Hello Professionals,

As we all know, venture capital, or VC, is an important source of capital for startups and businesses that aim for rapid growth.

As a form of financing, venture capital is essential in supporting early-stage companies, particularly those with high-scale potential.

If you’re a explorer, startup founder or an entrepreneur looking for a venture capital partner, it’s crucial to understand the process of finding and securing the right VC funding.

In this article, we will walk you through the complete process, explaining key concepts, the different types of VCs, their benefits, mistakes to avoid and strategies for attracting the right venture capital investors for your venture.

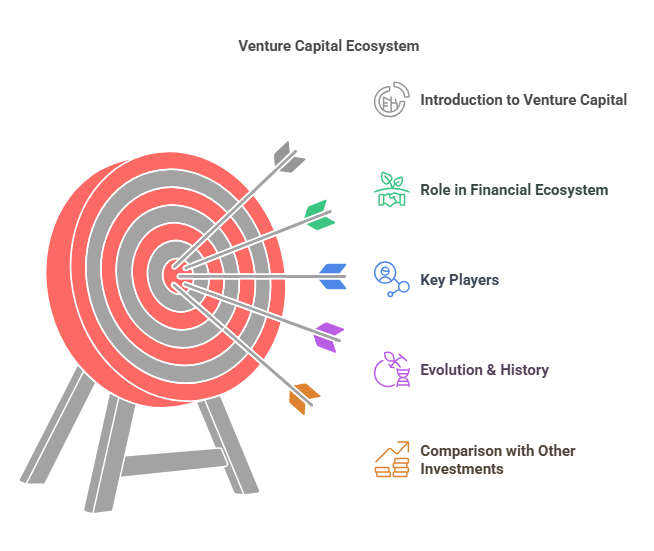

1. Introduction to Venture Capital

Venture Capital (VC) plays a pivotal role in fueling innovation, driving economic growth, and supporting early-stage companies with high growth potential. Unlike traditional financing methods, VC firms provide not just capital but also strategic guidance, mentorship, and access to networks that help startups scale.

1.1 Definition & Role of VC in the Financial Ecosystem

What is Venture Capital?

Venture Capital is a form of private equity financing where investors provide capital to early-stage, high-risk, high-growth startups in exchange for equity. Unlike traditional lenders such as banks, VCs invest in companies that typically lack tangible assets or cash flow but have strong market potential, disruptive technology, or innovative business models.

Why is VC Important?

- Bridges the Funding Gap: Many startups cannot secure bank loans due to lack of collateral; VCs provide risk capital.

- Accelerates Innovation: VCs back disruptive businesses in AI, fintech, SaaS, climate tech, and biotech, driving technological advancements.

- Boosts Economic Growth: Venture-backed startups contribute significantly to job creation, digital transformation, and GDP growth.

- Creates Industry Leaders: Many of today’s largest tech companies (Flipkart, Swiggy, Ola, Razorpay, Nykaa, Paytm) were backed by VCs.

1.2 Difference Between VC, Private Equity, and Angel Investing

| Feature | Venture Capital (VC) | Private Equity (PE) | Angel Investing |

| Stage of Investment | Early-stage & growth-stage startups | Mature companies | Pre-seed & early-stage startups |

| Risk Level | High | Moderate to Low | Very High |

| Investment Size | $500K – $100M | $50M – $1B+ | $10K – $500K |

| Equity Stake | 10-30% | Majority or controlling stake (51%+) | 5-20% |

| Investor Profile | VC firms, institutional LPs, corporate VCs | Large PE funds, sovereign funds, pension funds | Individual high-net-worth investors, syndicates |

| Exit Strategy | IPO, M&A, secondary sales | M&A, IPO, leveraged buyouts (LBOs) | Follow-on rounds, early secondary exits |

Key Differences:

- VC vs. PE: VCs invest in high-risk startups; PE firms buy mature, profitable companies for restructuring and efficiency improvement.

- VC vs. Angel Investing: Angel investors fund companies at the pre-seed or seed stage, while VCs invest larger amounts in scaling businesses.

1.3 Key Players in the VC Industry

1.3.1 Limited Partners (LPs)

LPs are investors who provide capital to VC funds but do not actively manage investments. These include:

- Pension Funds – Large institutional investors looking for long-term returns.

- Endowments & Foundations – Universities and non-profits with large capital bases.

- Sovereign Wealth Funds – Government-backed funds investing globally.

- Family Offices & HNIs – Ultra-high-net-worth individuals investing in private markets.

1.3.2 General Partners (GPs)

GPs are the VC fund managers who raise capital from LPs, source deals, and actively manage investments. They:

- Perform due diligence and invest in high-potential startups.

- Provide strategic guidance, mentorship, and operational support.

- Manage exits to generate returns for LPs.

1.3.3 Founders & Entrepreneurs

Startups raise capital from VCs in multiple rounds (Seed, Series A, B, C, Growth, Pre-IPO). Founders benefit from:

- Access to funding, networks, and mentorship.

- Scaling assistance, hiring support, and market expansion strategies.

- Guidance on unit economics, financial discipline, and governance.

1.3.4 Angel Investors & Syndicates

- Angel Investors: Individual investors funding early-stage startups (e.g., Rajan Anandan, Kunal Shah, Ratan Tata).

- Syndicates: Groups of investors pooling capital into startups (e.g., Indian Angel Network, LetsVenture, AngelList).

1.3.5 Corporate Venture Capital (CVC)

- Large companies investing in startups aligned with their strategic goals.

- Examples: Reliance Jio Platforms, Tata Digital, Google India Fund, Flipkart Ventures.

1.4 Evolution & History of Venture Capital

Global VC Evolution

- 1940s-50s: The VC industry was born in Silicon Valley post-WWII, with firms like American Research and Development Corporation (ARD) funding early tech companies.

- 1980s-90s: Rapid growth with investments in Microsoft, Apple, and Amazon.

- 2000s-2010s: The rise of SoftBank, Sequoia, Tiger Global, and other mega-funds.

- 2020s: Focus on AI, Web3, biotech, sustainability, and deep tech.

India’s VC Ecosystem Timeline

- 1990s: Early-stage investing begins with ICICI Ventures & SIDBI VC.

- 2000s: First wave of global VCs enter India (Sequoia, Accel, Tiger Global).

- 2010s: Massive startup boom with Flipkart, Paytm, Ola, Zomato, and Swiggy.

- 2020s: Growth of Indian VC firms (Blume Ventures, Elevation Capital, Nexus Venture Partners) and corporate VC players.

Key Takeaways for India-Focused VCs

- VC is distinct from PE & angel investing, focusing on high-growth, early-stage startups.

- LPs provide capital, GPs manage investments, and founders build ventures.

- India’s VC industry is growing, backed by global & domestic funds.

- The next wave will focus on AI, deep tech, sustainability, and Web3.

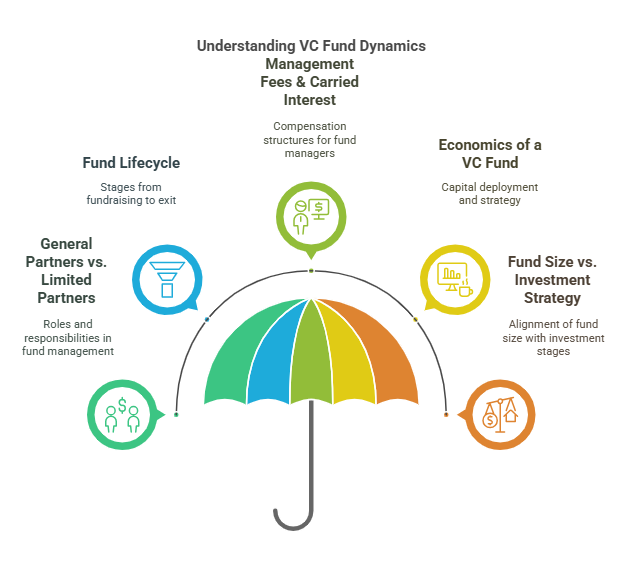

2. VC Fund Structure & Economics

A Venture Capital (VC) fund is a pooled investment vehicle where Limited Partners (LPs) commit capital, and General Partners (GPs) manage investments. The fund operates within a structured lifecycle, balancing capital deployment, returns, and exit strategies. Understanding VC fund economics—management fees, carried interest, and capital allocation—is crucial for both investors and founders.

2.1 General Partners (GPs) vs. Limited Partners (LPs)

Limited Partners (LPs) – The Investors

LPs provide the capital but do not actively manage the fund. Common LPs include:

- Institutional Investors – Pension funds, insurance companies, sovereign wealth funds.

- Endowments & Foundations – University endowments seeking long-term capital appreciation.

- Family Offices & High-Net-Worth Individuals (HNWIs) – Private wealth investors diversifying into venture.

- Corporate Venture Capital (CVCs) – Strategic investors from conglomerates like Tata, Reliance, and Mahindra.

General Partners (GPs) – The Fund Managers

GPs actively manage the fund, responsible for:

- Raising capital from LPs.

- Sourcing, evaluating, and investing in high-growth startups.

- Providing operational support to portfolio companies.

- Executing exits through IPOs, M&A, or secondary sales.

GPs typically commit their own capital (~1-2% of fund size) to align incentives with LPs.

2.2 Fund Lifecycle (Fundraising, Investment, Harvesting, Exit)

A typical VC fund follows a 10-12 year lifecycle, divided into three phases:

1. Fundraising Phase (Years 0-1)

- GPs raise commitments from LPs based on their track record and investment thesis.

- The fund is structured as a closed-end fund, meaning LPs commit capital for the full term.

- LPs do not provide the full amount upfront; capital calls occur periodically.

2. Investment Phase (Years 1-5)

- Capital Deployment: The fund invests in Seed, Series A, Series B, and growth-stage startups.

- Portfolio Construction:

- Typical allocation: 60-70% initial investments, 30-40% for follow-ons.

- Reserves for follow-ons to maintain pro-rata stakes in high-growth companies.

- Active Portfolio Management: GPs provide strategic guidance, board participation, and operational support.

3. Harvesting & Exit Phase (Years 5-10+)

- Exits via IPOs, M&A, secondary sales generate liquidity for LPs.

- The DPI (Distributions to Paid-In Capital) ratio improves as cash is returned to investors.

- Some funds extend beyond 10 years via extension periods to optimize exit timing.

2.3 Management Fees & Carried Interest

1. Management Fees (Fixed Income for GPs)

- Standard: 2% of committed capital annually.

- Covers salaries, office expenses, legal costs, and due diligence.

- Declines over time (e.g., 2% in the first five years, then 1.5% as investments mature).

2. Carried Interest (Performance-Based GP Compensation)

- Typically 20% of profits after LPs recover their initial capital.

- Profits are shared only if the fund achieves a hurdle rate (preferred return, usually 8%).

- Structure: 80% LPs | 20% GPs after preferred return.

3. Example of Fund Economics (100M USD Fund)

- Management Fees: $2M per year → $20M over 10 years.

- Investment Pool: $80M available for startups.

- Exit Returns: If the fund returns $300M, the profit is $200M.

- Carried Interest (20%): GPs earn $40M in carry.

2.4 Economics of a VC Fund (Capital Commitments, Deployment Strategy)

| Fund Size | Investment Size per Startup | Portfolio Size | Follow-on Reserves |

| $50M Seed Fund | $500K – $2M | 25-30 startups | 30-40% |

| $200M Series A Fund | $3M – $10M | 15-20 startups | 40-50% |

| $500M Growth Fund | $10M – $25M | 10-15 startups | 50-60% |

- Smaller funds (Seed & Series A) focus on early-stage bets.

- Larger funds prioritize later-stage, high-growth investments.

- Follow-on capital is key to maintaining ownership in breakout startups.

2.5 Fund Size vs. Investment Strategy

1. Seed & Pre-Series A Funds ($50M – $100M)

- Invest in 20-40 early-stage startups with smaller check sizes ($500K – $2M).

- High-risk, high-reward with a spray-and-pray approach.

- Requires higher reserves for follow-ons (~40%).

2. Series A & B Growth Funds ($100M – $300M)

- Focus on scaling startups with product-market fit (PMF).

- Invest in fewer companies (10-20) with higher check sizes ($3M – $10M).

- More capital-intensive with higher ownership targets (15-25%).

3. Late-Stage & Growth Funds ($300M – $1B+)

- Invest in 10-15 mature startups with check sizes of $10M – $50M.

- Require clear paths to IPO or M&A exits.

- Lower risk but fewer outsized returns compared to early-stage funds.

Key Takeaways for India-Focused VCs

- LPs provide capital, GPs manage investments, and carry structure aligns incentives.

- VC funds follow a 10-year lifecycle: fundraising, investment, harvesting.

- 2% management fee + 20% carried interest is the standard compensation model.

- Fund size dictates investment strategy: small funds = more bets, large funds = concentrated bets.

- Follow-on reserves are critical for maintaining ownership in high-growth startups.

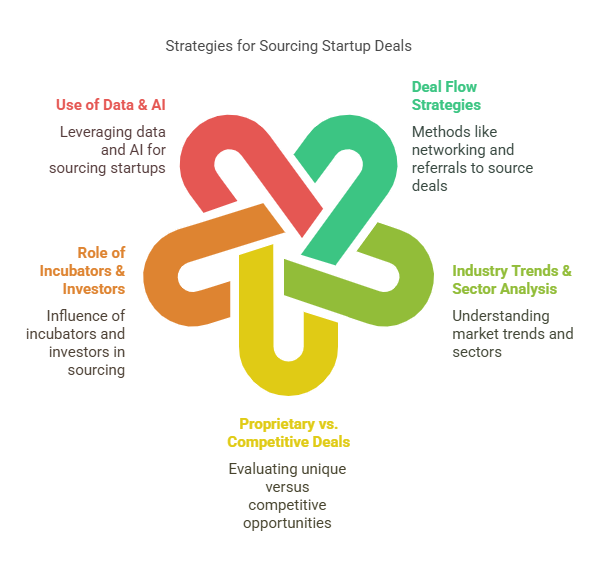

3. Sourcing Deals & Building a Pipeline

A strong deal pipeline is the foundation of a successful VC firm. Identifying high-potential startups early—before they become competitive or overvalued—gives VCs a significant advantage. This requires a mix of networking, industry research, proprietary sourcing, and technology-driven insights.

3.1 Deal Flow Strategies (Networking, Referrals, Demo Days)

1.1 Networking & Relationships (The Core of VC Sourcing)

- Founder Networks: Building relationships with successful entrepreneurs who refer high-potential startups.

- VC Peers & Co-Investors: Syndicating deals with other VCs to access hot startups.

- Corporate Networks: Partnering with large enterprises for market insights and deal referrals.

- University & Research Labs: Connecting with IITs, IIMs, ISB, and deep-tech research institutions.

1.2 Referrals (Warm Introductions vs. Cold Outreach)

- Most top-tier VCs rely on founder referrals and trusted ecosystem players.

- Law firms, accountants, and bankers often refer high-growth startups seeking funding.

- Cold outreach works only if highly targeted—demonstrate deep understanding of the startup’s business.

1.3 Demo Days & Pitch Events

- Startup Accelerators (Y Combinator, 100X.VC, Sequoia Surge, IndiaBizForSale’s BBC event) host Demo Days where founders pitch to investors.

- Industry-Specific Events (NASSCOM, TiE, Elevation Meetups) are great for meeting sector-focused founders.

- Corporate Innovation Hubs run startup challenges (e.g., Google for Startups, Flipkart Leap).

3.2 Industry Trends & Sector Analysis

2.1 Identifying High-Growth Sectors

- Smart VCs specialize in emerging sectors to gain an edge.

- Current India Trends:

- AI & Deep Tech (Large-scale AI adoption across SaaS, healthcare, and finance).

- Fintech (UPI, embedded finance, neobanks).

- EV & CleanTech (Battery tech, sustainable energy).

- SaaS for Global Markets (Indian SaaS startups going global).

- D2C & Consumer Brands (Digitally native brands scaling post-COVID).

2.2 Macro Trends & Timing Investments

- Understanding regulatory shifts (e.g., RBI fintech rules) helps in anticipating opportunities.

- Post-pandemic, remote work tools, AI automation, and Web3 became hot sectors.

- Keeping a pulse on VC-backed sector growth helps in benchmarking investments.

3.3 Proprietary vs. Competitive Deals

| Type of Deal | Description | Sourcing Strategy |

| Proprietary Deals | Startups sourced directly by the VC before competition enters. | Deep industry relationships, early networking, stealth mode founders. |

| Competitive Deals | Startups attracting multiple VCs, leading to bidding wars. | Popular accelerators, referrals from known investors. |

Why Proprietary Deals Matter?

- Less Competition = Better Valuations: Investing before others reduces pricing pressure.

- Better Founder Relationships: More time for due diligence and structured investment.

- Higher Success Rates: Startups sourced through strong networks tend to have lower failure rates.

Competitive Deals – When to Play?

- If the startup is high-growth with strong traction (e.g., Razorpay, Zepto).

- If other top-tier VCs are investing, increasing the chance of future rounds.

- If the valuation is still reasonable and aligned with market potential.

3.4 Role of Incubators, Accelerators & Angel Investors

| Ecosystem Player | Role in Sourcing | Examples in India |

| Incubators | Early-stage startup support, infrastructure, initial mentorship. | IIT Madras Incubation Cell, NSRCEL (IIM Bangalore), T-Hub Hyderabad, CIIE-IIMA |

| Accelerators | Intense 3-6 month programs with seed funding & investor access. | Sequoia Surge, 100X.VC, Y Combinator India, Axilor |

| Angel Networks | Early-stage funding, deal syndication, warm intros to VCs. | Indian Angel Network, LetsVenture, AngelList India |

| Venture Builders | Co-create startups with founding teams, then raise external funding. | Antler India, Rebright Partners, GrowthStory |

VC Collaboration with Accelerators & Angels

- Angels spot early-stage winners—VCs often follow them in later rounds.

- Many startups graduate from accelerators into Series A investments.

- VCs track incubator graduates for pre-emptive funding opportunities.

3.5 Use of Data & AI in Sourcing Startups

AI-Powered Deal Sourcing

- VC firms use AI-driven scouting platforms to identify early-stage winners.

- Examples of AI in VC:

- Tracxn, CB Insights – Track sector trends, startup activity.

- PitchBook, Dealroom – Data analytics for private market deals.

- LinkedIn & Twitter Signals – AI tracks viral startup hiring trends & traction.

- IndiaBizForSale – Online business matchmaking platform become a crucial to connect directly with sector & region based growing startups.

Data-Driven Investment Decisions

- AI helps VCs analyze startup momentum based on funding rounds, hiring, patents, and customer traction.

- Predictive models rank startups by potential exit probability.

Key Takeaways for India-Focused VCs

- Strong network-driven sourcing gives VCs early access to proprietary deals.

- Industry focus & trend analysis help in identifying high-growth opportunities.

- VCs collaborate with incubators, accelerators, and angels for pipeline access.

- AI-driven sourcing & market intelligence improve deal selection.

4. Investment Thesis & Due Diligence

A well-defined investment thesis is the foundation of successful VC investing, guiding decision-making, portfolio strategy, and risk assessment. Before committing capital, VCs conduct due diligence across multiple dimensions—market, team, technology, financials, competition, and legal risks—to maximize the probability of strong returns while mitigating downside risks.

4.1 Developing an Investment Thesis (Sector Focus, Thematic Investing)

An investment thesis is a structured approach that helps VCs decide where to invest, why, and how. It involves:

1. Sector Focus vs. Generalist Investing

- Sector-Focused Funds – Invest in specific industries like fintech, SaaS, deep tech, or healthtech.

- Example: Specialist VC Firms in India

- Lightrock (Impact & sustainability investing).

- Fundamentum (Growth-stage SaaS).

- Arkam Ventures (Mass-market fintech & consumer tech).

- Example: Specialist VC Firms in India

- Generalist VCs – Invest across multiple sectors but may specialize in business models.

- Example: Sequoia, Accel, Elevation Capital (Invest across consumer tech, SaaS, fintech, etc.).

2. Thematic Investing – Identifying Future Trends

- Instead of focusing on just sectors, many VCs develop thematic investment theses:

- AI-Driven Automation → Investing in AI-powered SaaS and deep-tech startups.

- India’s Digital Economy → Fintech, D2C, and UPI-led payment innovations.

- Bharat Market Opportunity → Investing in startups solving problems for India’s next billion users (vernacular, affordability).

- ClimateTech & Sustainability → Renewable energy, electric mobility, carbon credits.

VCs refine their thesis by analyzing macro trends, government policies, and tech advancements to predict where opportunities will emerge.

4.2 Key Due Diligence Areas

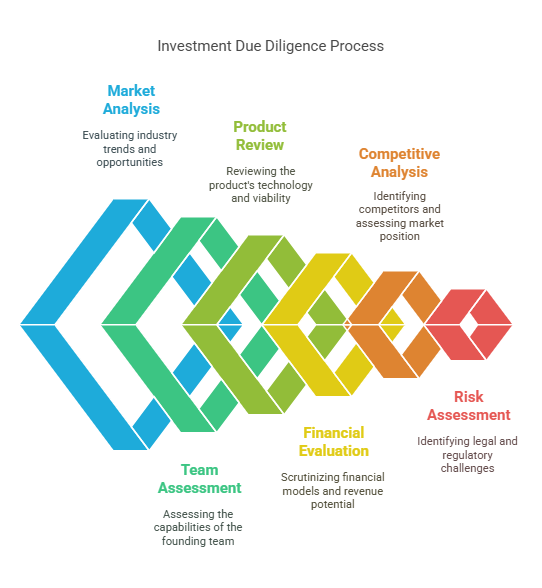

Once a startup fits the investment thesis, thorough due diligence is conducted to assess viability and risks.

1. Market & Industry Analysis

- Total Addressable Market (TAM) – Is the market large enough for a VC-scale return?

- Growth Trends – Is the industry expanding or saturated?

- Regulatory Risks – Are there potential legal hurdles (e.g., fintech compliance with RBI, healthtech data privacy laws)?

- Comparable Startups – How do similar companies perform in other geographies?

Example:

- Fintech investing in India requires understanding RBI guidelines on payments, lending, and digital banking.

- SaaS companies targeting global markets need insights into enterprise adoption cycles and pricing models.

2. Founding Team & Management Assessment

Team strength is often the biggest success factor in early-stage VC deals.

- Founder-Market Fit – Do founders have deep industry expertise or relevant experience?

- Execution Ability – Track record of scaling teams, managing crises, and pivoting when needed.

- Skin in the Game – Are founders committed for the long term? Have they invested personal capital?

- Cap Table Structure – Do founders retain enough equity for long-term motivation?

Red Flag: Frequent founder conflicts or unclear roles among co-founders.

3. Product & Technology Review

- Does the product solve a real problem?

- Is the tech stack scalable? (E.g., cloud-native, modular architecture)

- Is there a strong differentiation? (e.g., unique AI models, network effects)

- Are there potential IP or patent advantages?

For Deep-Tech Startups: VCs may bring in technical experts to assess algorithms, AI models, and R&D innovation.

Example: Indian SaaS unicorn Postman scaled by solving a niche problem (API development) with a differentiated product.

4. Financials & Revenue Models

- Unit Economics – Does the company make more money per customer than it spends acquiring them?

- Burn Rate & Runway – How long can the startup survive without raising more capital?

- Gross Margins & Scalability – High-margin businesses (SaaS, fintech) scale better than low-margin ones (D2C, e-commerce).

- Recurring Revenue vs. One-Time Sales – Subscription models (SaaS, fintech) are favored over transaction-based revenues.

Example: VCs prefer high Net Revenue Retention (NRR) (120%+) in SaaS, meaning customers spend more over time.

5. Competitive Landscape & Moats

- Direct vs. Indirect Competition – Who are the competitors, and how strong is their market position?

- Network Effects – Does the startup gain strength as more users join (e.g., UPI payments, marketplaces)?

- Switching Costs – Is it hard for customers to leave? (E.g., enterprise SaaS with deep integrations).

- Regulatory Moats – Are there licenses or approvals that give the startup an edge? (E.g., banking, EV infrastructure).

Example: PhonePe vs. Paytm vs. Google Pay → Strong network effects in payments, but regulatory dependencies with RBI.

6. Legal & Regulatory Risks

- Compliance – Are there sector-specific regulations (e.g., fintech under RBI, healthtech under HIPAA-like laws)?

- Data Privacy & Security – Does the startup follow Indian IT Act & GDPR compliance?

- Intellectual Property (IP) Risks – Any pending legal disputes on patents or trademarks?

- Cross-Border Risks – FDI restrictions (e.g., Chinese investments in India are restricted in sensitive sectors).

Example: EdTech startups had to adjust to new government regulations post-COVID restricting aggressive sales tactics.

4.3 Red Flags & Common Pitfalls in VC Investing

Common Red Flags That Kill Deals

- High Founder Turnover → Frequent exits of key team members signal instability.

- Unclear Business Model → If monetization is unclear after several pivots, it’s a warning sign.

- Legal Liabilities → Pending lawsuits, unclear IP rights, or non-compliant financial practices.

- Overhyped Valuations → Startups raising capital at inflated valuations without corresponding traction.

- Dependency on a Single Customer → If one client accounts for more than 40%+ revenue, business risk is high.

VC Pitfalls to Avoid

- FOMO Investing – Chasing trends without fundamental conviction (e.g., crypto bubble).

- Ignoring Governance – Lack of proper financial controls, especially in early-stage deals.

- Scaling Too Early – Startups burning cash before achieving product-market fit.

Key Takeaways for India-Focused VCs

- A strong investment thesis helps identify high-potential sectors & trends.

- Due diligence should cover market size, founder quality, tech differentiation, financial sustainability & legal risks.

- VCs must look for competitive moats and scalable business models.

- Avoid common red flags like founder churn, legal issues & unsustainable burn rates.

5. Valuation & Deal Structuring

Valuation and deal structuring are critical aspects of the VC investment process, determining how much equity investors receive in exchange for their capital, and how the startup’s future growth will affect all stakeholders. Proper structuring ensures both founders and investors are aligned on expectations, ownership, and future outcomes.

5.1 How Startups are Valued (DCF, Comparable Multiples, VC Method)

Valuation methods in early-stage investing differ from traditional corporate finance due to the higher uncertainty, limited financials, and scalability potential of startups. Here are some common methods:

1. Discounted Cash Flow (DCF)

- DCF is used when a startup has predictable cash flows, which is rare in early-stage investing.

- It involves projecting the startup’s future cash flows and discounting them back to present value using an appropriate discount rate.

- Risk: High subjectivity in projections, making it less reliable for early-stage companies without established revenue.

2. Comparable Company Multiples

- This approach involves comparing the startup to similar companies in the same sector that are either publicly listed or have received funding at a comparable stage.

- For instance, comparing a fintech startup’s valuation to similar Indian fintech firms, like Razorpay or PhonePe, based on revenue multiples, user growth, or market opportunity.

- Risk: Requires reliable data on peer companies, which can sometimes be limited for early-stage startups in emerging markets like India.

3. Venture Capital Method

- This is the most commonly used method for valuing early-stage startups. It estimates the exit value (e.g., IPO or acquisition) and works backward to determine the pre-money valuation today.

- Key formula:

- Exit Valuation / Target ROI = Post-money Valuation.

- Adjustments for dilution, exit probabilities, and time to exit are considered.

- Risk: It relies on assumptions regarding future exit opportunities and market conditions.

Valuation Benchmarks for India

- Early-stage Indian startups typically have valuation multiples of 5x-10x revenue for SaaS or 10x-20x revenue for fast-growing fintech or consumer startups (subject to growth rate, market potential, etc.).

- Example: Razorpay’s valuation jumped to $7.5B from $3B in less than a year, driven by strong growth in India’s digital payments market.

5.2 Term Sheets & Key Negotiation Points

Once the valuation is determined, term sheets outline the key terms of the investment and negotiations. VCs must carefully structure these terms to ensure their rights and protections are balanced with the startup’s growth trajectory.

1. Valuation (Pre-money vs. Post-money)

- Pre-money Valuation: The value of the company before the new investment is added.

- Example: If the pre-money valuation is $10M, and the VC invests $2M, the post-money valuation is $12M.

- Post-money Valuation: The total value of the company after the new capital injection.

- It determines the ownership percentage the VC gets for their investment.

- Formula:

- Ownership % = Investment Amount / Post-money Valuation

2. Equity vs. Convertible Notes vs. SAFEs

- Equity: Common form of investment, where VCs directly purchase shares at an agreed valuation.

- Convertible Notes: Debt instruments that convert into equity in a future financing round (typically at a discount or with a valuation cap).

- Used in Seed Rounds to delay valuation discussions.

- Converts to equity in the next equity round at a 20%-30% discount or capped at a pre-determined valuation.

- SAFEs (Simple Agreement for Future Equity): A simpler form of convertible note, typically with no interest rate or maturity date.

- Popular in the US and India for early-stage investments, as they offer flexibility without immediate valuation negotiations.

3. Liquidation Preferences

- This clause defines the order in which investors are paid in the event of a liquidity event (e.g., M&A, IPO).

- Standard Liquidation Preference:

- 1x Liquidation Preference: Investors get their initial investment back before any distributions to common shareholders (founders, employees).

- Participating Liquidation Preference: Investors get their initial investment back plus a share of the remaining proceeds on a pro-rata basis.

- Non-participating Liquidation Preference: Investors either get their invested amount or a pro-rata share of the proceeds, whichever is higher.

- Example:

- If a VC invests $10M in a company with 1x participating liquidation preference, and the company exits for $50M, the VC would first get their $10M, then a share of the remaining $40M.

4. Anti-Dilution Clauses

- Protects VCs from future dilution in case the company raises funds at a lower valuation than their current investment.

- Types of Anti-Dilution Provisions:

- Full Ratchet: VCs get enough additional shares to make up for the price drop.

- Weighted Average: VCs get additional shares, but the amount is weighted based on the number of new shares issued.

- Example:

- If a VC invests at a $20M valuation, and the company later raises funds at a $10M valuation, anti-dilution ensures the VC gets more shares to maintain their ownership percentage.

5. Pro-rata Rights & Follow-on Investments

- Pro-rata Rights give VCs the right to maintain their ownership percentage in future funding rounds by participating in follow-on investments.

- This is particularly important for early-stage investors who want to avoid dilution as the company scales.

- Example: If a VC owns 20% of a startup and the company raises additional funds, the VC can invest further to maintain their 20% stake.

6. Board Seats & Control Provisions

- Board Seats: VCs often negotiate for a board seat or observer rights to ensure they have a say in major strategic decisions.

- Control Provisions: Certain decisions, such as acquisitions, mergers, or fundraises, may require VC approval.

- Protective Provisions: VCs may ask for veto rights on key decisions like changes in business strategy, issuing new shares, or hiring/firing key personnel.

- Example:

- Sequoia India holds board seats in startups like Byju’s, allowing them to influence key business decisions.

7. Cap Tables & Ownership Dilution

- The Cap Table outlines the ownership structure of the company, including how much equity each founder, investor, and employee holds.

- Key Points:

- Pre-money ownership (how much the founders own before funding).

- Post-money ownership (how the founders’ stake is diluted after funding).

- Option Pool: Often, a portion of the equity (e.g., 10%) is set aside for future employee stock options (ESOPs).

- Dilution: VCs need to be aware of the future dilution impact from follow-on rounds and stock option grants.

Key Takeaways for India-Focused VCs

- Valuation methods like the VC Method and Comparable Multiples help determine a fair price for startups.

- Term Sheets outline critical terms like liquidation preferences, anti-dilution clauses, pro-rata rights, and board seats to protect VCs’ interests.

- Equity, convertible notes, or SAFEs offer flexibility depending on the stage of investment.

- Cap table analysis and careful attention to ownership dilution ensure alignment of incentives between VCs and founders.

6. Fundraising & Capital Deployment Strategy

How VCs Raise Funds (LP Strategy & Capital Calls)

Venture capital firms raise capital from Limited Partners (LPs), which include institutional investors (pension funds, endowments, sovereign wealth funds), high-net-worth individuals, family offices, and fund-of-funds. Successful fundraising depends on a strong track record, a clear investment thesis, and alignment with LP risk-return expectations.

VCs typically structure funds as closed-end vehicles with a 10-year lifespan. Capital is raised in committed tranches, with capital calls occurring over time as investment opportunities arise, reducing cash drag for LPs. Managing capital calls efficiently ensures liquidity for investments while optimizing fund performance.

Portfolio Construction (Number of Investments, Follow-ons)

A well-structured VC portfolio balances diversification and concentrated bets. Portfolio construction is influenced by fund size, risk appetite, and target returns. Key considerations include:

- Number of initial investments: Larger funds (e.g., $500M+) may target 30–50 startups, while smaller, sector-focused funds may concentrate on 15–25.

- Follow-on strategy: Reserving capital for follow-on rounds is critical to avoid excessive dilution in winning bets.

- Exit strategy alignment: Ensuring investments have pathways to liquidity through M&A, secondary markets, or IPOs.

Capital Allocation Across Stages (Seed, Series A, B, Growth)

Capital deployment strategy depends on fund mandate:

- Seed & Pre-Seed: Small checks ($100K–$1M) across a large number of startups, often through SAFEs or convertible notes.

- Series A & B: Larger allocations ($2M–$10M+) in companies with validated business models, typically leading or co-leading rounds.

- Growth & Late-Stage: Selective participation in high-growth companies approaching scale, where dilution and valuation sensitivity become key.

Balancing new investments vs. reserves for follow-ons is crucial. A common split is 40-60% initial investments, 40-60% follow-ons, but this varies by strategy.

Managing Reserves for Follow-on Rounds

VCs typically reserve 50–70% of their fund for follow-ons in the best-performing startups. This ensures they maintain ownership and avoid excessive dilution in later rounds. Strategies include:

- Pro-rata rights: Protecting initial stake in future financings.

- Asymmetric allocation: Doubling down on outperformers while minimizing capital for struggling companies.

- Opportunistic SPVs: Special Purpose Vehicles (SPVs) allow additional investment in select winners outside the core fund structure.

Diversification vs. Concentration Strategy

- Diversification Strategy: Investing in a broad range of sectors, geographies, and stages to spread risk. More common in generalist funds.

- Concentration Strategy: Focusing on specific industries (e.g., SaaS, biotech, fintech) to leverage deep expertise and generate outsized returns.

A barbell approach—diversifying early-stage bets while concentrating capital in late-stage winners—helps optimize risk-adjusted returns.

7. Post-Investment Portfolio Management

Effective post-investment management is critical for maximizing returns, derisking investments, and ensuring portfolio companies reach successful exits. VCs play an active role beyond capital deployment, offering strategic guidance, operational support, and access to follow-on funding.

Board Membership & Active Involvement

- Board Seats & Observer Roles: VCs often take board seats (or observer roles) in their portfolio companies, influencing strategy, governance, and financial discipline.

- Strategic Advisory: Acting as a bridge between founders and key stakeholders, VCs assist in refining business models, unlocking partnerships, and navigating M&A opportunities.

- Investor Syndicate Coordination: Collaborating with co-investors to align on governance decisions, future financing, and potential exit strategies.

Founder Coaching & Mentorship

- CEO & Leadership Development: Supporting founders in transitioning from product builders to scaled enterprise leaders.

- Crisis & Conflict Management: Providing guidance on handling board dynamics, team restructuring, and unforeseen financial challenges.

- Mental Resilience & Growth Mindset: Helping founders navigate the emotional and operational stress of scaling a company.

Scaling Startups: Go-to-Market, Hiring, International Expansion

- Go-to-Market (GTM) Execution: Assisting in customer acquisition strategies, enterprise sales playbooks, and channel partnerships.

- Talent Acquisition & Leadership Hiring: Leveraging networks to recruit top-tier executives (CFOs, CROs, CTOs) and functional leaders.

- International Expansion: Advising on market entry strategies, regulatory considerations, and localization tactics.

- Operational Scalability: Helping startups establish financial controls, unit economics discipline, and technology infrastructure.

Fundraising Support for Future Rounds

- Prepping for Next Raise: Guiding startups on valuation expectations, KPI benchmarks, and positioning for Series A, B, and beyond.

- Investor Introductions: Leveraging LP networks, strategic investors, and late-stage funds for warm introductions.

- Cap Table & Dilution Strategy: Ensuring founders maintain healthy ownership stakes while securing necessary capital.

- Exit Strategy Planning: Preparing for IPO, M&A, or secondary sales, ensuring alignment between investors and founders.

Portfolio Monitoring & Performance Metrics

Tracking key financial and operational KPIs ensures VCs maintain a pulse on portfolio health. Essential metrics include:

- Burn Rate & Runway: Assessing monthly cash burn to predict when additional funding is required.

- Revenue Growth & Unit Economics: Monitoring top-line growth, CAC/LTV ratios, and gross margins.

- Operational Efficiency: Evaluating cost structure, productivity benchmarks, and path to profitability.

- Market Positioning & Competitive Landscape: Analyzing competitive threats and strategic pivots needed.

Proactive portfolio management ensures that VCs not only maximize financial returns but also help build enduring, scalable businesses.

8. Exit Strategies & Liquidity Events

A well-planned exit strategy is essential for VCs to realize returns and distribute capital to Limited Partners (LPs). Exits typically occur via M&A, IPOs, or secondary market transactions, each with distinct financial and strategic implications. VCs must actively position portfolio companies for successful liquidity events while optimizing investor returns.

Exit Scenarios (M&A, IPO, Secondary Sales)

- Mergers & Acquisitions (M&A)

- Strategic Acquisitions: Larger companies acquire startups to gain market share, talent (acqui-hire), or technology/IP.

- Private Equity (PE) Buyouts: PE firms acquire later-stage startups, often as part of roll-up strategies or operational turnarounds.

- SPAC Mergers: Special Purpose Acquisition Companies (SPACs) provide an alternative IPO route with faster execution.

- Distressed Sales: Startups with liquidity challenges may pursue fire-sale exits or asset sales.

- Initial Public Offering (IPO)

- Traditional IPO: The most prestigious exit, providing liquidity and branding but requiring stringent regulatory compliance.

- Direct Listing: A non-dilutive exit where existing shareholders sell stock without raising new capital.

- SPAC IPO: A structured alternative to a traditional IPO with potentially faster execution but valuation risks.

- Secondary Sales (VC-to-VC, LP Liquidity, Founder Liquidity)

- VC Secondaries: Earlier-stage investors may sell stakes to growth-stage or late-stage funds.

- LP Liquidity: LPs may sell fund interests in secondary markets before full fund maturity.

- Founder & Employee Liquidity: Structured sales in later funding rounds allow partial cash-outs.

Timeline & Market Considerations for Exits

- Market Cycles & Valuations: IPO windows open during bullish markets, while M&A activity intensifies during downturns as companies seek strategic consolidations.

- Regulatory & Geopolitical Factors: Antitrust scrutiny, international regulations, and macroeconomic shifts impact exit feasibility.

- Exit Readiness & Growth Stage: Companies need strong fundamentals—scalable revenue models, profitability potential, and governance structures—to attract acquirers or public investors.

- Holding Period & VC Fund Lifecycle: VCs must align exits with fund lifespans (typically 8–12 years), balancing early wins with later-stage growth bets.

Preparing Portfolio Companies for IPOs & Acquisitions

- Financial & Operational Readiness

- Revenue scale ($100M+ ARR ideal for IPOs).

- Sustainable gross margins and path to profitability.

- Strong leadership team and internal controls.

- SEC compliance readiness for IPOs.

- Strategic Positioning

- Building relationships with investment banks, M&A advisors, and corporate development teams.

- Conducting market positioning and competitive analysis to enhance valuation.

- Running “dual-track” strategies (preparing for IPO while engaging with potential acquirers).

Secondary Market Sales & Liquidity for LPs

- VC Fund Secondaries: LPs may sell fund positions to other institutional investors before full distributions.

- Continuation Funds: VCs create new vehicles to extend holding periods for top-performing companies while providing LP liquidity.

- Structured Liquidity Programs: Pre-IPO share sales or tender offers allow VCs, founders, and early employees to de-risk.

Return Metrics: IRR, MOIC, TVPI, DPI

- Internal Rate of Return (IRR): Measures annualized fund performance, adjusting for time value of money.

- Multiple on Invested Capital (MOIC): Compares exit proceeds to initial investment (e.g., 5x return).

- Total Value to Paid-In Capital (TVPI): Includes both realized and unrealized returns.

- Distributed to Paid-In Capital (DPI): Measures actual cash distributions relative to LP commitments.

Key Takeaways:

- Exit planning should start early, with clear pathways for IPO, M&A, or secondary sales.

- Market timing, valuation dynamics, and financial readiness are critical in optimizing exit outcomes.

- Fund-level liquidity strategies ensure that LPs receive timely distributions while maximizing fund IRR.

9. Legal, Regulatory & Compliance Aspects (India Focused)

India’s venture capital ecosystem operates within a dynamic regulatory and tax framework. VC firms investing in India must navigate SEBI regulations, RBI guidelines, FEMA compliance, and taxation rules while considering offshore vs. onshore fund structuring.

SEBI & Regulatory Framework for VC Funds in India

- Alternative Investment Funds (AIFs):

- Regulated under SEBI (AIF) Regulations, 2012.

- Categorized into Category I (early-stage startups, social impact funds, infrastructure), Category II (PE & debt funds), and Category III (hedge funds, complex strategies).

- Foreign Venture Capital Investors (FVCI) Regulations:

- Registered foreign investors can invest in Indian startups under relaxed FEMA norms.

- Permitted to invest in sectors such as IT, biotech, nanotechnology, and more.

- FDI vs. FPI Considerations:

- Foreign Direct Investment (FDI) in startups is allowed in most sectors under the automatic route but restricted in areas like defense, telecom, and media.

- Foreign Portfolio Investors (FPIs) follow stricter norms under SEBI guidelines.

- RBI & FEMA Compliance:

- Investments involving foreign capital must adhere to the Foreign Exchange Management Act (FEMA).

- Down rounds & valuation guidelines: Indian laws require fair valuation principles for share issuances to foreign investors.

- Round-tripping concerns: Restrictions exist on Indian investors routing funds abroad and reinvesting domestically to prevent tax evasion.

Tax Considerations & Structuring Funds Offshore vs. Onshore

- Onshore Fund Structure (India-domiciled AIFs)

- Tax pass-through status available for AIF Category I & II funds (profits taxed at investor level).

- Gains from exits are taxed as capital gains (long-term vs. short-term rates vary by holding period).

- Dividend Distribution Tax (DDT) removed, but dividends are now taxed in the hands of investors.

- Offshore Fund Structure (Mauritius, Singapore, UAE, Cayman Islands)

- Many foreign LPs prefer Mauritius, Singapore, and UAE due to favorable tax treaties with India.

- General Anti-Avoidance Rule (GAAR) applies if the offshore entity lacks substantial commercial presence.

- Indirect Transfer Tax (Vodafone Case Precedent): Foreign investors may face capital gains tax in India when selling shares of an offshore holding company with Indian assets.

- Angel Tax (Section 56(2)(viib))

- Previously taxed startup funding above “fair market value” as income; now relaxed for DPIIT-registered startups.

- Recent Budget updates have extended this relief to foreign investors.

Cross-Border Investments & Geopolitical Risks

- China Investment Restrictions:

- Post-2020, FDI from China requires government approval, affecting Chinese VCs (Alibaba, Tencent, Hillhouse) investing in Indian startups.

- Data Localization & Privacy Compliance:

- Digital Personal Data Protection Act, 2023 (DPDP Act) mandates compliance with data processing rules.

- Startups handling financial or sensitive user data must follow RBI guidelines for data storage.

- Currency Volatility & Exit Barriers:

- INR depreciation impacts foreign investor returns.

- RBI restrictions on IPO proceeds & repatriation delays create additional friction for global VCs.

Managing Legal Risks in Early-Stage Investing

- Term Sheet & Founder Agreements

- Ensuring strong investor protections: Liquidation preference, anti-dilution rights, drag-along, and governance rights.

- Founder vesting and non-compete clauses to prevent IP or talent leakage.

- Cap Table Complexity & ESOP Regulations

- Indian startups often have multiple share classes; ensuring clean cap tables is critical for future funding rounds.

- 409A equivalent for ESOPs: Valuation considerations for tax-efficient stock option issuance.

- Exit Risks & Regulatory Approvals

- IPO Challenges: SEBI mandates pre-IPO lock-in for certain investors.

- M&A Approvals: Larger deals require CCI (Competition Commission of India) approval.

- Buyback Restrictions: Indian companies face stricter share buyback norms compared to global peers.

Key Takeaways for India-Focused VCs:

- SEBI’s AIF framework & RBI’s FEMA rules shape the investment landscape for both domestic and foreign VCs.

- Tax-efficient structuring (onshore vs. offshore) is key for maximizing returns, but compliance with GAAR, FDI norms, and indirect transfer tax is crucial.

- Geopolitical & regulatory risks (China restrictions, data localization, currency volatility) impact investment strategy.

- Early-stage legal protections (strong term sheets, governance rights, IP safeguards) are critical to ensuring smooth exits.

10. Trends & The Future of Venture Capital

The Indian VC ecosystem is evolving rapidly, driven by technological advancements, shifting investor preferences, and regulatory changes. Emerging sectors such as AI, deep tech, Web3, and climate tech are gaining traction, while new funding models and data-driven decision-making are reshaping how capital is deployed.

1. Emerging Markets & Frontier Tech Investing

- Bharat-Focused Startups: With increasing digital penetration beyond Tier-1 cities, vernacular tech, rural fintech, and agri-tech are attracting VC interest.

- Deep Tech & AI Startups: India’s AI, space tech, robotics, and quantum computing sectors are growing, backed by initiatives like IndiaAI Mission and ISRO’s privatization.

- Climate & Sustainability Investing:

- EVs, green hydrogen, and carbon credits are key investment areas.

- Government policies such as PLI schemes and FAME incentives are accelerating adoption.

- HealthTech & BioTech Revolution: Post-COVID, telemedicine, genomics, and personalized medicine are scaling rapidly, supported by regulatory tailwinds.

2. Rise of Corporate VC & Strategic Investors

- Indian Conglomerates Entering VC: Reliance, Tata, Aditya Birla, and Mahindra are actively investing in D2C brands, AI, and SaaS startups.

- Global Tech Giants’ India Play: Google, Amazon, and Microsoft continue to invest in Indian startups via their corporate VC arms and accelerator programs.

- Strategic Investments vs. Pure Financial VC:

- Corporate VCs offer distribution, infrastructure, and market access, making them attractive to founders.

- Unlike traditional VCs, their focus is often on long-term synergy rather than quick exits.

3. The Role of AI & Data Science in VC Decision-Making

- Algorithmic Investing & Predictive Analytics:

- VCs are using AI models to analyze pitch decks, founder backgrounds, and market trends for smarter deal sourcing.

- Platforms like AngelList, PitchBook, and CB Insights are integrating machine learning for startup scoring.

- Alternative Data for Investment Decisions:

- Real-time tracking of social sentiment, hiring patterns, web traffic, and app downloads influences investment theses.

- AI-driven due diligence helps in fraud detection and founder credibility assessment.

- Automated Term Sheets & Smart Contracts:

- AI is helping automate legal agreements, reducing friction in closing deals.

- Blockchain-based smart contracts may soon replace traditional legal documentation.

4. Alternative VC Models (Rolling Funds, Revenue-Based Financing)

- Rolling Funds & Angel Syndicates:

- Platforms like AngelList India and LetsVenture are making Rolling Funds (evergreen investment vehicles) popular among micro-VCs.

- Founders, operators, and angel networks are launching micro-funds, democratizing access to capital.

- Revenue-Based Financing (RBF) & Alternative Debt:

- Non-dilutive funding models like RBF allow startups to raise capital against future revenues, avoiding equity dilution.

- Players like Recur Club, Klub, and GetVantage are pioneering RBF in India.

- Decentralized VC (DAO-Based Investing):

- Blockchain-based Decentralized Autonomous Organizations (DAOs) are experimenting with community-led VC funding models.

- While still nascent in India, tokenized investment pools could emerge as an alternative asset class.

5. Web3, Crypto, & Tokenization of VC Investments

- VCs Exploring Web3 & Blockchain Startups:

- Despite regulatory uncertainty in India, Web3-focused funds are backing decentralized finance (DeFi), NFTs, and metaverse projects.

- Layer-2 solutions, tokenized assets, and smart contract platforms are key areas of interest.

- Tokenization of VC Investments:

- VCs are experimenting with security tokens, allowing fractional ownership of startup equity.

- Tokenized funds may enable liquidity in traditionally illiquid VC investments.

- Regulatory Uncertainty in India:

- RBI & SEBI regulations on crypto investments remain unclear, affecting Web3 startups.

- GIFT City (Gujarat) is emerging as a fintech sandbox for crypto & blockchain innovation.

Key Takeaways for Indian VCs

- AI, deep tech, and climate tech are becoming the next big investment frontiers.

- Corporate VC & strategic investors are playing a bigger role in startup funding.

- AI & alternative data are reshaping deal sourcing and due diligence.

- Rolling funds, RBF, and decentralized VC models are emerging as viable alternatives to traditional equity funding.

- Web3 & tokenization of VC investments could be game-changers but require regulatory clarity.

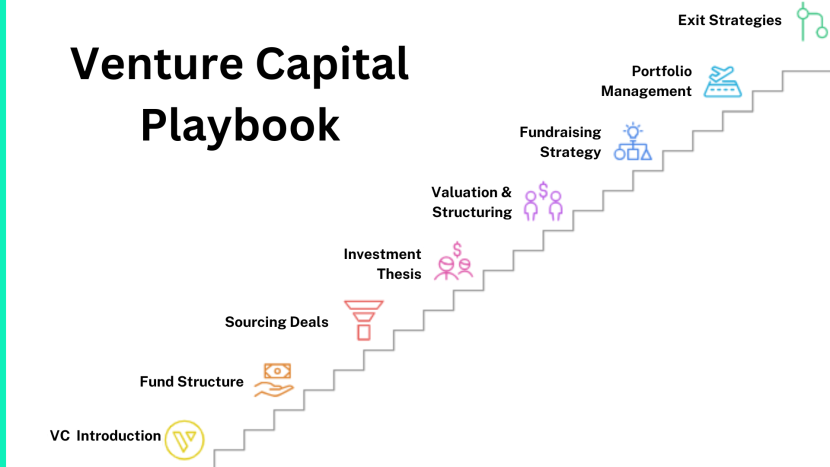

Wrapping Up Wrapping Up: Venture Capital Playbook

Venture Capital is a powerful force behind innovation, helping small startups grow into major industry players. This playbook has provided a comprehensive overview of the Venture Capital world, from understanding its role in the financial ecosystem to navigating the intricacies of VC fund structure, deal sourcing, and investment strategies.

We’ve explored the important differences between Venture Capital, Private Equity, and Angel Investing, and delved into the key players who make the VC industry thrive—Limited Partners, General Partners, founders, and syndicates. We also traced the evolution and history of venture capital, both globally and within India’s vibrant startup ecosystem.

By understanding the fundamentals of sourcing deals, developing an investment thesis, due diligence, valuation, and deal structuring, you’re better equipped to make informed investment decisions. We’ve also highlighted the importance of post-investment portfolio management, guiding portfolio companies towards successful exits, and navigating legal, regulatory, and compliance aspects.

Looking to the future, emerging trends such as AI, Web3, and sustainability will shape the next wave of venture capital investments.

Whether you’re an aspiring investor, a startup founder, or just curious about the world of venture capital, this playbook serves as a valuable resource to guide you through the dynamic and exciting VC landscape.