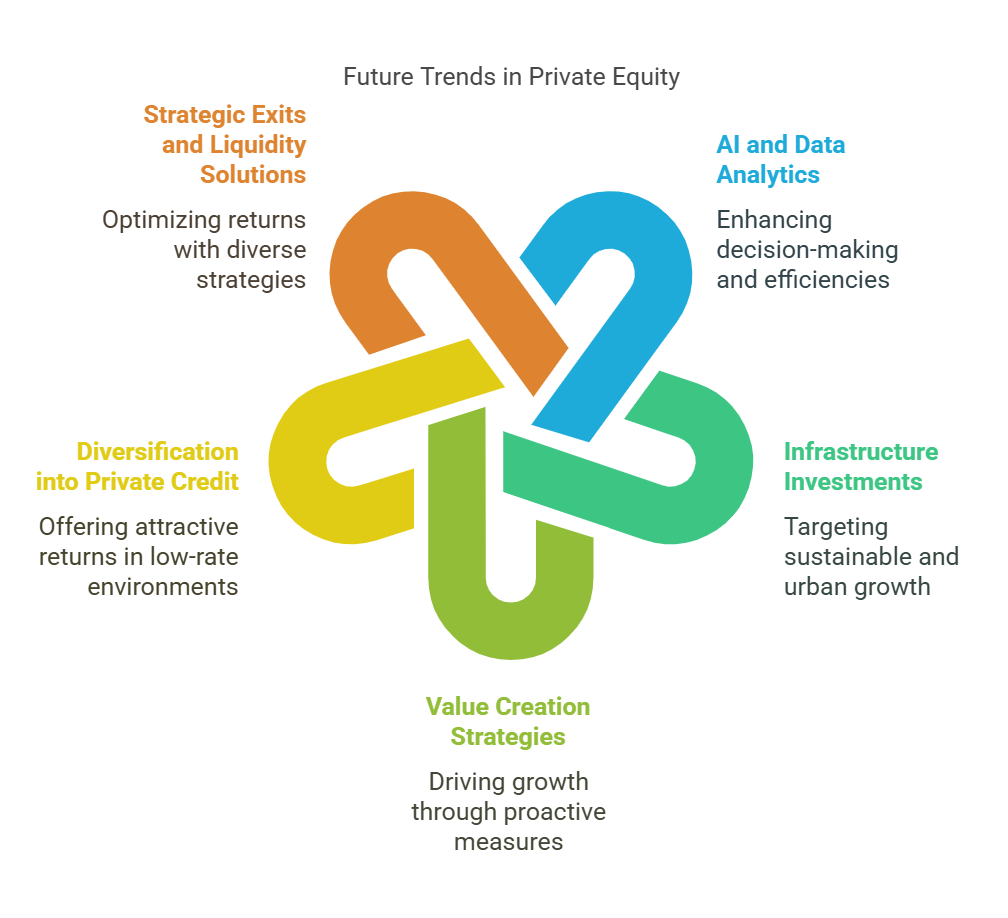

9. The Future of Private Equity Firms

The private equity industry is transforming at a fast pace, influenced by advancements in technology, regulatory changes, and changes in the preferences of private equity investors. Key trends and the future of private equity firms are;

- Use of AI and Data Analytics: PE firms are increasingly using AI and data analytics to enhance decision-making processes, improve operational efficiencies, and identify investment opportunities. The technologies allow private equity firms to analyze large data, predict market trends, and simplify portfolio management strategies.

- Investment in the Infrastructure Industry: PE firms have concentrated investment in the infrastructure industry. Private equity firms are focussing on industries such as renewable energy, transportation, and telecommunications, as per global trends of sustainable growth and urbanization.

- Value Creation Strategies: Private equity investors are adopting more aggressive value creation strategies, such as operational improvements, strategic buyouts, and technological innovations in portfolio companies. This approach aims to drive growth and increase the overall value of investments.

- Diversification into Private Credit: Private equity firms are diversifying their portfolios by adding private credit investments. This strategy offers great returns and provides investors with other ways of generating income, especially in a low-interest-rate world.

- Strategic Exits and Liquidity Solutions: Private equity firms are exploring various exit strategies, including initial public offerings (IPOs), secondary buyouts, and strategic sales, to optimize returns and deliver liquidity to investors. The choice of exit strategy is influenced by market conditions and the specific circumstances of portfolio companies.

Conclusion: Making the Right Decision

For business owners, private equity funding can be a great opportunity but finding the right private equity firm is equally important. Therefore, understanding private equity and how the private equity firm works can help you to make informed decisions that help your company achieve long-term success.

Lastly, whether to approach private equity firms for funds must be decided on the basis of your business’s specific needs, the level of involvement you’re comfortable with, and your vision for the future.

If you are not sure, it is also a good idea to explore other options, such as connecting with individual investors through online platforms like IndiaBizForSale, where you can find suitable investors that align with your company’s goals.