Insights into the Indian IT Industry: An Overview

India’s IT sector has emerged as a global powerhouse, contributing 7.5% to the GDP in FY 2023. This vibrant sector, which includes information technology services and business process outsourcing, brought in an astounding $250 billion in income, of which $191 billion came from exports abroad and $59 billion from the domestic market. About 5.5 million people are employed by it, making it a major employer.

With its roots dating back to the 1960s and the pioneering efforts of Tata Consultancy Services (TCS) in Mumbai, the industry has thrived due to several factors. A vibrant free market, a large pool of highly qualified professionals, a solid education system centered on the English language, and strong government backing are a few of these.

The Indian economy has benefited greatly from the notable expansion of the IT sector throughout the last 20 years. Significant foreign direct investment has been drawn to it, and a large number of job opportunities have been created. Notably, The Indian IT Sector in FY2023 showcased a YoY growth of 9.5%, a drop from the 15.5% recorded in FY22. Additionally, the IT sector’s share of India’s GDP has climbed from 1.2% in 1998 to over 7.5% in 2023.

The global information technology (IT) market grew from $8179.48 billion in 2022 to $8852.41 billion in 2023, a compound annual growth rate (CAGR) of 8.2%. However, the Russia-Ukraine war has disrupted the global economic recovery from the COVID-19 pandemic, at least in the short term. The war has led to economic sanctions on multiple countries, a surge in commodity prices, and supply chain disruptions, causing inflation across goods and services and affecting many markets, including the IT market. Despite these challenges, the IT market is expected to grow to $11995.97 billion in 2027 at a CAGR of 7.9%, offering vast prospects for IT services companies across the value chain

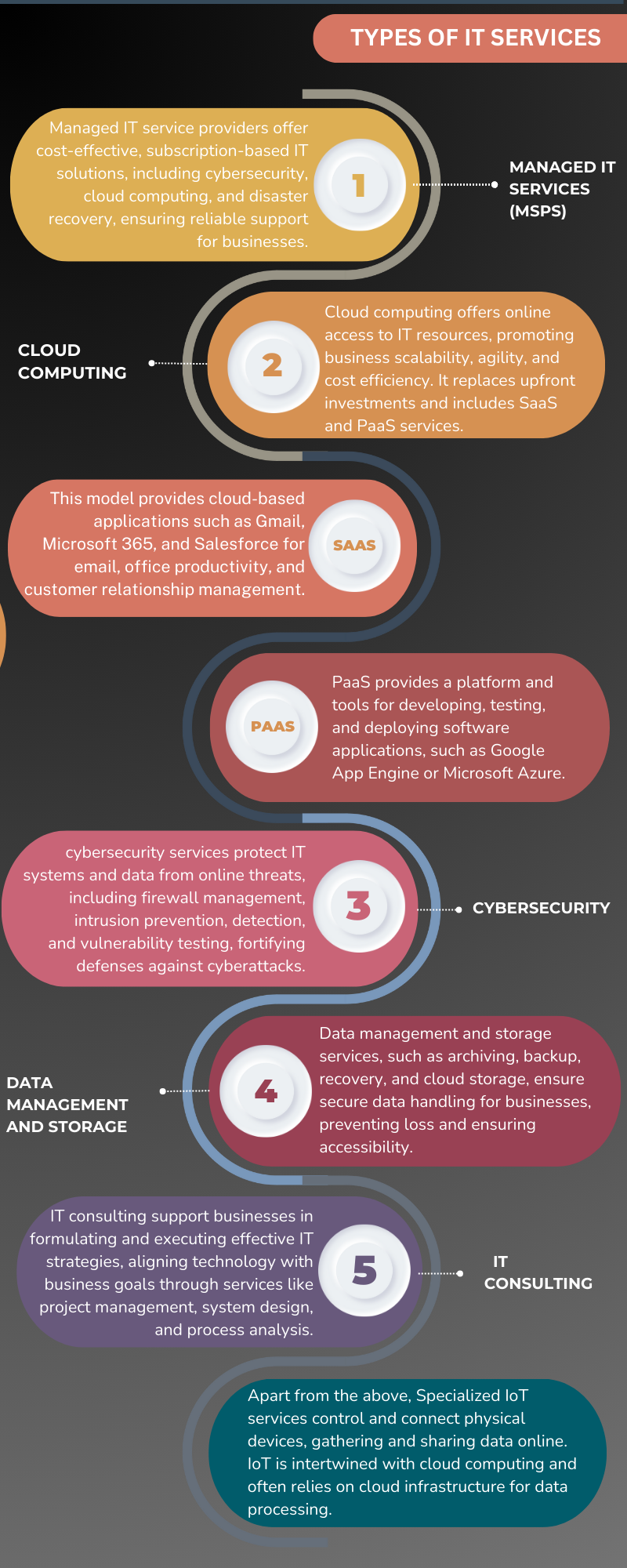

Demystifying IT Services: What You Need to Know

Major types of IT Services

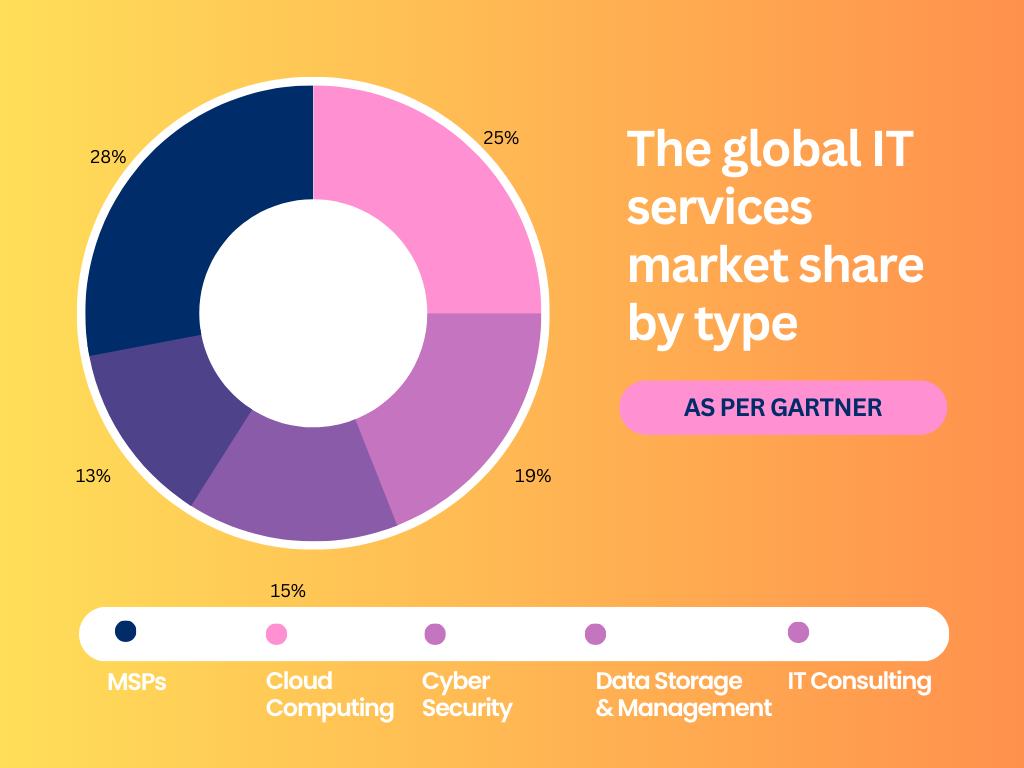

Global market share of different types of IT services :

Shaping the Future: Tech Sector Mergers and Acquisitions Trends

Source: EY report

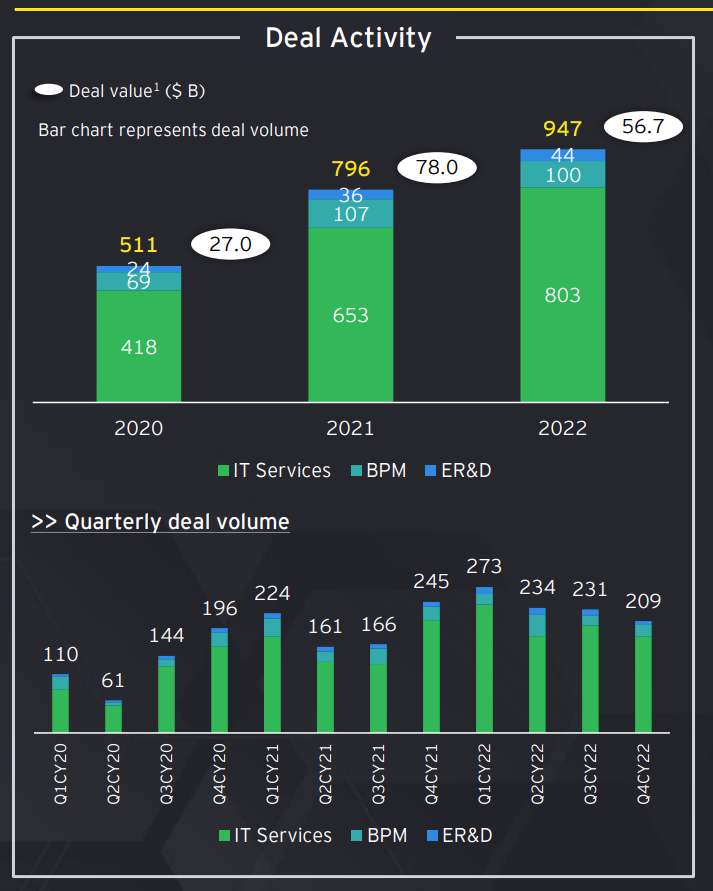

The year 2022 proved to be a year of paradoxes for the technology services (IT Services, BPM, and ER&D) deal market. After eight consecutive quarters of hypergrowth In deal activity, signs of an impending slowdown began to emerge near the end of 2022 and continued to the first quarter of 2023. 2022 saw the most transaction activity in the preceding five years, with the aim of accelerating competitive advantage in both emerging technologies and the talent market as a result of an increase in technology services investment after the pandemic. Not surprisingly, these were the key themes for strategic M&A and were driving private equity (PE) to build platforms. As the year progressed, macroeconomic uncertainties began to creep in, affecting the demand outlook and supply environment. This was exacerbated by the increase in the cost of capital

- With 947 deals, 2022 saw highest deal activity in last 5 years

- PE direct investment and roll-ups were significant contributors to deal volume

According to the Q3 2023 Indian Investment Banking Review published by Refinitiv, Mergers & Acquisitions (M&A) activity with a primary focus on India has reached a three-year low, amounting to $65.6 billion in the first nine months of 2023. This represents a substantial 56.6% decrease compared to the previous year.

Breaking down this figure, the report highlights that domestic M&A activity in India accounted for $44.1 billion during the same period, marking a significant 60% decline from the corresponding period in 2022.

The technology sector, which witnessed the highest number of M&A deals announced in the first three quarters of 2023, managed to secure a 9% market share with a total value of $6 billion. However, this figure showed a sharp decline of 71.7% when compared to the previous year.

Delving deeper into the Indian technology industry, GlobalData’s Deals Database reveals that there were 33 M&A deals announced in the third quarter of 2023, with a cumulative value of $22.6 million. Among these deals, the acquisition of Trejhara Solutions by AurionPro Solutions, valued at $16.8 million, emerged as the largest disclosed transaction in the industry.

M&A Activity in the Indian IT Industry

Here the graph representing the Indian technology industry (by deal value) from Q2 2021 – Q3 2023

- Q2 2021 - Q3 2023.png)

Emerging Themes

- Emerging technologies like IoT, AR/VR, Hyper Automation, Low Code No Code are garnering strong interest from large strategic buyers

- Services players are acquiring equity interest in IP/product companies for access to technology and create differentiation

Here’s a graph representing the deal activity in IT industry from 2020-2022:

The deal value jumped 2x from 2020 levels but was flattish across 2022/2021 (excluding two $10 B deals in 2021). The buyers appeared inclined toward tuck-in acquisitions. Deals valued at more than $500 M came down from 30 in 2021 to 23 in 2022 ( IT Services: 16, BPM: 7) . Interestingly PE investors orchestrated 15 of the 23 large deals in the industry.

The notable mega deal of 2022 in IT Services was the $7 B merger of LTI and Mindtree (IT services) . CloudMed – R1 RCM ($4.0 B) and Vinci Energies – Kontron ($400 M) were the largest(1) deals in the BPM and ER&D segments respectively.

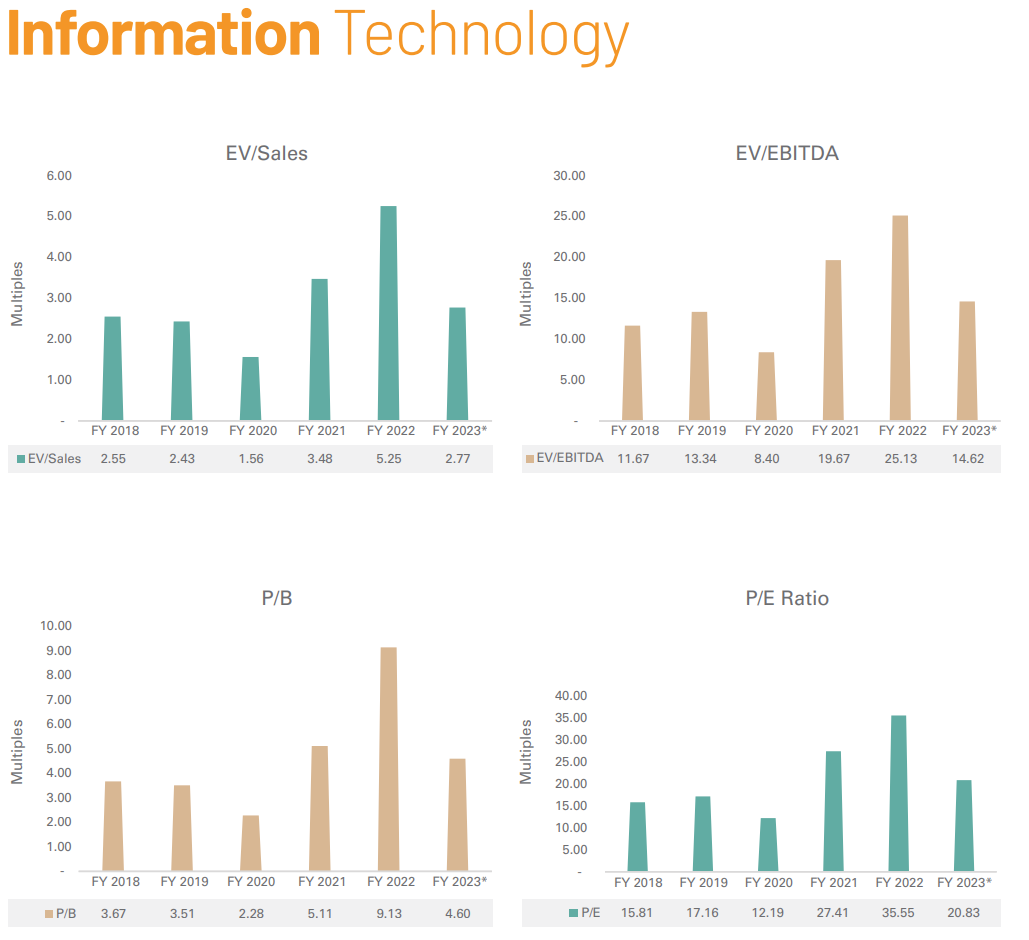

The Trend In Multiples Used In Indian IT Industry : As per RBSA Advisors

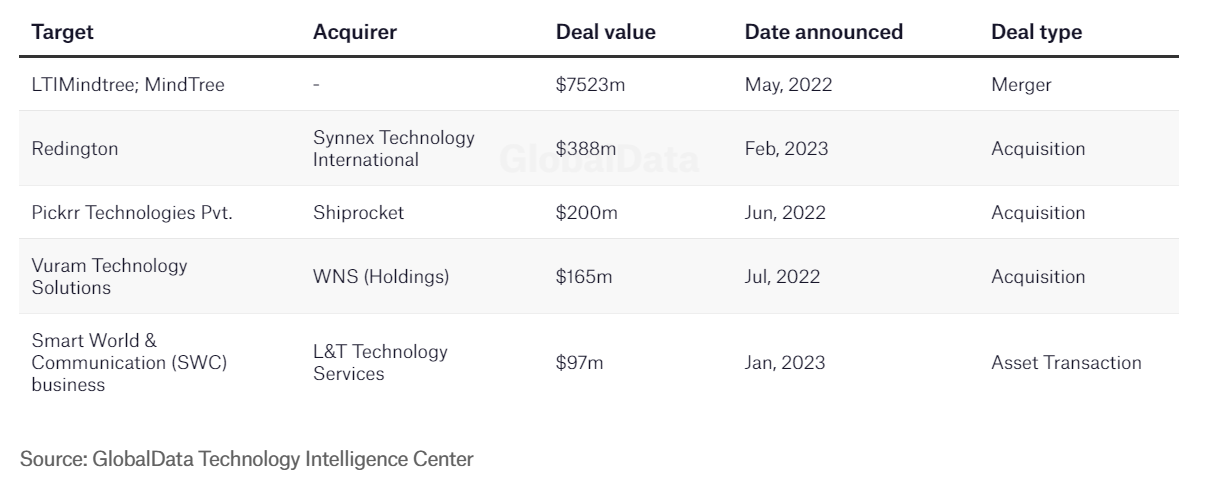

Tech Titans Unite: India’s Most Impactful Mergers and Acquisitions of 2022

Reliance’s stake in Addverb

Reliance Industries Limited spent USD 132 million to pick up a 54% stake in Addverb Technologies, an Indian robotics startup.

The Noida-based startup focuses on building automation and robotics solutions for warehouses and factories. Reliance has been already using Addverb’s robotic conveyors, pick-by-voice software, and semi-automated systems in its warehouses. Addverb churns out around 10,000 robots in a calendar year, including mobile robots, sorting robots, pallets shuttle and carton shuttle. And 80% of the startup’s revenue comes from the domestic market.

The robotics startup plans to use Reliance’s resources to achieve its goal of becoming a billion-dollar company in the next five years by targeting the global market.

HCL’s majority stake in GBS & Starschema acquisition

HCL Technologies has acquired a majority stake (51%) in German IT consulting firm Gesellschaft für Banksysteme GmbH (GBS). The remaining stake (49%) is with the largest German cooperative primary bank Deutsche Apotheker- und ärztebank eG (apoBank).

Additionally, HCL has agreed to buy the Budapest-based company Starschema in a deal worth USD 42.5 million to strengthen its data engineering services and build a stronghold in Central and Eastern Europe. Starschema, founded in 2006, offers consulting, technology, and managed services in data engineering.

The deal enables HCL to provide data engineering consulting and near-shore access to digital engineering services to a bigger pool of clients. The main idea behind the acquisition is to utilize Starschema’s data-focused expertise with HCL’s industry presence for a data-driven transformation.

Infosys buys Oddity

Infosys has \completed acquiring oddity, a German digital marketing, experience, and commerce agency. The move reinforces Infosys’ creative, branding and experience design capabilities and demonstrates its continued commitment to co-create with clients and help them navigate their digital transformation journey.

“Using oddity’s digital commerce, marketing knowledge, and metaverse-ready set-up, it easily complements Infosys’ prowess in technological transformation,” said Ravi Kumar S, Infosys President, in a statement.

oddity has a comprehensive service portfolio comprising digital-first brand management and communication, in-house production, including virtual and augmented reality, experience design and e-commerce services across Europe and China. The acquisition will power Infosys’ metaverse play.

Tech Mahindra buys Thirdware, picks stake in Geomatic.AI

Tech Mahindra has acquired Mumbai-based enterprise applications startup Thirdware in a USD 42 million all-cash deal. Thirdware specializes in services like RPA, ERP, and EPM, serving over 300 global clients, including Ford, Pfizer, and the United Nations. This acquisition will enhance Tech Mahindra’s capabilities in ERP solutions for the manufacturing sector.

Additionally, Tech Mahindra has acquired an 80 percent stake in Geomatic.AI through its Singapore subsidiary, with a consideration of AUD 6 million. Geomatic.AI will focus on digital platforms, leveraging its unique IP to offer services like Drone Technologies, Digital Twins, and AI-led solutions to asset-intensive industries in collaboration with AusNet Services.

Some Other M&As In Indian IT Industry:

Expert Opinions and Estimates: Unveiling Insights

“Across multiple business and technology cycles, the India Tech Services sector has proven incredibly innovative and resilient. If we look beyond near-term concerns, we continue to be excited about the opportunities in Digital Transformation over the next decade and expect to see increasing M&A and private equity investments in this sector. “

Hari Gopalakrishnan: partner,

BPEA-EQT, Co Head of Services,

Co Head of India

“Global IT services spend is likely to grow in ~8% range next few years. Given macroeconomics, there will be caution rest of calendar 2023 and increased scrutiny on new investments, but customers will continue to repurpose to areas of high impact such as CX and data/analytics to gain market share. Clients are also looking to get more ROI from their cloud & digital investments, so they can drive business value, while balancing with cost optimization initiatives. Enterprises are driving data-driven programs, and large platform leaders such as Oracle, Salesforce, ServiceNow, AWS, Microsoft, Snowflake and SI’s continue to differentiate with industry solutions – patient experience & interoperability in Healthcare, or connected devices with IoT in discrete industries, or AI driven competitive intelligence in Retail/Consumer are some examples.”

Hiral Chandrana

Global CEO, Mastek group

“M&A is an integral part of Infosys’ strategy. Executing on our priorities, we are focused on inorganic investments to strengthen digital capabilities, expand into new buying centres, penetrate further into untapped markets, and deepen vertical expertise. Over the years, we have built a systematic M&A approach and a framework that is repeatable with lots of cumulative experience, creating significant value. Our success from all the recent investments, built on a framework of acquisition design principles, ability to retain entrepreneurial culture, right integration with collaboration as the secret sauce, gives us the edge and we continuously evaluate acquisition opportunities. As clients look upon us as the digital transformation partner and the market sees favorable valuations, with our capital allocation policy and a strong balance sheet, we stay invested into inorganic growth opportunities to create a multiplier effect and influence the organic.”

Shyam Mundhada

VP, M&A, Infosys

“At Quest Global, we strive to be the most trusted partner for the world’s hardest engineering problems. To support this ambition, we prudently plan our M&A strategy to accelerate innovation, expand access to new markets, and deepen our expertise in emerging technologies to service our customers. Companies that can navigate this landscape strategically and acquire firms that complement their current capabilities will be better positioned for long-term customer relevance and success.Strategic deployment of capital towards M&A is a critical lever for companies to build capabilities. Regardless of the current economic slowdown, the ER&D sector globally has strong demand drivers as organizations undergo structural changes, while still facing increased pressure for innovation, reduced time-to-market, and operational excellence. This context creates a vibrant market for M&A and private equity investment. “

Ajit Prabhu,

CoFounder, Chairman & CEO,

Quest Global

Wrapping Up

The India Tech Services sector has proven incredibly innovative and resilient across multiple business and technology cycles. Despite near-term concerns, experts are excited about the opportunities in Digital Transformation over the next decade.

Industry leaders highlighted the following key takeaways:

- Global IT services spend is likely to grow in ~8% range next few years.

- Clients are looking to repurpose to areas of high impact such as CX (Customer Experience) and data/analytics to gain market share.

- Clients are also looking to get more ROI from their cloud & digital investments, so they can drive business value, while balancing with cost optimization initiatives.

- Enterprises are driving data-driven programs, and large platform leaders such as Oracle, Salesforce, ServiceNow, AWS, Microsoft, Snowflake and SI’s continue to differentiate with industry solutions.

These trends indicate that the demand for digital transformation services will continue to grow in the coming years. This will drive M&A and private equity investments in the India Tech Services sector.

Companies that can navigate the current economic slowdown strategically and acquire firms that complement their current capabilities will be better positioned for long-term customer relevance and success.

Prepared By

Aman Tiwari

Business Analyst – IndiaBiz

Double Master’s Program with a focus on Financial Markets

Excellent analysis of M&A trends in India’s IT sector. The insights into market dynamics and future projections are invaluable for industry professionals.

Glad to hear this. Hope it helps other too.