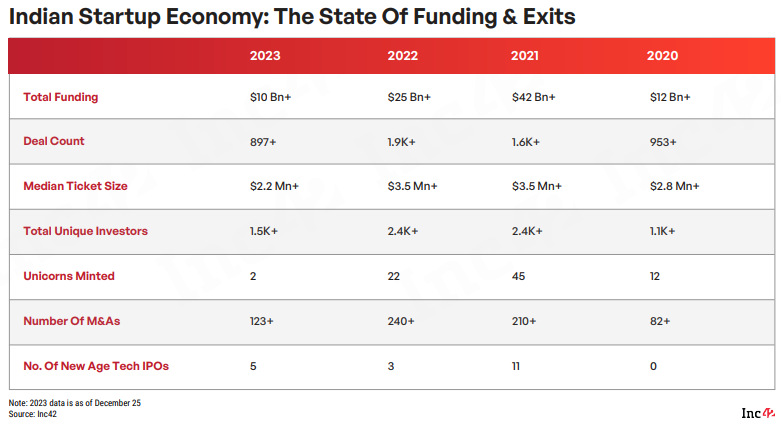

In 2023, the Indian startup ecosystem faced challenges reminiscent of past funding scenarios, with the total funding inflow dropping to just above $10 billion, reaching pre-2017 levels. Despite this, Indian startups have been significant contributors to employment, generating jobs for over 10 lakh individuals in the last seven years. Many ventures have played a pivotal role in creating tens of thousands of jobs individually, showcasing the resilience of the ecosystem in the face of challenges.

The initial months of 2023 witnessed the Indian startup ecosystem grappling with the effects of a funding winter, raising expectations of increased mergers and acquisitions (M&As) due to funding scarcity and declining valuations. However, as the year concludes, the scenario differs from predictions. Only 123 M&As occurred in the first three quarters of the year, a notable decrease from the 205 M&As recorded in 2022, which itself marked growth from 120 deals in 2021.

Notably, tech companies such as Swiggy and RateGain engaged in strategic acquisitions to enhance their business scope. International companies acquiring Indian startups, including Flutura, TrustCheckr, and Rephrase.ai by Accenture, Truecaller, and Adobe, respectively, underscored the increasing strength of the Indian startup ecosystem.

India 2023 Startup M&A: Sectors-wise Key Deals Snapshot

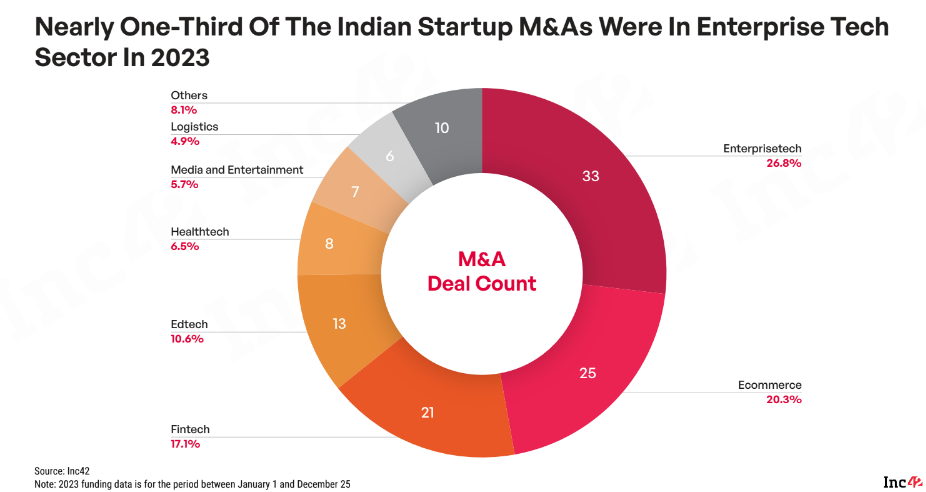

Ecommerce, enterprise tech, fintech, and EdTech emerged as top sectors for M&A deals in the initial three quarters of 2023, with deal amounts ranging from a minimum of $7.5 million to a maximum of $67 million. Enterprise tech led the consolidation charge, recording 33 deals. Ecommerce and fintech completed the podium with 25 and 21 deals, respectively.

The year 2023 became a crucial juncture for India’s edtech sector, revealing the repercussions of the aggressive growth strategies pursued in the preceding years. Previously fueled by unrestrained expansion and substantial investor funding, reaching its peak at $172 million in 2021, the edtech sector encountered a substantial reality check in 2023. The unsustainable business models and unit economics, which contributed to rapid growth, ultimately resulted in a significant contraction. This is evident in the sharp decline in funding, with Indian edtech startups experiencing a reduction of over 88% in 2023.

2023’s Top Startup Acquisitions: Leading Sectors Spotlight

1. M&A in Enterprise Tech

Enterprise tech startups are anticipated to face ongoing challenges in 2024, requiring a focus on expanding revenue and enhancing customer retention. Despite India’s flourishing digital and startup ecosystem and increased tech adoption, the enterprise tech sector experienced a slowdown in 2023 due to its susceptibility to global macroeconomic shifts.

Nevertheless, the sector remains a key area of interest for investors, having raised a substantial $7.7 billion across more than 540 deals in 2021 and 2022. In 2023, it constituted nearly one-third or 26.8% of the total M&As in the Indian startup ecosystem, with expectations of further consolidation. However, funding for enterprise tech startups witnessed a significant 68% year-on-year decline in 2023, plummeting from $4 billion to $1.3 billion.

Major M&A Deal: RateGain Acquires Adara To Consolidate Position

Established in 2004 and headquartered in India, RateGain stands out as one of the world’s largest processors of electronic transactions, price points, and travel intent data. Recently, RateGain Travel Technologies Ltd successfully acquired Adara, a leading data collection and management entity in the travel and hospitality sector, in a $16 million deal (approximately Rs 132.4 crore). This strategic acquisition is poised to empower companies with access to the most comprehensive travel-intent, pricing, and inventory data, ultimately maximizing return on investment (ROI).

Adara distinguishes itself by securing permissioned travel-intent data from prominent players in the travel and hospitality industry, as well as destination marketing organizations. This approach reduces reliance on conventional methods of tracking consumer intent. Together, Adara and RateGain are set to become an unparalleled travel-intent platform, processing over 200 billion ARI updates, managing nearly 30 billion data points, and collaborating with more than 700 partners across 100 countries.

2. M&A in Ecommerce

In India’s dynamic digital marketplace, a significant transformation has occurred, reshaping traditional brick-and-mortar stores and establishing a new era dominated by e-commerce. The preference for online shopping has evolved into a transformative force, paving the way for innovative startups that redefine the fundamental dynamics of buying and selling.

According to the latest “Indian Startup Funding Report 2023” by Inc42, Indian ecommerce startups secured $2.6 billion in funding during the year, reflecting a 32% decrease from the $3.8 billion raised in 2022.

Ecommerce emerged as the leading sector in 2023 in terms of the number of deals, while it secured the second spot after fintech in total funding amount. The overall funding for ecommerce reverted to 2019 levels when the sector raised a total of $2.5 billion across 130 deals.

Major M&A Deal 1: CarTrade Snaps Up OLX India’s Business

In a notable achievement, CarTrade successfully outpaced competitors such as Spinny and Cars24 to acquire OLX India for a substantial sum of INR 535 crore ($67 million). OLX India, a prominent player in the classifieds domain with over 100 million app downloads, operates across 12 diverse categories, including cars, bikes, real estate, and electronics. The acquisition encompasses OLX’s classified and auto business in India, marking a 100% ownership transfer to CarTrade Tech.

As of July 2023, OLX India reported a profit of INR 23 crore pre-PDT (product and tech) costs, with a significant track record of more than 35,000 sales completed annually. CarTrade envisions leveraging this acquisition to establish India’s largest auto classifieds and auto transaction platform, anticipating an impressive reach of approximately 68 million average monthly unique visitors and a portfolio of 32 million listings annually.

Major M&A Deal 2: Reliance Retail Expands Portfolio With Acquisition Of Ed-a-Mamma

Reliance Retail Ventures Limited (RRVL), based in India, has secured a majority 51% stake in Ed-a-Mamma, a clothing brand specializing in children’s and maternity wear, for $44 million. Established in 2020 by Alia Bhatt, Ed-a-Mamma initially operated as an online brand for 2 to 12-year-olds before expanding its presence offline in department stores. The collaboration is expected to facilitate the brand’s expansion into additional categories, including personal care and baby furniture, children’s storybooks, and the development of an animated series.

3. M&A in FinTech

India, despite facing challenges such as rising borrowing costs and macroeconomic conditions, has solidified its position as one of the most well-funded countries globally. In 2023, India secured the third position in FinTech startup funding worldwide, as per the latest Tracxn report, underscoring its prominence as a key player on the global.

However, as highlighted in the India FinTech report by Tracxn. the Indian fintech space has also faced downturn in 2023. The received funding has faced a downfall of 63% in 2023 as compared to 2021 and 37% fall in comparison to 2022.

Major M&A Deal 1: M2P Fintech’s $30 Million Acquisition of Goals101

Chennai-based API infrastructure provider, M2P Fintech, has successfully acquired Goals101, a transaction behavior intelligence company, in a deal valued at approximately $30 million (INR 250 crore). The integration of Goals101’s platform, known for utilizing machine learning and artificial intelligence to analyze consumer transaction patterns, into M2P Fintech’s suite of financial services is poised to revolutionize the understanding and optimization of financial transactions.

With a nine-year history, M2P Fintech offers a comprehensive range of services, including a core banking and loan management system stack, payment tools, and value-added services for both banks and fintech entities. This strategic acquisition follows M2P’s previous takeovers of cloud lending platform Finflux and digital identity platform Syntizen in the preceding year.

The incorporation of Goals101’s big data platform and expertise is expected to act as a catalyst for M2P, enabling a strengthened focus on enhancing its credit card management suite, expanding value-added services, and personalizing digital banking products.

Major M&A Deal 2: Lendingkart Bags Upwards Fintech

In a move to enhance its personal loans offering, Lendingkart, an online MSME lender, has acquired Mumbai-based fintech Upwards in a cash-and-stocks deal valued at Rs 100 crore ($15 million). Lendingkart has been expanding its platform business through Lendingkart Technologies, providing APIs and a software-as-a-service (SaaS) platform, XLr8, to banks, NBFCs, and partners for credit line extension.

Upwards, established in 2017, specializes in offering personal loans to salaried professionals through its proprietary technology platform. The platform employs intricate algorithms, analyzing over 500 data points from various sources for loan underwriting and disbursement. Through this acquisition, Lendingkart aims to capitalize on Upwards’ network and technology stack, strengthening its presence in the personal loan segment.

2023 Wrapping Up:

- Despite the challenges posed by funding winters and macroeconomic conditions, the Indian startup ecosystem showcased resilience, adapting to the evolving landscape and navigating through uncertainties.

- The acquisitions across diverse sectors such as enterprise tech, ecommerce, fintech, and edtech reflect the dynamic nature of India’s startup ecosystem. Each sector presented unique challenges and opportunities, contributing to the overall narrative of 2023.

- Startups strategically leveraged acquisitions to enhance their capabilities, expand their market reach, and stay competitive. These strategic moves underscored the importance of foresight and adaptability in a rapidly changing business environment.

- International acquisitions of Indian startups by global giants like Accenture, Truecaller, and Adobe highlight the increasing global recognition and attractiveness of India’s innovative startups on the world stage.

- The shift in funding dynamics in 2023 prompted startups to rethink their growth strategies, focusing on sustainable business models, unit economics, and operational efficiency.

As the Indian startup ecosystem enters 2024, a renewed focus on revenue expansion, customer retention, and sustainable growth is anticipated. The learnings from 2023 will likely shape the strategies of startups in the coming year.

In conclusion, 2023 marked a transformative year for Indian startups, characterized by challenges, strategic acquisitions, and valuable learnings. The ecosystem’s ability to adapt, innovate, and strategically position itself bodes well for the continued evolution of India’s startup landscape in the years to come.

Prepared By

Nishtha Gurnani

Investment Banking Analyst – IBGRID

MBA in Finance (Gold Medalist)