Raise Funds or Achieve a Successful Exit from Your Solar/Utilities & Energy Business in the Fastest and Most Cost-Effective Way with direct solar & renewable investors/buyers connection.

India’s solar power sector is expected to generate 104.59 billion kWh in 2025, growing at 7.50% (CAGR 2025-2029), supported by healthy government policies and increasing private investments as per statista report. With the growth for clean energy accelerating, having the right investor is critical to achieving optimum growth and profitability for this developing industry.

Solar Investors or Renewable Investors are actively looking for solar investment and renewable energy business opportunities. They understand the potential of clean energy and visualize long-term profitability in it. But acquiring the right investor with your business goals is not easy.

Indian solar and renewable power sector is developing rapidly, but development requires capital. Be it solar farm, EV charging station, or solar panel manufacturing facility, businesses require finance to expand, innovate, or exit with returns.

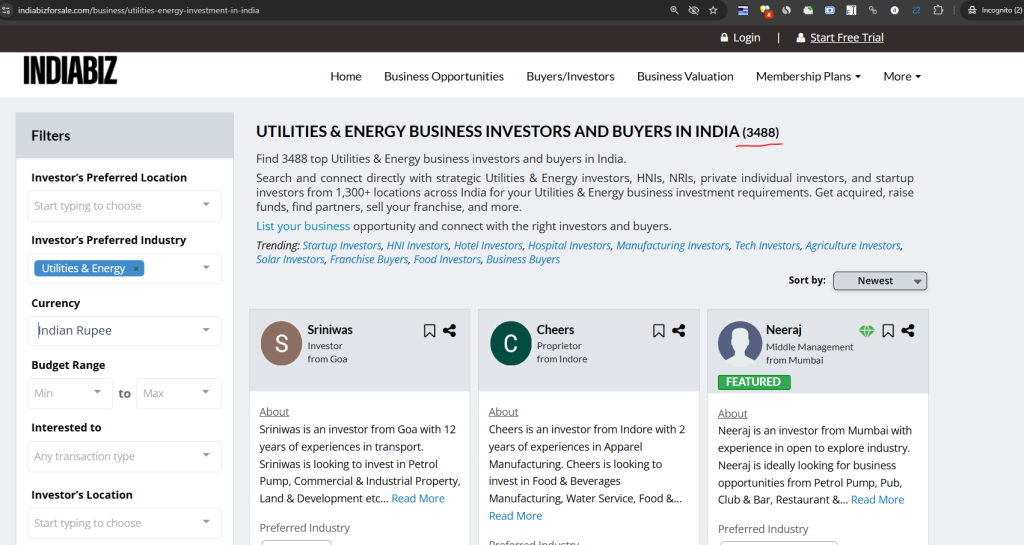

This is where IndiaBizForSale steps in. We connect entrepreneurs to 3484+ active private utilities & energy investors seeking investment opportunities in the solar, EV, and renewable energy sectors. If you require growth capital, a strategic investor, or an exit at a premium value, this guide will keep you informed of:

- Why investors care about solar and green energy business

- What investors look for before investing in a project

- How to make your business attractive to the right investors

- Where to look for serious solar investors and how to pitch effectively

Worth reading if you are an owner of a business intending to raise capital for your renewable energy, EV, or solar business, this book will equip you with the best practices for raising funds successfully or selling your business on the best possible terms.

2. Why Investors Are Interested in Solar, Renewable Energy, & EV Businesses?

Solar and green energy firms are attracting a lot of investor interest. But why are venture capitalists, individual investors, and corporate buyers looking for opportunities in this space?

1. Strong Government Support & Policy Push

The Indian government has been promoting the utilization of solar and renewable energy through policies, tax relief, and subsidies. They are:

- Solar Energy Corporation of India (SECI) schemes for financing solar businesses

- 100% FDI in the renewable energy sector

- Incentives to battery storage firms and EV charging point operators

- Production-Linked Incentive (PLI) schemes for solar panel and battery producers

These policies reduce the risk of investment and increase profitability, thereby making the industry very attractive to investors.

2. Increasing Demand for Clean Energy & Sustainability

Customers and businesses alike are turning towards clean energy as a means to save costs and go green. Market leaders such as Tata, Adani, and Reliance are all out in the race for renewable energy, thus building investor confidence in the industry.

3. Long-Term Stability & High ROI

Solar farms, solar projects, and EV charging stations have returns due in 20+ years. Such firms are most favored by solar project investors, and solar farm investors which give fixed returns with very low risk, and solar projects are the best fit for such a model.

4. Mergers & Acquisitions (M&A) Opportunities

Most major companies are buying solar, EV, and green energy companies to diversify their portfolios. If you’re looking for an exit, investors view your business as a sweet acquisition opportunity.

With the support of encouraging governments, huge demand, and high returns, the time to seek renewable investors for your solar or renewable energy enterprise is now.

3. Types of Investors Looking for Solar & Renewable Energy Companies

Knowing who the right type of investor is will make you get funded sooner. Investors specialize in different sizes of businesses and investment objectives.

1. High-Net-Worth Individuals (HNIs) & Private Investors

These are individual investors looking for direct investment in solar farms, charging EV companies, and clean-tech start-ups. They are likely to:

✔ Invest ₹1 crore – ₹50 crore in medium-sized projects

✔ Seek secure returns in the long term

✔ Prefer firms having reported revenue and official approvals

2. Private Equity (PE) & Venture Capital (VC) Firms

VC and PE funds including renewable investment funds focus on scalable, high-growth solar and EV firms. They usually:

✔ Invest ₹5 crore – ₹100 crore in innovative green energy start-ups

✔ Seek companies that offer rapid scalability and high return on investment

✔ Provide strategic counsel with finance

3. Institutional Investors and Solar Investment Companies

These are large investment firm including clean energy investment funds and solar investment funds, that trade in clean energy and specialize in:

- Big solar farms, battery storage and grid-scale projects

- Investments above ₹50 crore

- Long-term management and control of operations

4. Strategic Buyers & Corporate Purchasers

Large corporations are actively purchasing renewable energy firms to diversify their portfolio. If you need an exit strategy, these acquirers can offer the best option.

Knowing what kind of investor suits your funding needs will help you locate the best deal sooner.

4. What Solar & Green Energy Investors Look for Before Investing?

Investors carefully contemplate key factors before investing. You must make your company comply with their needs in case you would like to raise capital or sell your solar business.

1. Growth Potential & Financial Stability

Solar energy investors, renewables investors, and green energy investment funds consider:

✔ Last 3 years’ revenue, profits, and cash flows

✔ Revenue growth in the next 5-10 years

✔ Break-even point and expected ROI

2. Land & Government Approvals

For solar farms and EV plants, investors consider:

✔ Land title & legal permits

✔ Grid integration of solar project

✔ Compliance with renewable energy policy

3. Business Scalability

Solar investors, solar panel investors, and renewable investment funds like enterprises that have the ability to grow with more funds. Companies with:

✔ Established technology & legitimate market demand

✔ Available contracts & power purchase agreements (PPAs)

✔ Broad opportunities in emerging markets

are bound to be attractive to investors.

4. Exit Strategy for Investors

Investors would prefer to know how they will be repaid. Clear exit options like:

✔ Mergers and acquisitions (M&A) with larger players

✔ IPO or public offering

✔ Resale to another investor within 5-7 years

attract more business to your company. If you require raising funds, a sound financial plan, clear approvals, and a clear growth strategy are of utmost priority.

5. How to Attract the Right Solar & Renewable Energy Investors?

Finding the right investors is half the battle. The real battle is to convince them to invest in your renewable business. Investors seek a solid business model, financial stability, and a clear growth strategy before they invest. This is how you can put yourself in the position to acquire the right investors.

1. Develop a Strong & Detailed Business Plan

Investors need to understand how your business makes money and how it will grow. Your business plan should have the following well-written elements:

✔ Business model – How do you generate money? (e.g., from selling electricity from solar panels, charging for electric vehicle charging, production, etc.)

✔ Market opportunity – How big is the demand for your service or product?

✔ Investment requirement – How much will you need and what will you use it for?

✔ Financial projections – Projected future revenue, profitability, and rate of return over the next 5-10 years.

✔ Risk assessment & mitigation plan – What risks do you see, and how do you plan to mitigate them?

A clearly defined business plan generates investor confidence and makes your business more attractive.

2. Highlight Your Experience & Ability

If you already possess a successful solar or renewable energy business, investors will seek proof of success. Make sure that you emphasize:

✔ Successful past projects and installations

✔ Existing customer contracts and power purchase agreements (PPAs)

✔ Company and industry achievements and milestones

If you are a startup, emphasize your experienced team and innovative solution to industry challenges.

3. Leverage Government Incentives & Tax Benefits

One of the biggest reasons why solar farm investors, renewable investors, and clean energy investment funds are drawn to solar and renewable energy is the strong government financial support and incentives;

✔ Investment risks are reduced through tax deductions and depreciation tax benefits.

✔ Government subsidization and funding programs that maximize profitability.

✔ Ongoing policy dedication to renewable energy companies.

Illustrating how such benefits increase returns to investors will make your business appealing to potential investors.

4. Provide a Definitive Exit Plan

Investors want to know how they will recover their capital and what return they will get. A good exit strategy also provides assurance to investors. Consider:

✔ Mergers & Acquisitions (M&A) – Big corporations are acquiring renewable energy companies.

✔ selling investor equity after 5-7 years at a profitable valuation.

✔ Dividend-based returns – Offering regular returns from the business profits.

The more detailed your exit strategy is, the better your business will look to potential investors.

Transparency, a strong financial plan, and a strong growth vision are the ingredients to attract the right investor. If your company is likely to be profitable in the long term and has minimal risk, it will be simple to raise investment.

6. Where/How to Find Solar & Renewable Energy Investors in India – Ultimate List

Once your business is investor-ready, the next step is finding the right solar investors with the same vision as yours. Below are some of the best sources to get serious investors.

1. IndiaBizForSale – Direct Access to 3484+ Investors

IndiaBizForSale is India’s top business for sale and investment portal, connecting renewable energy and solar business owners with 638+ solar investors.

✔ Just create your attractive business proposal free of charge.

✔ Check the Investor network section and use filters to find relevant investors who are seeking opportunities.

✔ Save time by connecting investors directly in one place

You can find top region based solar and renewable energy investors list actively looking to invest below;

This is the most rapid way of getting the right investor for your company.

2. Renewable Energy Investment Summits & Expos

India Renewable Energy Expo, Solar India Expo, and Green Energy Summits are some such events which link investors, entrepreneurs, and industry professionals. Such events help you:

✔ Network with investors and pitch your business in person.

✔ Recognize market trends and emerging investing opportunities.

✔ Forming strategic alliances with key players in the renewable energy industry.

These events are attended by most investors seeking new business prospects, and so they are ideal for presenting your business.

3. Private Equity Funds and Venture Capital Firms

If you have a high-growth renewable energy company, going to venture capitalist, private equity, firms and renewable investment funds can help you raise more capital from some serious solar investment firms.

✔ Private equity firms invest in mature solar farms and large-scale developments.

✔ Venture capital firms invest in new start-ups in the solar, battery storage, and EV industry.

✔ Strategic corporate investors acquire companies for corporate expansion.

Talking to and investigating the right investor will boost your chances of getting funded.

4. LinkedIn & Investment Websites

Almost every investor is looking actively for renewable and solar energy companies on LinkedIn

✔ Optimize your LinkedIn page and company profile.

✔ Join solar and renewable investment clubs.

✔ Engage solar investors via direct communication and content marketing.

Networking through the internet will assist in making you accessible to investors worldwide and not only India.

The best way to approach finding investors is to be proactive. Whether it is through IndiaBizForSale, business networking conferences, or calling people directly, the objective is to reach out to serious investors who share your vision for your utility business.

7. How to Pitch Your Solar & Renewable Energy Business to Investors?

After securing the perfect investors, you then have to pitch your business. Pitching your business can make or break an investment opportunity. Here’s the best way to pitch your business.

1. Create a Winning Investor Pitch Deck

Your presentation has to be brief, factual, and engaging. It has to include:

✔ Introduction – What you and your company do.

✔ Market Opportunity – Why is the time now ripe to invest in solar/renewable energy?

✔ Business Model – How is your business generating money and profit?

✔ Investment Ask – How much do you need, and how will you use it?

✔ Financial Projections – Projected revenue, profits, and ROI over the next 5-10 years.

✔ Exit Strategy – How will returns be made for the investors?

2. Common Mistakes to Avoid in Pitch Deck

- Overuse of jargon words – Keep it plain and formal.

- No clear finances – Investors want real numbers and projections.

- Risk denial – Be open about risks and demonstrate how you will manage them.

- Excessive promises of returns – Be honest and realistic/achievable expectation.

3. Present with Confidence & Negotiate Wisely

✔ Speak confidently and clearly – Investors invest in confident entrepreneurs who know what they are doing.

✔ Be ready to deal with tough questions – Investors will question your business model and your finances.

✔ Agree mutually beneficial terms – Investors hope for equitable and lucrative agreements.

Investors don’t invest in ideas; they invest in people who can execute ideas. If you can walk in with confidence and a decent story and some legitimate numbers to back you up, then you stand a chance of getting the capital you’re seeking.

8. Secure Your Investment or Exit Deal Today

The clean energy sector is booming, and investors are keenly searching for lucrative investments in solar, EV, and green energy businesses.

If you have a solar farm, electric vehicle charging company, or a renewable energy company and need:

✔ Investment for business growth

✔ Strategic investors for expansion

✔ A profitable exit by disposing of your company

Register your company on IndiaBizForSale today!

Get seen by 3484+ active private solar and energy investors looking to invest.

Speak with genuine investors/buyers and lock your business into the best investment terms available!

The time to scale or exit your business profitably is NOW! Don’t miss the opportunity to partner with serious investors and take your business to the next level.

For any assistance, connect with our experienced investment banking team at [email protected].

Best of Luck!

Renewable energy is the future! This blog provides great insights into the growing investment opportunities in India’s solar and renewable energy sector.

Thank you for taking the time to read and share your insights. Your feedback is invaluable, and I hope this helps other professionals gain crucial growth insights for the solar and utility sectors.